18. On December 31, 2010, Chelsea Co. provides a service for its customer Villas Boas Co. inexchange for a promissory note requiring five annual payments of $1,000 each. The paymentsare to occur on December 31 of each year beginning on December 31, 2011. The note does notspecify any interest, and there is no market for the note. Based on the credit worthiness of VillasBoas Co. and the length of the note, it is estimated that Villas Boas Co. would have to pay 10%interest if it borrowed a similar amount from a bank. The income tax rate for Chelsea is 35%.The effect of the entries made on December 31, 2014 on net income is:a. $0b. An increase of $113c. An increase of $162d. A decrease of $162

18. On December 31, 2010, Chelsea Co. provides a service for its customer Villas Boas Co. in

exchange for a promissory note requiring five annual payments of $1,000 each. The payments

are to occur on December 31 of each year beginning on December 31, 2011. The note does not

specify any interest, and there is no market for the note. Based on the credit worthiness of Villas

Boas Co. and the length of the note, it is estimated that Villas Boas Co. would have to pay 10%

interest if it borrowed a similar amount from a bank. The income tax rate for Chelsea is 35%.

The effect of the entries made on December 31, 2014 on net income is:

a. $0

b. An increase of $113

c. An increase of $162

d. A decrease of $162

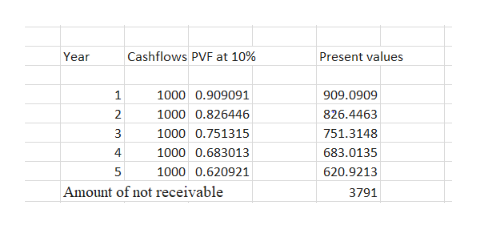

First step is to compute the Amount of note receivable to be recorded on 31.12.10 through present value of cashflows as above.

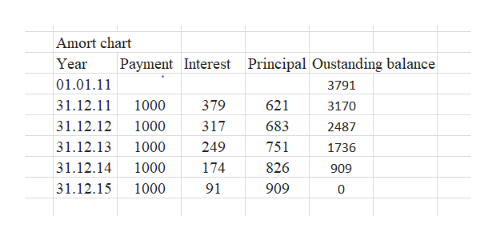

Next step is to compute the Amort chart and to alocate the total payment among interest and principal repayment as above.

Step by step

Solved in 4 steps with 4 images