2a) Consider a 4-year loan of $5,000 which you will pay back in 4 equal annual payments. If the loan has an 8% annual interest rate over the 4-year period, what would the size of each payment be? 2b) Of the payment you calculated for the first part of this question, how much of that payment would be the interest for the second payment and how much of that payment would be principal repayment for the loan?

2a) Consider a 4-year loan of $5,000 which you will pay back in 4 equal annual payments. If the loan has an 8% annual interest rate over the 4-year period, what would the size of each payment be?

2b) Of the payment you calculated for the first part of this question, how much of that payment would be the interest for the second payment and how much of that payment would be principal repayment for the loan?

2a)

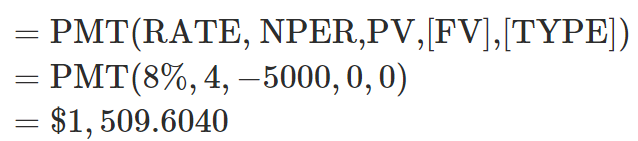

Determine the amount of annual payments using the Excel PMT function with the following inputs:

RATE = 8% [The annual interest rate]

NPER = 4 [The maturity period of loan]

PV = 5000 [This is the present value of the loan. Take this value as negative for the Excel function to work properly]

FV = 0 [There is no future value]

TYPE = 0 [For the end of the period]

Thus, the amount of each annual payment is $1,509.6040.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 5 images