w is information about three $10000 par value bonds, each of which pays coupon semiannually. The required rate of return on each bond is 14%. Calculate the value of the bonds and determine whether the bond is selling at discount, premium or par value. Bond Coupon Rate (%) Maturity (years) 1 8 5 2 14 10 3 16 15 2. Using the Interpolation Method to calculate the YTM for the below Bonds: > The par value $18000 > Coupon Rate 10% every year

1. Below is information about three $10000 par value bonds, each of which pays coupon semiannually. The required

Calculate the value of the bonds and determine whether the bond is selling at discount, premium or par value.

|

Bond |

Coupon Rate (%) |

Maturity (years) |

|

|

|

|

|

1 |

8 |

5 |

|

2 |

14 |

10 |

|

3 |

16 |

15 |

2. Using the Interpolation Method to calculate the YTM for the below Bonds:

> The par value $18000

> Coupon Rate 10% every year

> Maturity period 10 years

> Market

Step by step

Solved in 5 steps

Coupon rate=8%

Annual coupon=0.08 x 10000=$800

Maturity period=n=5years

Price of bond=Coupon x 1-(1+r)-nr+10000(1+r)n=80 x 1-1.14-50.14+100001.145=$7940.15

Price of bond=$7940.15

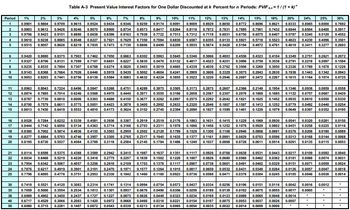

Please explain the answer how to get $7940.15. Is it possible to calculate using Vb = I (PVIFA kb%, n ) + M (PVIFkb%, n) to find the

Attached together the PVIF & PVIFA table below for references. Thank you!

![Period

1

2

3

4

5

6

7

8

9

10

14

15

16

17

18

19

20

3.1473

11 10.368 9.7868 9.2526 8.7605

8.3064 7.8869 7.4987 7.1390 6.8052 6.4951 6.2065 5.9377 5.6869 5.4527 5.2337 5.0286 4.3271 3.7757 3.6564

12 11.255 10.575 9.9540 9.3851 8.8633 8.3838 7.9427

7.5361 7.1607 6.8137

6.4924 6.1944

5.4206 5.1971 4.4392 3.8514 3.7251 3.1903

13 12.134 11.348 10.635 9.9856 9.3936 8.8527 8.3577 7.9038 7.4869 7.1034 6.7499 6.4235

5.5831 5.3423 4.5327 3.9124 3.7801 3.2233

13.004 12.106 11.296 10.563 9.8986 9.2950 8.7455 8.2442 7.7862 7.3667 6.9819 6.6282

5.7245 5.4675 4.6106 3.9616 3.8241 3.2487

13.865

12.849 11.938 11.118 10.380 9.7122 9.1079 8.5595 8.0607 7.6061 7.1909 6.8109

5.8474 5.5755 4.6755 4.0013 3.8503 3.2682

5.9176 5.6603

6.1218 5.8424

6.3025 6.0021

6.4624 6.1422

21

22

Table A-4 Present Value Interest Factors for a One-Dollar Annuity Discounted at k Percent for n Periods: PVIFA[1-1/(1+k)]/k

16%

20%

24%

25%

11%

12%

13%

14% 15%

0.9009 0.8929 0.8850 0.8772 0.8696

1.6901

0.8621 0.8333 0.8065 0.8000

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

30%

0.9901 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 09174 0.9091

0.7692

1.9704 1.9416 1.9135 1.8861

1.8594 1.8334 1.8000 1.7833 1.7591 1.7355 1.7125

1.6681 1.6467 1.6257 1.6052 1.5278 1.4568 1.4400 1.3609

2.9410 2.8839 2.8286 2.7751 2.7232 2.6730 2.6243 2.5771 2.5313 2.4869 2.4437 2.4018 2.3612 2.3216 2.2832 2.2459 2.1065 1.9813 1.9520 1.8161

3.6299

3.5460 3.4651 3.3872 3.3121 3.2397 3.1699 3.1024 3.0373 2.9745

4.4518 4.3295 4.2124 4.1002 3.9927 3.8897 3.7908 3.6959

3.6048 3.5172

2.9137 2.8550 2.7982 2.5887 2.4043 2.3616 2.1662

3.4331 3.3522 3.2743 2.9906 2.7454 2.6893 2.4356

30

35

3.9020 3.8077 3.7171

4.8534 4.7135 4.5797

36

40

50

5.7955 5.6014

5.4172

5.2421

4.4859 4.3553 4.2305 4.1114

3.9975

3.6847

5.0757 4.9173 4.7665 4.6229

3.8887 3.7845

3.3255 3.0205 2.9514 2.6427

6.7282 6.4720 6.2303 6.0021 5.7864 5.5824 5.3893 5.2064 5.0330 4.8684 4.7122 4.5638 4.4226 4.2883

