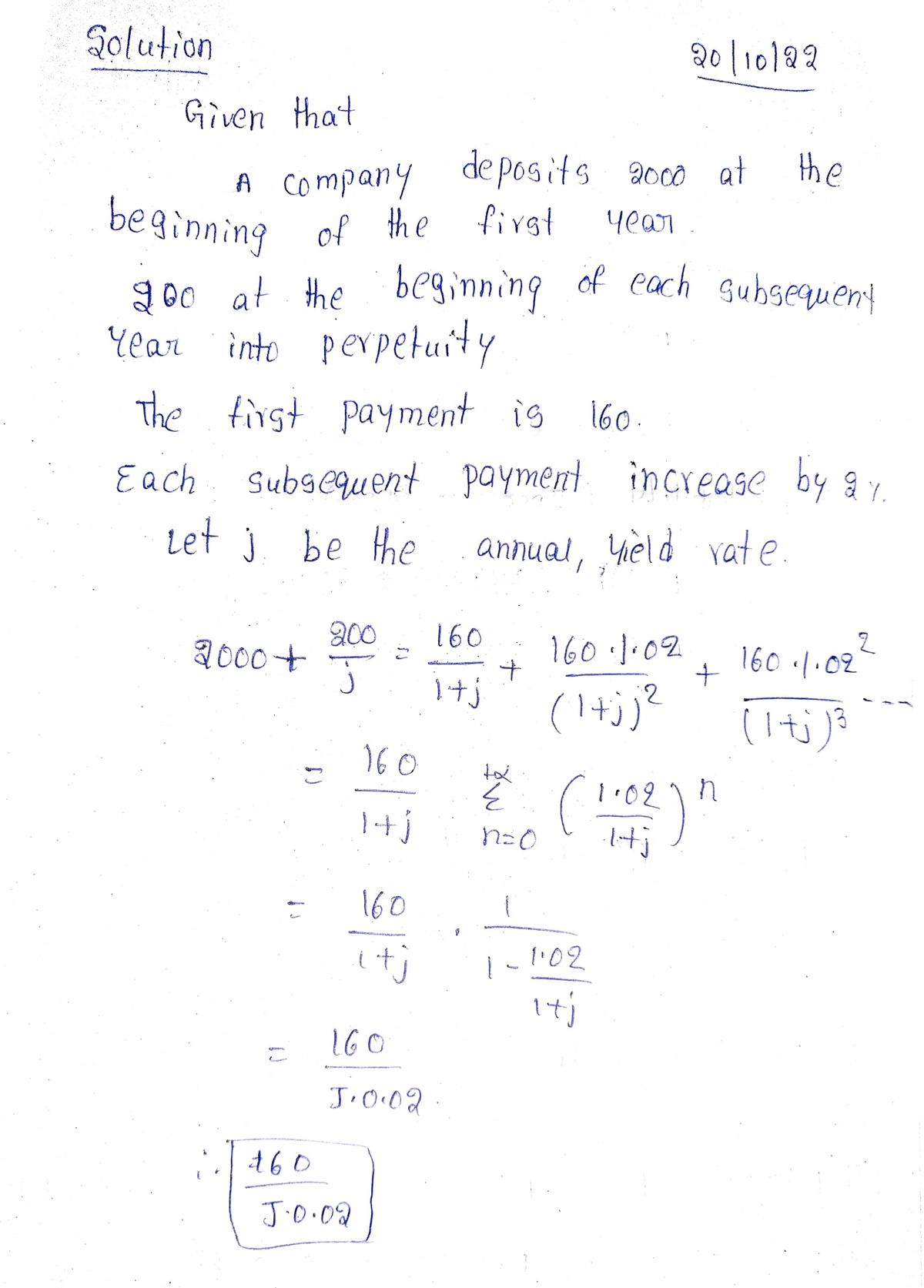

A company deposits 2000 at the beginning of the first year and 200 at the beginning of each subsequent year into perpetuity. In return the company receives payments at the end of each year forever. The first payment is 160. Each subsequent payment increases by 2%. Calculate the company's yield rate (i.e. the annual interest rate) for this transaction. Solution:

A company deposits 2000 at the beginning of the first year and 200 at the beginning of each subsequent year into perpetuity. In return the company receives payments at the end of each year forever. The first payment is 160. Each subsequent payment increases by 2%. Calculate the company's yield rate (i.e. the annual interest rate) for this transaction. Solution:

MATLAB: An Introduction with Applications

6th Edition

ISBN:9781119256830

Author:Amos Gilat

Publisher:Amos Gilat

Chapter1: Starting With Matlab

Section: Chapter Questions

Problem 1P

Related questions

Question

![Certainly! Below is the transcription suitable for an educational website:

---

**Problem Statement:**

A company deposits 2000 at the beginning of the first year and 200 at the beginning of each subsequent year into perpetuity. In return, the company receives payments at the end of each year forever. The first payment is 160. Each subsequent payment increases by 2%.

Calculate the company's yield rate (i.e., the annual interest rate) for this transaction.

**Solution:**

[Here, a detailed solution explaining the financial calculations to find the yield rate would be provided. This would typically involve using formulas for perpetuities and possibly the concept of present value of a growing annuity if the solution is shown.]

---](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Fa216c9ee-ecac-40ec-b583-a361985d4bbd%2Ff84598f3-26ad-4ba4-8fe9-11e597656049%2Fcysz9a_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Certainly! Below is the transcription suitable for an educational website:

---

**Problem Statement:**

A company deposits 2000 at the beginning of the first year and 200 at the beginning of each subsequent year into perpetuity. In return, the company receives payments at the end of each year forever. The first payment is 160. Each subsequent payment increases by 2%.

Calculate the company's yield rate (i.e., the annual interest rate) for this transaction.

**Solution:**

[Here, a detailed solution explaining the financial calculations to find the yield rate would be provided. This would typically involve using formulas for perpetuities and possibly the concept of present value of a growing annuity if the solution is shown.]

---

Expert Solution

Step 1

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

Elementary Statistics: Picturing the World (7th E…

Statistics

ISBN:

9780134683416

Author:

Ron Larson, Betsy Farber

Publisher:

PEARSON

The Basic Practice of Statistics

Statistics

ISBN:

9781319042578

Author:

David S. Moore, William I. Notz, Michael A. Fligner

Publisher:

W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:

9781319013387

Author:

David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:

W. H. Freeman