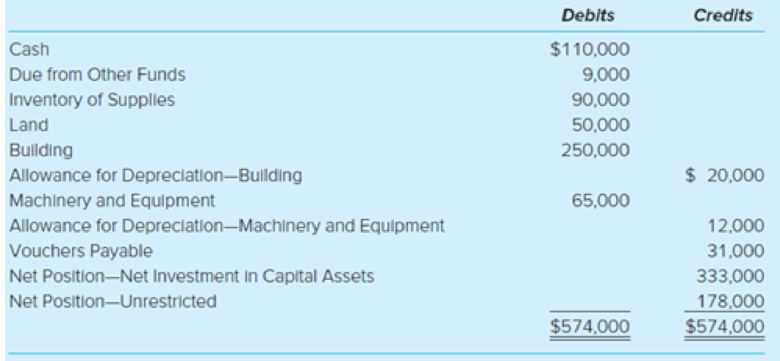

Central Garage Internal Service Fund. (LO7-2) The City of Ashville operates an internal service fund to provide garage space and repairs for all city-owned-and-operated vehicles. The Central Garage Fund’s preclosing

The following information, not yet reflected in the preclosing figures above, applies to the current Fiscal year:

- 1. Supplies were purchased on account for $92,000; the perpetual inventory method is used.

- 2. The cost of supplies used during the year was $110,000. A physical count taken as of that date showed materials and supplies on hand totaled $72,000 at cost.

- 3. Salaries and wages paid to employees totaled $235,000, including related costs.

- 4. Billings totaling $30,000 were received from the enterprise fund for utility charges. The Central Garage Fund paid $27,000 of the amount owed. (At the government-wide level, record the payable amount as Internal Balances.)

- 5.

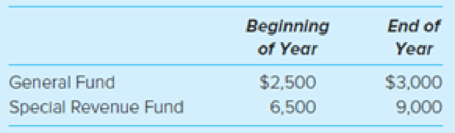

Depreciation of the building was recorded in the amount of $10,000; depreciation of the machinery and equipment amounted to $9,000. - 6. Billings to other departments for services provided to them were as follows:

- 7. Unpaid interfund receivable balances were as follows:

- 8. Vouchers payable at year-end were $16,000.

- 9. Closing entries were prepared for the Central Garage Fund (ignore government-wide closing entry).

Required

- a. Prepare

journal entries to record all of the transactions for this period in the Central Garage Fund accounts and in the governmental activities accounts. Assume all expenses at the government-wide level are charged to the General Government function. - b. Prepare a statement of revenues, expenses, and changes in fund net position for the Central Garage Fund for the period.

- c. Prepare a statement of net position for the Central Garage Fund as of year-end.

- d. Explain what the Central Garage Fund would need to report at the governmental activities level, and where the information would be reported.

a.

Prepare journal entries to record all the transactions in Central Garage Fund accounts and governmental activities accounts.

Explanation of Solution

Internal service funds record the activities that are related to purchase and distribution within the departments of the government. Internal service fund accounts for the internal financial transactions.

Journal: Journal is the method of recording monetary business transactions in chronological order. It records the debit and credit aspects of each transaction to abide by the double-entry system.

Rules of Debit and Credit: Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

The purchase of inventory is recorded as below in Central Garage Fund accounts and governmental activities accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Inventory of supplies | 92,000 | |||

| Vouchers payable | 92,000 | |||

| (To record the purchase of inventory) |

Table (1)

The value of supplies used is recorded as below in Central Garage Fund accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Cost of supplies used | 110,000 | |||

| Inventory of supplies | 110,000 | |||

| (To record the cost of supplies used) |

Table (2)

The value of supplies used is recorded as below in Governmental activities accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Expenses-General government | 110,000 | |||

| Inventory of supplies | 110,000 | |||

| (To record the cost of supplies used) |

Table (3)

The payment of salaries and wages is recorded as below in Central Garage Fund accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Salaries and Wages Expense | 235,000 | |||

| Cash | 235,000 | |||

| (To record the payment of salaries and wages) |

Table (4)