4.1604 4.0386 3.6046 3.2423 3.1611

2.8021

7.6517 7.3255 7.0197 6.7327

6.4632 6.2098 5.9713 5.7466 5.5348 5.3349 5.1461 4.9676 4.7988 4.6389 4.4873 4.3436 3.8372 3.4212 3.3289 2.9247

8.5660 8.1622

7.7861 7.4353 7.1078 6.8017 6.5152 6.2469 5.9952 5.7590 5.5370 5.3282 5.1317 4.9464 4.7716 4.6065 4.0310 3.5655 3.4631 3.0190

9.4713 8.9826 8.5302 8.1109 7.7217 7.3601 7.0236 6.7101 6.4177 6.1446 5.8892 5.6502 5.4262 5.2161 5.0188 4.8332 4.1925 3.6819 3.5705 3.0915

14.718 13.578 12.561 11.652

10.838 10.106 9.4466 8.8514 8.3126

15.562 14.292 13.166 12.166 11.274 10.477 9.7632

16.398 14.992 13.754 12.659 11.690 10.828

17.226 15.678 14.324 13.134 12.085 11.158

18.046 16.351 14.877 13.590 12.462 11.470

18.857

19.660

20.456 18.292

17.011

17.658

23

16.444

24 21.243 18.914 16.936

22.023 19.523

25

17.413

15.415

15.937

7.8237 7.3792 6.9740

9.1216 8.5436 8.0216 7.5488

10.059 9.3719 8.7556 8.2014

10.336 9.6036 8.9501 8.3649

10.594 9.8181 9.1285 8.5136

14.029 12.821 11.764

14.451 13.163 12.042

14.857 13.489 12.303

15.247 13.799 12.550 11.469 10.529 9.7066

15.622 14.094 12.783 11.654 10.675

10.836

11.061

11.272

9.8226

10.017 9.2922 8.6487 8.0751 7.5620 7.1016 6.6870 6.3125

10.201 9.4424 8.7715 8.1757 7.6446 7.1695 6.7429 6.3587

10.371 9.5802 8.8832 8.2664 7.7184 7.2297 6.7921 6.3988

8.9847 8.3481 7.7843 7.2829 6.8351 6.4338

9.0770 8.4217 7.8431 7.3300 6.8729 6.4641

6.6039 6.2651 5.9542

7.1196 6.7291 6.3729 6.0472

7.7016 7.2497 6.8399 6.4674 6.1280

7.8393 7.3658 6.9380 6.5504 6.1982

7.9633 7.4694 7.0248 6.6231 6.2593

25.808 22.396 19.600 17.292 15.372 13.765 12.409 11.258 10.274

29.409 24.999 21.487 18.665 16.374 14.498 12.948 11.655 10.567

30.108 25.489 21.832 18.908 16.547 14.621 13.035 11.717 10.612

32.835 27.355 23.115 19.793 17.159 15.046 13.332 11.925 10.757

39.196 31.424 25.730 21.482 18.256 15.762 13.801 12.233 10.962

5.6685 4.7296 4.0333 3.8874 3.2832

5.7487 4.7746 4.0591 3.9099 3.2948

5.8178 4.8122 4.0799 3.9279 3.3037

5.8775 4.8435 4.0967 3.9424 3.3105

5.9288 4.8696 4.1103 3.9539 3.3158

5.9731 4.8913 4.1212 3.9631 3.3198

6.0113 4.9094 4.1300 3.9705

3.3230

6.0442 4.9245 4.1371 3.9764 3.3254

6.0726 4.9371 4.1428 3.9811 3.3272

6.0971 4.9476 4.1474 3.9849 3.3286

3.3321

9.4269 8.6938 8.0552

7.4957 7.0027 6.5660 6.1772 4.9789 4.1601 3.9950

9.6442 8.8552 8.1755 7.5856 7.0700 6.6166 6.2153 4.9915 4.1644 3.9984 3.3330

9.6765 8.8786 8.1924 7.5979 7.0790 6.6231 6.2201 4.9929 4.1649 3.9987 3.3331

9.7791 8.9511 8.2438 7.6344 7.1050 6.6418 6.2335 4.9966 4.1659 3.9995

9.9148 9.0417 8.3045 7.6752 7.1327 6.6605 6.2463 4.9995 4.1666 3.9999

3.3332

3.3333](https://content.bartleby.com/qna-images/question/a3e2e62b-ab82-4445-b399-462e76a690f9/82ad3738-b9f0-49f0-9411-38a52eb17cbf/1f0en6v_thumbnail.jpeg)