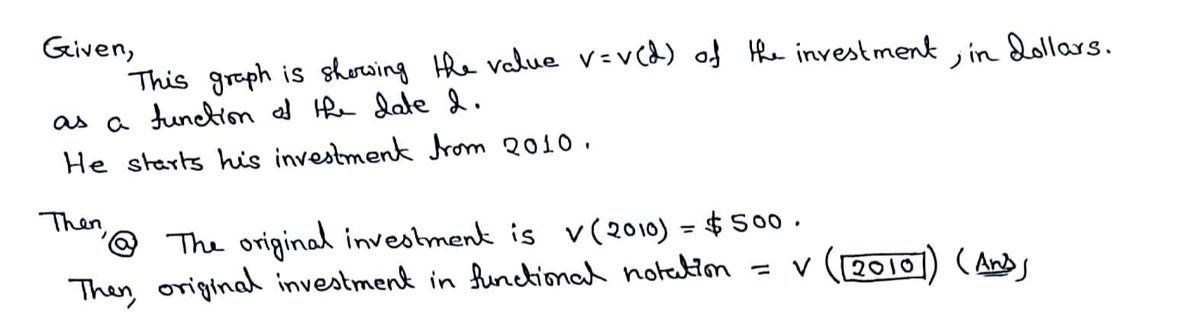

2010, an investor put money into a fund. The graph below shows the value v = v(d) of the investment, in dollars, as a function of the date d. v(d) Investment value $305,000- $255,000- $205,000- $155,000+ $105,000- $55,000- $5,000 2010 2020 2030 2040 2050 2060 d = Date (a) Express the original investment using functional notation. 2010 ) Give the value of the above term. $ (b) Is the graph concave up or concave down? concave up concave down Explain what this means about the growth in value of the account. This means that the investment is increasing ✓ (c) In what year will the value of the investment reach $105,000? 2050 (d) What is the average yearly increase from 2050 to 2060? per year $ at an increasing ✓ Explain your reasoning. (e) which is larger, the average yearly increase from 2050 to 2060 or the average yearly increase from 2010 to 2020? 2010 to 2020 2050 to 2060 The average yearly increase from 2010 to 2020 is $ rate. . The average yearly increase from 2050 to 2060 is $

2010, an investor put money into a fund. The graph below shows the value v = v(d) of the investment, in dollars, as a function of the date d. v(d) Investment value $305,000- $255,000- $205,000- $155,000+ $105,000- $55,000- $5,000 2010 2020 2030 2040 2050 2060 d = Date (a) Express the original investment using functional notation. 2010 ) Give the value of the above term. $ (b) Is the graph concave up or concave down? concave up concave down Explain what this means about the growth in value of the account. This means that the investment is increasing ✓ (c) In what year will the value of the investment reach $105,000? 2050 (d) What is the average yearly increase from 2050 to 2060? per year $ at an increasing ✓ Explain your reasoning. (e) which is larger, the average yearly increase from 2050 to 2060 or the average yearly increase from 2010 to 2020? 2010 to 2020 2050 to 2060 The average yearly increase from 2010 to 2020 is $ rate. . The average yearly increase from 2050 to 2060 is $

Advanced Engineering Mathematics

10th Edition

ISBN:9780470458365

Author:Erwin Kreyszig

Publisher:Erwin Kreyszig

Chapter2: Second-order Linear Odes

Section: Chapter Questions

Problem 1RQ

Related questions

Question

100%

Transcribed Image Text:In 2010, an investor put money into a fund. The graph below shows the value v = v(d) of the investment, in dollars, as a function of the date d.

v(d) Investment value

$305,000

$255,000-

$205,000+

$155,000+

$105,000

$55,000-

$5,000

2010 2020 2030 2040 2050 2060

d = Date

Express the original investment using functional notation.

2010

)

Give the value of the above term.

$

(b) Is the graph concave up or concave down?

concave up

concave down

Explain what this means about the growth in value of the account.

This means that the investment is increasing

(c) In what year will the value of the investment reach $105,000?

2050

(d) What is the average yearly increase from 2050 to 2060?

$

per year

at an increasing ✓

Explain your reasoning.

(e) Which is larger, the average yearly increase from 2050 to 2060 or the average yearly increase from 2010 to 2020?

2010 to 2020

2050 to 2060

The average yearly increase from 2010 to 2020 is $

rate.

C. The average yearly increase from 2050 to 2060 is $

Expert Solution

Step 1

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Advanced Engineering Mathematics

Advanced Math

ISBN:

9780470458365

Author:

Erwin Kreyszig

Publisher:

Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:

9780073397924

Author:

Steven C. Chapra Dr., Raymond P. Canale

Publisher:

McGraw-Hill Education

Introductory Mathematics for Engineering Applicat…

Advanced Math

ISBN:

9781118141809

Author:

Nathan Klingbeil

Publisher:

WILEY

Advanced Engineering Mathematics

Advanced Math

ISBN:

9780470458365

Author:

Erwin Kreyszig

Publisher:

Wiley, John & Sons, Incorporated

Numerical Methods for Engineers

Advanced Math

ISBN:

9780073397924

Author:

Steven C. Chapra Dr., Raymond P. Canale

Publisher:

McGraw-Hill Education

Introductory Mathematics for Engineering Applicat…

Advanced Math

ISBN:

9781118141809

Author:

Nathan Klingbeil

Publisher:

WILEY

Mathematics For Machine Technology

Advanced Math

ISBN:

9781337798310

Author:

Peterson, John.

Publisher:

Cengage Learning,