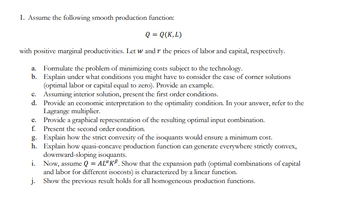

1. Assume the following smooth production function: Q = Q(K,L) with positive marginal productivities. Let w and r the prices of labor and capital, respectively. a. Formulate the problem of minimizing costs subject to the technology. b. Explain under what conditions you might have to consider the case of corner solutions (optimal labor or capital equal to zero). Provide an example.

1. Assume the following smooth production function: Q = Q(K,L) with positive marginal productivities. Let w and r the prices of labor and capital, respectively. a. Formulate the problem of minimizing costs subject to the technology. b. Explain under what conditions you might have to consider the case of corner solutions (optimal labor or capital equal to zero). Provide an example.

Chapter1: Making Economics Decisions

Section: Chapter Questions

Problem 1QTC

Related questions

Question

Micro Question 1

Please help to solve this. Thank you

Transcribed Image Text:1. Assume the following smooth production function:

Q = Q(K,L)

with positive marginal productivities. Let w and r the prices of labor and capital, respectively.

a. Formulate the problem of minimizing costs subject to the technology.

b.

Explain under what conditions you might have to consider the case of corner solutions

(optimal labor or capital equal to zero). Provide an example.

c. Assuming interior solution, present the first order conditions.

d.

Provide an economic interpretation to the optimality condition. In your answer, refer to the

Lagrange multiplier.

e.

Provide a graphical representation of the resulting optimal input combination.

f. Present the second order condition.

g. Explain how the strict convexity of the isoquants would ensure a minimum cost.

h.

Explain how quasi-concave production function can generate everywhere strictly convex,

downward-sloping isoquants.

i. Now, assume Q = AL" KB. Show that the expansion path (optimal combinations of capital

and labor for different isocosts) is characterized by a linear function.

j.

Show the previous result holds for all homogeneous production functions.

Transcribed Image Text:Greek Letters:

0: Usually a "type" of some sort; private information.

6: (Normal, exponential) discount rate; one period from now is worth d as much as now.

T: Used for many things, for instance, profit or probabilities.

Geometric Series:

If you have a geometric series arx¹, where a is any constant and 0 < x < 1, then the

series converges to

'i=0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Please continue to solve from part d to part j. Thank you very much

Transcribed Image Text:1. Assume the following smooth production function:

Q = Q(K,L)

with positive marginal productivities. Let w and r the prices of labor and capital, respectively.

a. Formulate the problem of minimizing costs subject to the technology.

b.

Explain under what conditions you might have to consider the case of corner solutions

(optimal labor or capital equal to zero). Provide an example.

c. Assuming interior solution, present the first order conditions.

d.

Provide an economic interpretation to the optimality condition. In your answer, refer to the

Lagrange multiplier.

e.

Provide a graphical representation of the resulting optimal input combination.

f. Present the second order condition.

g. Explain how the strict convexity of the isoquants would ensure a minimum cost.

h.

Explain how quasi-concave production function can generate everywhere strictly convex,

downward-sloping isoquants.

i. Now, assume Q = AL" KB. Show that the expansion path (optimal combinations of capital

and labor for different isocosts) is characterized by a linear function.

j.

Show the previous result holds for all homogeneous production functions.

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-…

Economics

ISBN:

9781259290619

Author:

Michael Baye, Jeff Prince

Publisher:

McGraw-Hill Education