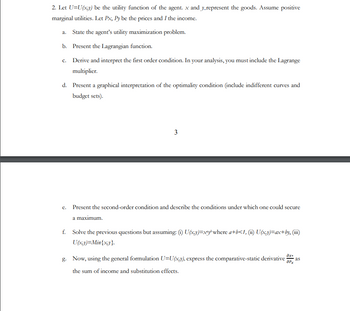

2. Let U=U(x,y) be the utility function of the agent. x and y_represent the goods. Assume positive marginal utilities. Let Px, Py be the prices and I the income. a. State the agent's utility maximization problem. b. Present the Lagrangian function. c. Derive and interpret the first order condition. In your analysis, you must include the Lagrange multiplier. d. Present a graphical interpretation of the optimality condition (include indifferent curves and budget sets). 3 دیا e. Present the second-order condition and describe the conditions under which one could secure a maximum. f. Solve the previous questions but assuming: (i) U(x,y)=xy where a+b<1, (ii) U(x,y)=ax+by, (iii) U(x,y)=Min{x,y}. ax. apx g. Now, using the general formulation U=U(x,y), express the comparative-static derivative as the sum of income and substitution effects.

2. Let U=U(x,y) be the utility function of the agent. x and y_represent the goods. Assume positive marginal utilities. Let Px, Py be the prices and I the income. a. State the agent's utility maximization problem. b. Present the Lagrangian function. c. Derive and interpret the first order condition. In your analysis, you must include the Lagrange multiplier. d. Present a graphical interpretation of the optimality condition (include indifferent curves and budget sets). 3 دیا e. Present the second-order condition and describe the conditions under which one could secure a maximum. f. Solve the previous questions but assuming: (i) U(x,y)=xy where a+b<1, (ii) U(x,y)=ax+by, (iii) U(x,y)=Min{x,y}. ax. apx g. Now, using the general formulation U=U(x,y), express the comparative-static derivative as the sum of income and substitution effects.

Chapter1: Making Economics Decisions

Section: Chapter Questions

Problem 1QTC

Related questions

Question

Please help to solve this into detail. Thank you.

![### Advanced Microeconomics - Utility Maximization Problems

**Question 2: Utility Maximization**

Given a utility function \( U=U(x,y) \), where \( x \) and \( y \) represent goods:

- Assume positive marginal utilities.

- Let \( P_x \) and \( P_y \) be the prices, and \( I \) the income.

**Parts of the Question:**

a. **State the agent’s utility maximization problem.**

- This involves setting up the problem where the agent allocates income \( I \) across goods \( x \) and \( y \) to maximize their utility:

\[

\max U(x,y) \quad \text{subject to} \quad P_x x + P_y y \leq I

\]

b. **Present the Lagrangian function.**

- The Lagrangian function for the utility maximization problem is formulated as:

\[

\mathcal{L} = U(x,y) + \lambda (I - P_x x - P_y y)

\]

where \( \lambda \) is the Lagrange multiplier.

c. **Derive and interpret the first-order condition. Include the Lagrange multiplier in your analysis.**

- The first-order conditions for a maximum are obtained by taking the partial derivatives of the Lagrange function with respect to \( x \), \( y \), and \( \lambda \), and setting them to zero:

\[

\frac{\partial \mathcal{L}}{\partial x} = \frac{\partial U}{\partial x} - \lambda P_x = 0

\]

\[

\frac{\partial \mathcal{L}}{\partial y} = \frac{\partial U}{\partial y} - \lambda P_y = 0

\]

\[

\frac{\partial \mathcal{L}}{\partial \lambda} = I - P_x x - P_y y = 0

\]

Interpretation involves:

\[

\frac{\partial U/\partial x}{\partial U/\partial y} = \frac{P_x}{P_y}

\]

showing that the marginal rate of substitution (MRS) equals the price ratio.

d. **Present a graphical interpretation of the optimality condition (include indifference curves and](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F362a762f-914f-42d1-b0fa-542c2b1764ea%2F8af33371-a618-449d-9ae8-4c5ad4309a30%2Fk5f2l1_processed.png&w=3840&q=75)

Transcribed Image Text:### Advanced Microeconomics - Utility Maximization Problems

**Question 2: Utility Maximization**

Given a utility function \( U=U(x,y) \), where \( x \) and \( y \) represent goods:

- Assume positive marginal utilities.

- Let \( P_x \) and \( P_y \) be the prices, and \( I \) the income.

**Parts of the Question:**

a. **State the agent’s utility maximization problem.**

- This involves setting up the problem where the agent allocates income \( I \) across goods \( x \) and \( y \) to maximize their utility:

\[

\max U(x,y) \quad \text{subject to} \quad P_x x + P_y y \leq I

\]

b. **Present the Lagrangian function.**

- The Lagrangian function for the utility maximization problem is formulated as:

\[

\mathcal{L} = U(x,y) + \lambda (I - P_x x - P_y y)

\]

where \( \lambda \) is the Lagrange multiplier.

c. **Derive and interpret the first-order condition. Include the Lagrange multiplier in your analysis.**

- The first-order conditions for a maximum are obtained by taking the partial derivatives of the Lagrange function with respect to \( x \), \( y \), and \( \lambda \), and setting them to zero:

\[

\frac{\partial \mathcal{L}}{\partial x} = \frac{\partial U}{\partial x} - \lambda P_x = 0

\]

\[

\frac{\partial \mathcal{L}}{\partial y} = \frac{\partial U}{\partial y} - \lambda P_y = 0

\]

\[

\frac{\partial \mathcal{L}}{\partial \lambda} = I - P_x x - P_y y = 0

\]

Interpretation involves:

\[

\frac{\partial U/\partial x}{\partial U/\partial y} = \frac{P_x}{P_y}

\]

showing that the marginal rate of substitution (MRS) equals the price ratio.

d. **Present a graphical interpretation of the optimality condition (include indifference curves and

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Continue from part d - part g. Thank you!

Transcribed Image Text:2. Let U=U(x,y) be the utility function of the agent. x and y_represent the goods. Assume positive

marginal utilities. Let Px, Py be the prices and I the income.

a. State the agent's utility maximization problem.

b. Present the Lagrangian function.

c. Derive and interpret the first order condition. In your analysis, you must include the Lagrange

multiplier.

d. Present a graphical interpretation of the optimality condition (include indifferent curves and

budget sets).

3

e. Present the second-order condition and describe the conditions under which one could secure

a maximum.

f. Solve the previous questions but assuming: (1) U(x,y)=xy where a+b<1, (ii) U(x,y)=ax+by, (iii)

U(x,y)=Min{x,y}.

əx+

apx

g. Now, using the general formulation U=U(x,y), express the comparative-static derivative as

the sum of income and substitution effects.

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-…

Economics

ISBN:

9781259290619

Author:

Michael Baye, Jeff Prince

Publisher:

McGraw-Hill Education