629.86 SUD 129-86 from the bank? c) Jean invested 500 FFR in Paris at 8% simple interest per annum. Paul invested 800 GBP in London at 6% simple interest per annum. 500 (1.0857 subtract. this # thendivide $136. i) How much interest in FFR did Jean earn after 4 years? 500 (1.08 ) B-629.86 500.0.08-40 540-08= 43.20 583.2.0.08-46.660 629.86.0.08-50.39 ii) How much interest in US Dollars did Paul earn after 4 years? iii) Who had earned more interest after 4 years? iv) Explain your reasoning in part (ciii). 1352.87 9.901 (2) (2) (1) (2) ای

629.86 SUD 129-86 from the bank? c) Jean invested 500 FFR in Paris at 8% simple interest per annum. Paul invested 800 GBP in London at 6% simple interest per annum. 500 (1.0857 subtract. this # thendivide $136. i) How much interest in FFR did Jean earn after 4 years? 500 (1.08 ) B-629.86 500.0.08-40 540-08= 43.20 583.2.0.08-46.660 629.86.0.08-50.39 ii) How much interest in US Dollars did Paul earn after 4 years? iii) Who had earned more interest after 4 years? iv) Explain your reasoning in part (ciii). 1352.87 9.901 (2) (2) (1) (2) ای

Advanced Engineering Mathematics

10th Edition

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Erwin Kreyszig

Chapter2: Second-order Linear Odes

Section: Chapter Questions

Problem 1RQ

Related questions

Question

100%

Can someone please help with c) ii-iv please? Thank you.

Transcribed Image Text:3) The following is a currency conversion table:

FFR

1 mill po,16

629,86

500

129-86

6.289

able: moxd

0.057

9.901

USD

French Francs

(FFR)

US Dollars

(USD)

Japanese Yen

(JPY)

British Pounds

166.667

(GBP)

SS00S saitub blog od

For example, from the table 1 USD = 0.631 GBP. Use the table to answer the following questions.

a tod

P=1²92-0.1559007594

a) Find the values of p and q.

6.289

b) Mireille wants to change money at a bank in London.

1

JPY

1.585

qoe din

111.111

0.00902 210 10 061

9 = 0.057

00.21 bloz etinu to 15dmun faros

i) How many French Francs (FFR) will she have to change to receive

9.901,140 - 1386.14

140 British Pounds (GBP)?

#

GBP

0.101

ii) The bank charges a 2.4% commission on all transactions. If she makes

this transaction, how many British Pounds will Mireille actually receive

from the bank? 1386. 15.024-33,27%

0.631

0.006

1

multiply

0.029

17.5439

17.54

500.0.08-40

540-08-43.20

1386.15

33. 27

1352.87

9.901

(2)

