ADVANCED FIN. ACCT. LL W/ACCESS>CUSTOM<

12th Edition

ISBN: 9781265074623

Author: Christensen

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 9.12E

Subsidiary Stock Dividend

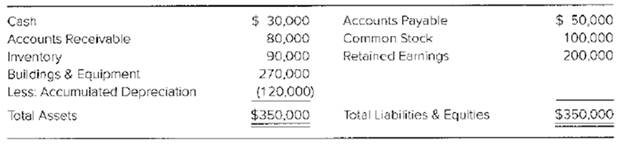

Stake Company reported the following summarized

Stake issues 4.000 additional shares of its $10 par value stock to its shareholders as a stock dividend on April 20, 20X3. The mat1et price of Stake’s shares at the time of the stock dividend is $40. Stake reports net income of $25,000 and pays a $10,000 cash dividend in 20X3. Pole Company acquired 70 percent of Stake’s common shares at book value on January 1, 20X1. At that date, the fair value of the noncontrolling interest was equal to 30 percent of Stake’s book value. Pole uses the equity method in accounting for its investment in Stake.

Required

- Give the

journal entries recorded by Stake and Pole at the time the stock dividend is declared and distributed. - Give the worksheet consolidation entries needed to prepare consolidated financial statements for 20X3.

- Give the worksheet consolidation entry needed to prepare a consolidated balance sheet on January 1, 20X4.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Don't want wrong answer

Sub. General accounting

Provide accurate answer

Chapter 9 Solutions

ADVANCED FIN. ACCT. LL W/ACCESS>CUSTOM<

Ch. 9 - Prob. 9.1QCh. 9 - Prob. 9.2QCh. 9 - Prob. 9.3QCh. 9 - Prob. 9.4QCh. 9 - Prob. 9.5QCh. 9 - Prob. 9.6QCh. 9 - Prob. 9.7QCh. 9 - Prob. 9.8QCh. 9 - Prob. 9.9QCh. 9 - Prob. 9.10Q

Ch. 9 - Prob. 9.11QCh. 9 - Prob. 9.12QCh. 9 - Prob. 9.13QCh. 9 - Prob. 9.14QCh. 9 - Prob. 9.15QCh. 9 - Prob. 9.16QCh. 9 - Prob. 9.1CCh. 9 - Prob. 9.2CCh. 9 - Prob. 9.3CCh. 9 - Prob. 9.4CCh. 9 - Prob. 9.5CCh. 9 - Prob. 9.1.1ECh. 9 - Prob. 9.1.2ECh. 9 - Prob. 9.1.3ECh. 9 - Prob. 9.1.4ECh. 9 - Prob. 9.2.1ECh. 9 - Prob. 9.2.2ECh. 9 - Prob. 9.2.3ECh. 9 - Prob. 9.2.4ECh. 9 - Prob. 9.2.5ECh. 9 - Prob. 9.3ECh. 9 - Prob. 9.4ECh. 9 - Prob. 9.5ECh. 9 - Prob. 9.6ECh. 9 - Prob. 9.7ECh. 9 - Prob. 9.8ECh. 9 - Prob. 9.9ECh. 9 - Prob. 9.10ECh. 9 - Prob. 9.11ECh. 9 - Subsidiary Stock Dividend Stake Company reported...Ch. 9 - Prob. 9.13ECh. 9 - Prob. 9.14ECh. 9 - Prob. 9.15ECh. 9 - Prob. 9.16ECh. 9 - Prob. 9.17.1PCh. 9 - Prob. 9.17.2PCh. 9 - Prob. 9.17.3PCh. 9 - Prob. 9.17.4PCh. 9 - Prob. 9.17.5PCh. 9 - Prob. 9.18PCh. 9 - Prob. 9.19PCh. 9 - Prob. 9.20PCh. 9 - Prob. 9.21PCh. 9 - Prob. 9.22PCh. 9 - Prob. 9.23PCh. 9 - Prob. 9.24PCh. 9 - Prob. 9.25PCh. 9 - Prob. 9.26PCh. 9 - Prob. 9.27P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Need help this question solutionarrow_forwardKevin Rogers and Kelly Simmons started Book Haven as a corporation, each contributing $55,000 in cash to start the business and receiving 5,000 shares of stock. At the end of the first year of operations on December 31, 2023, the following financial details were recorded: cash on hand and in the bank was $50,300, amounts due from customers for book sales totaled $32,400, and equipment was valued at $54,000. The company owed $10,000 to publishers for books purchased, and there was a one-year note payable to the bank for $6,100. No dividends were declared or paid during the year. Using the retained earnings equation with an opening balance of $0, calculate the net income for the year ending December 31, 2023.arrow_forwardi want to correct answer please help mearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Stockholders Equity: How to Calculate?; Author: Accounting University;https://www.youtube.com/watch?v=2jZk1T5GIlw;License: Standard Youtube License