MANAGERIAL ACCT. F/MANAGERS (LL)-W/ACCES

6th Edition

ISBN: 9781266395420

Author: Noreen

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 7C, Problem 7C.5P

Income Taxes and

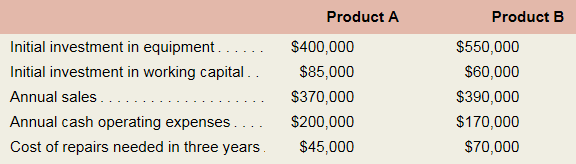

Shimano Company has an opportunity to manufacture and sell one of two new products for a five-year period. The company’s tax rate is 30% and its after-tax cost of capital is 14%. The cost and revenue estimates for each product are as follows:

Required:

- Calculate the annual income tax expense for each of Years 1 through 5 that will arise if Product A is introduced.

- Calculate the net present value of the investment opportunity pertaining to Product A.

- Calculate the annual income tax expense for each of Years 1 through 5 that will arise if Product B is introduced.

- Calculate the net present value of the investment opportunity pertaining to Product B.

- Calculate the project profitability index for Product A and Product B. Which of the two products should the company pursue? Why?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

none

Please solve this problem

Overhead costs in December

Chapter 7C Solutions

MANAGERIAL ACCT. F/MANAGERS (LL)-W/ACCES

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Net operating income for the year using variable costing?arrow_forwardThe magnitude of operating leverage for Peterson Industries is 4.2 when sales are $150,000. If sales increase to $165,000, profits would be expected to increase by what percent? Accounting 12arrow_forwardSubject accountingarrow_forward

- Beacon Corporation applies manufacturing overhead on the basis of direct labor hours. At the beginning of the most recent year, the company based its predetermined overhead rate on a total estimated overhead of $95,400 and 3,600 estimated direct labor hours. Actual manufacturing overhead for the year amounted to $98,800 and actual direct labor-hours were 3,500. The applied manufacturing overhead for the year was closest to __.arrow_forwardMonth cost units producedarrow_forwarddo fast answer of this question solve mearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Depreciation -MACRS; Author: Ronald Moy, Ph.D., CFA, CFP;https://www.youtube.com/watch?v=jsf7NCnkAmk;License: Standard Youtube License