thes #by

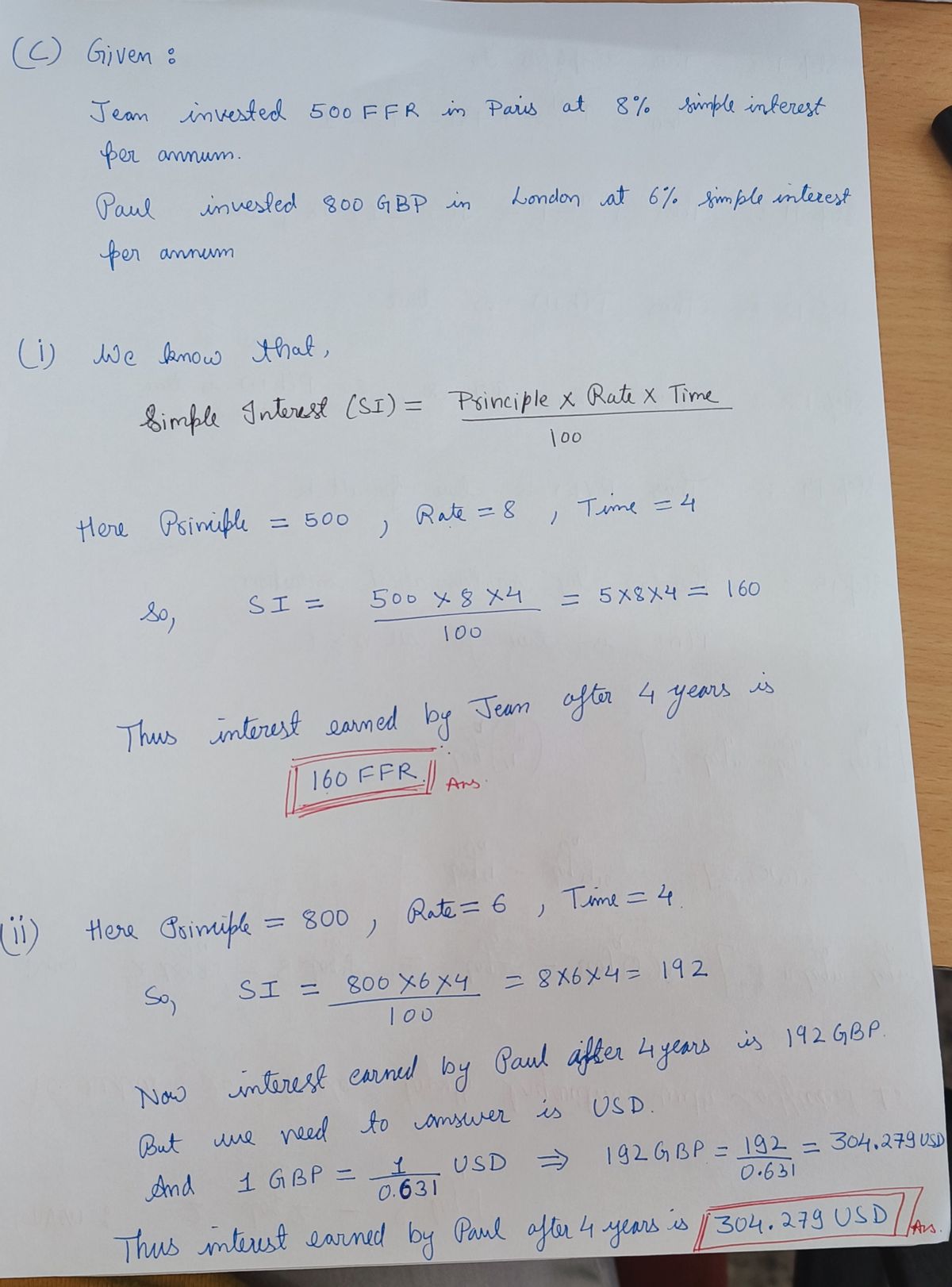

c) Jean invested 500 FFR in Paris at 8% simple interest per annum. Paul invested 800 GBP in London at

6% simple interest per annum. 500 (1.0859

subtract.

this.

thendivide

713664/

i) How much interest in FFR did Jean earn after 4 years?

500 (1.08 ) B-629.86

583.2.0.08-46.60

629.86.0.08-50.39

ii) How much interest in US Dollars did Paul earn after 4 years?

iii) Who had earned more interest after 4 years?

iv) Explain your reasoning in part (ciii).

3

(2)

(2)

(1)

(2)

Expert Solution

Step 1

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Advanced Engineering Mathematics

Advanced Math

ISBN:

9780470458365

Author:

Erwin Kreyszig

Publisher:

Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:

9780073397924

Author:

Steven C. Chapra Dr., Raymond P. Canale

Publisher:

McGraw-Hill Education

Introductory Mathematics for Engineering Applicat…

Advanced Math

ISBN:

9781118141809

Author:

Nathan Klingbeil

Publisher:

WILEY

Advanced Engineering Mathematics

Advanced Math

ISBN:

9780470458365

Author:

Erwin Kreyszig

Publisher:

Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:

9780073397924

Author:

Steven C. Chapra Dr., Raymond P. Canale

Publisher:

McGraw-Hill Education

Introductory Mathematics for Engineering Applicat…

Advanced Math

ISBN:

9781118141809

Author:

Nathan Klingbeil

Publisher:

WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:

9781337798310

Author:

Peterson, John.

Publisher:

Cengage Learning,