4. Based on the answer to the previous question (question #3), if half of those government expenditures are financed through lump sum taxes, calculate the new level if NI? (C+I+G)

PLEASE ONLY ANSWER QUESTION FOUR (i am giving you the others as context) (i need this by 11:55pm tonight, so in like 25 minutes, so please hurry!!)

ANSWER THIS ONE:

4. Based on the answer to the previous question (question #3), if half of those government expenditures are financed through lump sum taxes, calculate the new level if NI? (C+I+G)

HERE ARE THE FIRST THREE QUESTIONS AS CONTEXT:

1. Calculate the MPC in the above diagram.

2. Based on Diagram 1, If private Investment of $100 is added to the existing C, calculate the new equilibrium level of NI.

3. Given your answer to the previous question (question #2) calculate by how much G should change, if the full employment level in the economy is at $3000.

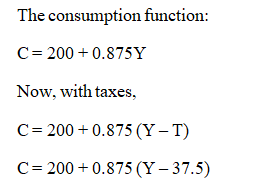

4) The government expenditure should be increased by 75. Half of this is financed by taxes. The taxes are 37.5. Remaining government expenditure is 37.5

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images