6) On 1/18/20, Ehrlich Inc. purchased 30,000 shares of the common stock of XYZ Co. for $16 per share. Ehrlich’s ownership represents 10% of XYZ’s total shares. On 6/15/20, XYZ Co. paid dividends of $3.00 a share. On 12/31/20, the fair market value of the XYZ stock was $20 a share. On 3/3/21, Ehrlich sold 10,000 shares of XYZ stock for $21 per share. On 6/15/21, XYZ Co. paid dividends of $3.50 a share. On 12/31/21, the fair market value of the XYZ stock was $21 per share. Instructions: Prepare the 6 journal entries that Ehrlich would make during 2020 and 2021 to account for its investment AND determine the amount of the investment in XYZ that would be shown on the balance sheet at 12/31/20 and at 12/31/21.

6)

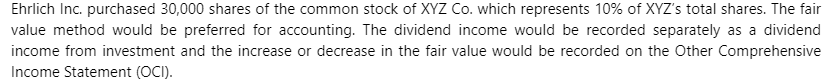

On 1/18/20, Ehrlich Inc. purchased 30,000 shares of the common stock of XYZ Co. for $16 per share. Ehrlich’s ownership represents 10% of XYZ’s total shares.

On 6/15/20, XYZ Co. paid dividends of $3.00 a share.

On 12/31/20, the fair market value of the XYZ stock was $20 a share.

On 3/3/21, Ehrlich sold 10,000 shares of XYZ stock for $21 per share.

On 6/15/21, XYZ Co. paid dividends of $3.50 a share.

On 12/31/21, the fair market value of the XYZ stock was $21 per share.

Instructions:

Prepare the 6

AND determine the amount of the investment in XYZ that would be shown on the

Step by step

Solved in 2 steps with 3 images