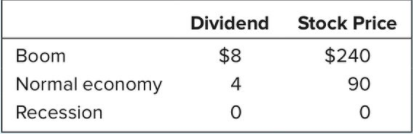

16. Scenario Analysis. The common stock of Escapist Films sells for $25 a share and offers the following payoffs next year: (L011-3) Dividend Stock Price Вoom $0 $18 Normal economy 1 26 Recession 3 34 a. Calculate the expected return and standard deviation of Escapist. All three scenarios are equally likely. b. Now calculate the expected return and standard deviation of a portfolio half invested in Escapist and half in Leaning Tower of Pita (from Problem 15). Show that the portfolio stan- dard deviation is lower than that of either stock. Explain why this happens.

Risk and return

Before understanding the concept of Risk and Return in Financial Management, understanding the two-concept Risk and return individually is necessary.

Capital Asset Pricing Model

Capital asset pricing model, also known as CAPM, shows the relationship between the expected return of the investment and the market at risk. This concept is basically used particularly in the case of stocks or shares. It is also used across finance for pricing assets that have higher risk identity and for evaluating the expected returns for the assets given the risk of those assets and also the cost of capital.

DO NOT SOLVE QUESTION 15 it has already been answered question 15 is only required as part of the information to solve question 16. I NEED PART a) & b) FROM QUESTION 16, Thank you very much for the help

Answers of Question 15

a) Expected

Standar Deviation = 127.78 %

b) A successful bankruptcy lawyer would view the stock of leaning tower of pita as a risk reducing investment

Here,

Selling Price of Company Esc Stock is $25

Other Details are as follows:

Probability in three possible states is equally likely

Probability between both the companies is equal i.e 50%

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 7 images