3. Set up your bank reconciliation template. (Use the Ch. 7 Notes.) 4. Fill in the Bank Balance and Book Balance. 6/30 . Suggestions: 1. Take a few minutes to look through the information provided: Information for books, last month's bank reconciliation, and the bank statement. 2. Create a T-Account to determine the amount of Cash as of 6/30/Y2. 5. Have the Outstanding checks from last month cleared on the Bank Statement? 6. Has all the activity recorded in the Books reflected in the Bank Statement? 7. Pay attention to the numbers. Were there any errors by the Bank or the Books (Accountants) or anything missing? 13,624.71 . Instructions: • Prepare a Bank Reconciliation as of June 30, 20Y2. If errors in recording deposits or checks are discovered, assume that the errors were made by the company. Assume all deposits are from cash sales. A checks are written to satisfy Accounts Payable. Note that the 6/9 deposits for $3,500 and $210 on the Bank Statement are for Notes Receivable and interest earned that was paid directly to the bank and into the company's account. • Prepare the necessary journal entries. Please make one combined journal entry for all of the additions and another combined journal entry for all of the deductions,

3. Set up your bank reconciliation template. (Use the Ch. 7 Notes.) 4. Fill in the Bank Balance and Book Balance. 6/30 . Suggestions: 1. Take a few minutes to look through the information provided: Information for books, last month's bank reconciliation, and the bank statement. 2. Create a T-Account to determine the amount of Cash as of 6/30/Y2. 5. Have the Outstanding checks from last month cleared on the Bank Statement? 6. Has all the activity recorded in the Books reflected in the Bank Statement? 7. Pay attention to the numbers. Were there any errors by the Bank or the Books (Accountants) or anything missing? 13,624.71 . Instructions: • Prepare a Bank Reconciliation as of June 30, 20Y2. If errors in recording deposits or checks are discovered, assume that the errors were made by the company. Assume all deposits are from cash sales. A checks are written to satisfy Accounts Payable. Note that the 6/9 deposits for $3,500 and $210 on the Bank Statement are for Notes Receivable and interest earned that was paid directly to the bank and into the company's account. • Prepare the necessary journal entries. Please make one combined journal entry for all of the additions and another combined journal entry for all of the deductions,

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

100%

Please follow instructions to better understand. Thank you.

Transcribed Image Text:1

. . .

I

1

Y....1

CASH ACCOUNT:

I

30, 20Y2, have been taken from various documents and records and are reproduced as

follows. The sources of the data are printed in capital letters. All checks were written for

payments on account.

June 1

3

8

CHECKS WRITTEN:

2

2 3 4 5

Balance as of June 1

CASH RECEIPTS FOR MONTH OF JUNE

DUPLICATE DEPOSIT TICKETS:

Date and amount of each deposit in June:

Date

Amount

Check No.

740

741

742

743

744

745

746

.

I

$1,080.50

854.17

840.50

Amount

Adjusted balance.....

Number and amount of each check issued in June:

Check No.

747

748

749

750

751

752

753

Total amount of checks issued in June

BANK RECONCILIATION FOR PRECEDING MONTH:

$237.50

495.15

501.90

761.30

506.88

117.25

298.66

***

Cash balance according to bank statement.

Add: Deposit in transit on May 31...

Deduct: Outstanding Check No. 731

Outstanding Check No. 736

Outstanding Check No. 738.

Outstanding Check No. 739

Total deductions

Date

I

****...

June 10

15

17

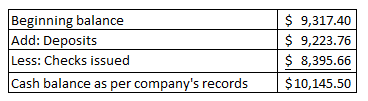

Cash balance according to company's records

Deduct: Bank service charges

Adjusted balance.....

Amount

Amount

Beeler Furniture Company

Bank Reconciliation

May 31, 2012

******

Void

$450.90

640.13

276.77

299.37

537.01

380.95

$996.61

882.95

1,606.74

Check No.

754

755

756

757

758

759

760

Date

June 22

24

30

$162.15

345.95

251.40

60.55

$9,317.40

9,223.76

Amount

$897.34

947.21

1,117.74

Amount

$ 449.75

272.75

113.95

407.95

259.60

901.50

486.39

$8,395.66

$9,447.20

690.25

(820.05)

$9,317.40

$9,352.50

(35.10)

$9,317.40

7.

Transcribed Image Text:NB

CHICAGO, IL 60603 (312) 441-1239

AMERICAN NATIONAL BANK

OF CHICAGO

BEELER FURNITURE COMPANY

No. 731

No. 739

No. 741

No. 743

No. 748

No. 748

No. 760

No. 762

No. 764

No. 767

162.18

60.88

496.18

671.30

117.28

460.90

276.77

637.01

449.75

407.96

ACCOUNT NUMBER

NSP 680.00

SC 76.00

FROM 6/01/20Y2

BALANCE

9 DEPOSITS

20 WITHDRAWALS

4 OTHER DEBITS

AND CREDITS

NEW BALANCE

---CHECKS AND OTHER DEBITS -----DEPOSITS ---DATE---BALANCE--.

No. 736 348.96

No. 740 237.50

No. 742 801.90

No. 744 606.88

No. 746 298.66

No. 749 640.13

No. 781 299.37

No. 763

380.96

No. 768 272.78

No. 760 486.39

690.28

1,080.60

864.17

840.50

MS 3,800.00

MS 210.00

896.61

882.96

1,606.74

897.34

942.71

TO 6/30/20Y2

6/01

6/02

6/04

6/09

6/09

6/09

6/11

6/16

6/18

6/23

6/28

6/28

6/30

9,447.20

8,691.77

7,599.26

3,086.00CR

13,624.71

9,629.38

10,411.80

10,268.92

9.931.24

13,018.33

12,134.30

12,484.77

12.419.76

13,304.00

13,307.00

14,249.71

13,699.71

13,624.71

• Suggestions:

1. Take a few minutes to look through the information provided: Information for books, last month's bank reconciliation, and the bank statement.

2. Create a T-Account to determine the amount of Cash as of 6/30/Y2.

3. Set up your bank reconciliation template. (Use the Ch. 7 Notes.)

4. Fill in the Bank Balance and Book Balance.

5. Have the Outstanding checks from last month cleared on the Bank Statement?

6. Has all the activity recorded in the Books reflected in the Bank Statement?

7. Pay attention to the numbers. Were there any errors by the Bank or the Books (Accountants) or anything missing?

. Instructions:

• Prepare a Bank Reconciliation as of June 30, 20Y2. If errors in recording deposits or checks are discovered, assume that the errors were made by the company. Assume all deposits are from cash sales. A

checks are written to satisfy Accounts Payable.

. Note that the 6/9 deposits for $3,500 and $210 on the Bank Statement are for Notes Receivable and interest earned that was paid directly to the bank and into the company's account.

• Prepare the necessary journal entries. Please make one combined journal entry for all of the additions and another combined journal entry for all of the deductions.

Expert Solution

Step 1

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education