Concept explainers

Bean Nursery sells bark to its customers at retail. Bean buys bark from a plywood mill in bulk and transports the bark in its own trucks. Information relating to the beginning inventory and purchases of bark is as follows:

Required

Find the cost of 1,200 cubic yards in the ending inventory by the weighted-average-cost method. Carry average cost per cubic yard to four decimals.

Check Figure

Cost of ending inventory, $519.24

Compute the cost of ending inventory using weighted-average-cost method.

Explanation of Solution

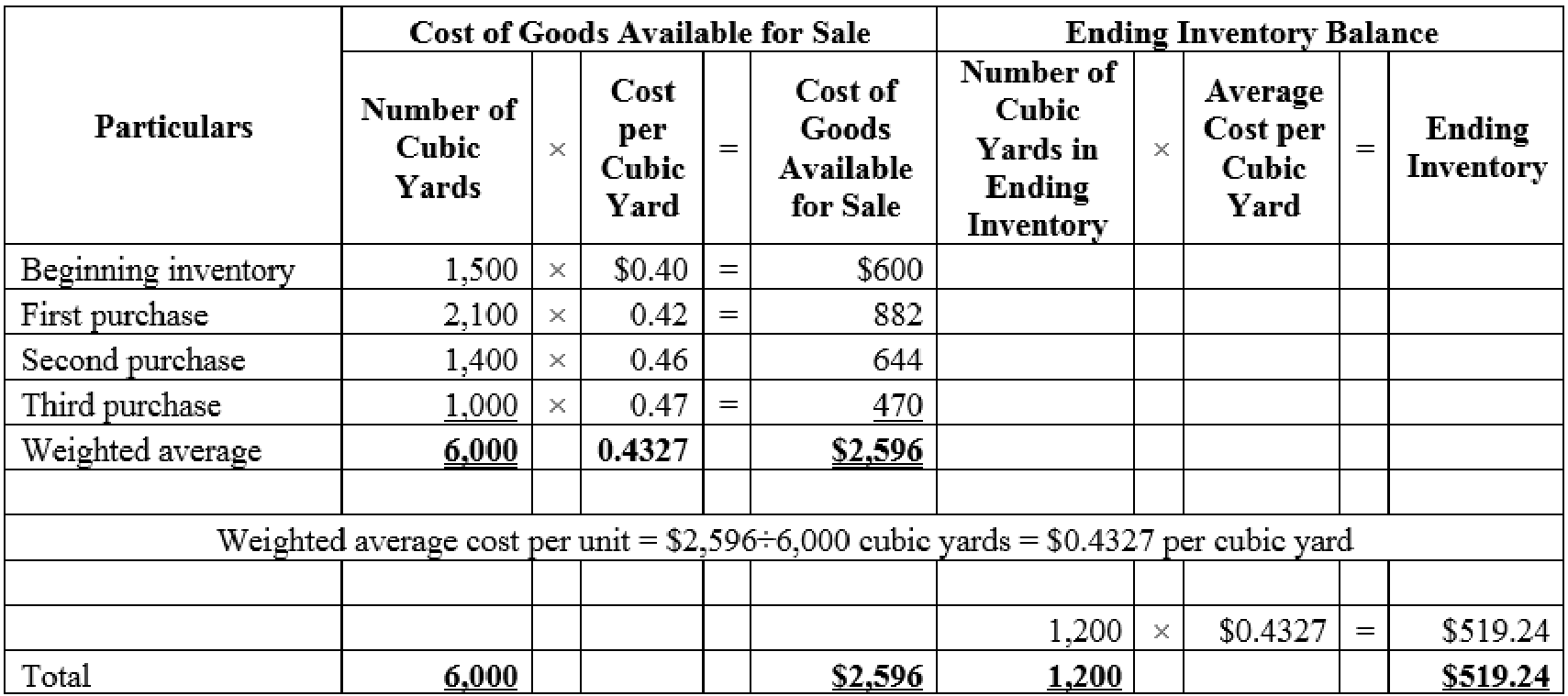

Weighted-average cost method: Under average cost method, company calculates a new average after every purchase. It is determined by dividing the cost of goods available for sale by the units on hand.

Compute the cost of ending inventory of 1,200 cubic yards using weighted-average-cost method.

Table (1)

Thus, the cost of 1,200 cubic yards using weighted-average-cost is $519.24.

Want to see more full solutions like this?

Chapter C Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

Essentials of MIS (13th Edition)

Fundamentals of Management (10th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

- A firm has net working capital of $510, net fixed assets of $2,750, sales of $7,200, and current liabilities of $950. How many dollars worth of sales are generated from every $1 in total assets?arrow_forwardHi expert please given correct answer with accounting questionarrow_forwardGeneral accounting questionarrow_forward

- Hemsworth Electronics company has a beginning finished goods inventory of $24,500, raw material purchases of $35,600, cost of goods manufactured of $42,800, and an ending finished goods inventory of $27,300. The cost of goods sold for this company is?arrow_forwardThunderstorm Industries, which produces a single product, has provided the following data concerning its most recent month of operations: Details Selling price Units beginning inventory Units produced Units sold Units in ending inventory Values $110 0 7,200 6,800 400 Variable costs per unit: Direct materials $15 Direct labor $48 Variable manufacturing overhead $9 Variable selling and administrative $8 Fixed costs: $198,000 Fixed manufacturing overhead Fixed selling and administrative expenses $32,000 The company produces the same number of units every month, although the sales in units vary. The company's variable costs per unit and total fixed costs remain constant from month to month. What is the unit product cost for the month under absorption costing?arrow_forwardWhat is the total sales volume in terms of the constitution margin?arrow_forward

- Kindly help me with this General accounting questions not use chart gpt please fast given solutionarrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forwardPlease provide the solution to this financial accounting question using proper accounting principles.arrow_forward

- Deluxe Industries used direct materials totaling $78,350; direct labor incurred totaled $217,600; manufacturing overhead totaled $389,200; Work in Process Inventory on January 1, 2022, was $195,400; and Work in Process Inventory on December 31, 2022, was $204,300. What is the cost of goods manufactured for the year ended December 31, 2022? Help me with thisarrow_forwardThe company products the same number of units every month, although the sales in units vary.arrow_forwardTutor please provide answerarrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,