A 180-day $500,000 banker's acceptance (BA) is currently trading at a discount of 3.75%. You purchase the BA today and sell it 90 days later when the three-month yield is 4.10%. What is your rate of return? Use 360-day to annualize. The following is true, except The price of the BA today is $490,625 The price of the BA 90 days from today is $494,875 Your rate of return is -3.46% Your rate of return is 3.46% QUESTION 4 The following Is true for standby letters of credit (SBLCs), except: The bank receives an annual fee for using a SBLC for the life of the bond issue The fee for SLBCs for municipal bonds depends on maturity and the credit ratings of the issuer The bank that issues SLBCs is responsible for paying the principal and accrued interest to bondholders in the event of a default A SBLC can enhance the credit rating of a borrower allowing it to borrow at a higher interest rate

QUESTION 3

-

A 180-day $500,000 banker's acceptance (BA) is currently trading at a discount of 3.75%. You purchase the BA today and sell it 90 days later when the three-month yield is 4.10%. What is your

rate of return ? Use 360-day to annualize.The following is true, except

The price of the BA today is $490,625

The price of the BA 90 days from today is $494,875

Your rate of return is -3.46%

Your rate of return is 3.46%

QUESTION 4

-

The following Is true for standby letters of credit (SBLCs), except:

The bank receives an annual fee for using a SBLC for the life of the bond issue

The fee for SLBCs for municipal bonds depends on maturity and the credit ratings of the issuer

The bank that issues SLBCs is responsible for paying the principal and accrued interest to bondholders in the event of a default

A SBLC can enhance the credit rating of a borrower allowing it to borrow at a higher interest rate

-

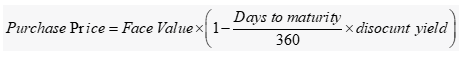

The purchase price of the BA can be calculated by subtracting the discount from the face value. Hence, 2 purchase prices will be determined using the formula:

Step by step

Solved in 5 steps with 4 images