The payment of salaries and wages is recorded as below in Governmental activities accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Expenses-General government | 235,000 | |||

| Cash | 235,000 | |||

| (To record the payment of salaries and wages) |

Table (5)

The accrual and payment of utilities expense is recorded as below in Central Garage Fund accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Utilities expense | 30,000 | |||

| Due to other funds | 3,000 | |||

| Cash | 27,000 | |||

| (To record the payment of utilities expense to the utility fund and the accrual of remaining bills) |

Table (6)

The accrual and payment of utilities expense is recorded as below in Governmental activities accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Expenses-General government | 30,000 | |||

| Internal balances | 3,000 | |||

| Cash | 27,000 | |||

| (To record the payment of utilities expense to the utility fund and the accrual of remaining bills) |

Table (7)

The depreciation expense is recorded is recorded as below in Central Garage Fund accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Depreciation expense - Building | 10,000 | |||

| Depreciation expense – Machinery and Equipment | 9,000 | |||

| Allowance for depreciation - Building | 10,000 | |||

| Allowance for depreciation - Machinery and Equipment | 9,000 | |||

| (To record the allowance for depreciation on building and machinery and equipment) |

Table (8)

The depreciation expense is recorded as below in Governmental activities accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Expenses-General government | 19,000 | |||

| Allowance for depreciation - Building | 10,000 | |||

| Allowance for depreciation - Machinery and Equipment | 9,000 | |||

| (To record the allowance for depreciation on building and machinery and equipment) |

Table (9)

The due from other funds is recorded is recorded as below in Central Garage Fund accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Due to other funds | 397,000 | |||

| Billings to other departments | 397,000 | |||

| (To record the accrual of revenue from general fund and special revenue fund) |

Table (10)

Working Note: It is given that the “central garage fund” is billed $270,000 to general fund and $127,000 to special revenue fund. Hence, the total due to other funds is $397,000

Note: As the “central garage fund” has dues from the other governmental funds like general fund and special revenue fund, there is no need for an entry in the governmental activities. The reason is that both the “internal service funds” and “governmental funds” will be recorded in the same column of the governmental activities.

The receipt of dues from other funds is recorded as below in Central Garage Fund accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Cash | 394,000 | |||

| Due to other funds | 394,000 | |||

| (To record the receipt of due from general fund and special revenue fund) |

Table (11)

Working note: The opening balance of general fund is $2,500 and the special revenue fund is $6,500. Hence, the opening balance of dues from other funds would be $9,000

Note: As the “central garage fund” has dues from the other governmental funds like general fund and special revenue fund, there is no need for an entry in the governmental activities. The reason is that both the “internal service funds” and “governmental funds” will be recorded in the same column of the governmental activities.

The payment of vouchers payable is recorded as below in Central Garage Fund accounts and governmental activities accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Vouchers payable | 107,000 | |||

| Cash | 107,000 | |||

| (To record the vouchers paid) |

Table (12)

The closing entry is recorded as below in Central Garage Fund accounts:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Billings to departments | 397,000 | |||

| Cost of supplies issued | 110,000 | |||

| Salaries and wages expense | 235,000 | |||

| Utilities expense | 30,000 | |||

| Depreciation expense-building | 10,000 | |||

| Depreciation expense- machinery and equipment | 9,000 | |||

| Excess of net billings over cost | 3,000 | |||

| (To record closing of nominal accounts) |

Table (13)

The journal entry to transfer the excess of net billing over cost to the unrestricted net position is recorded as below:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Excess of net billings over cost | 3,000 | |||

| Net position-unrestricted | 3,000 | |||

| (To transfer the excess of net billings over cost to the “unrestricted net position”) |

Table (14)

The journal entry to allocate the decrease in “net investment in capital assets” to the “unrestricted net position” is recorded as below:

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| Net position-net investments in capital assets | 19,000 | |||

| Net position-unrestricted | 19,000 | |||

| (To charge he decrease in the “net position-net investment in capital assets” to the “unrestricted net position”) |

Table (15)

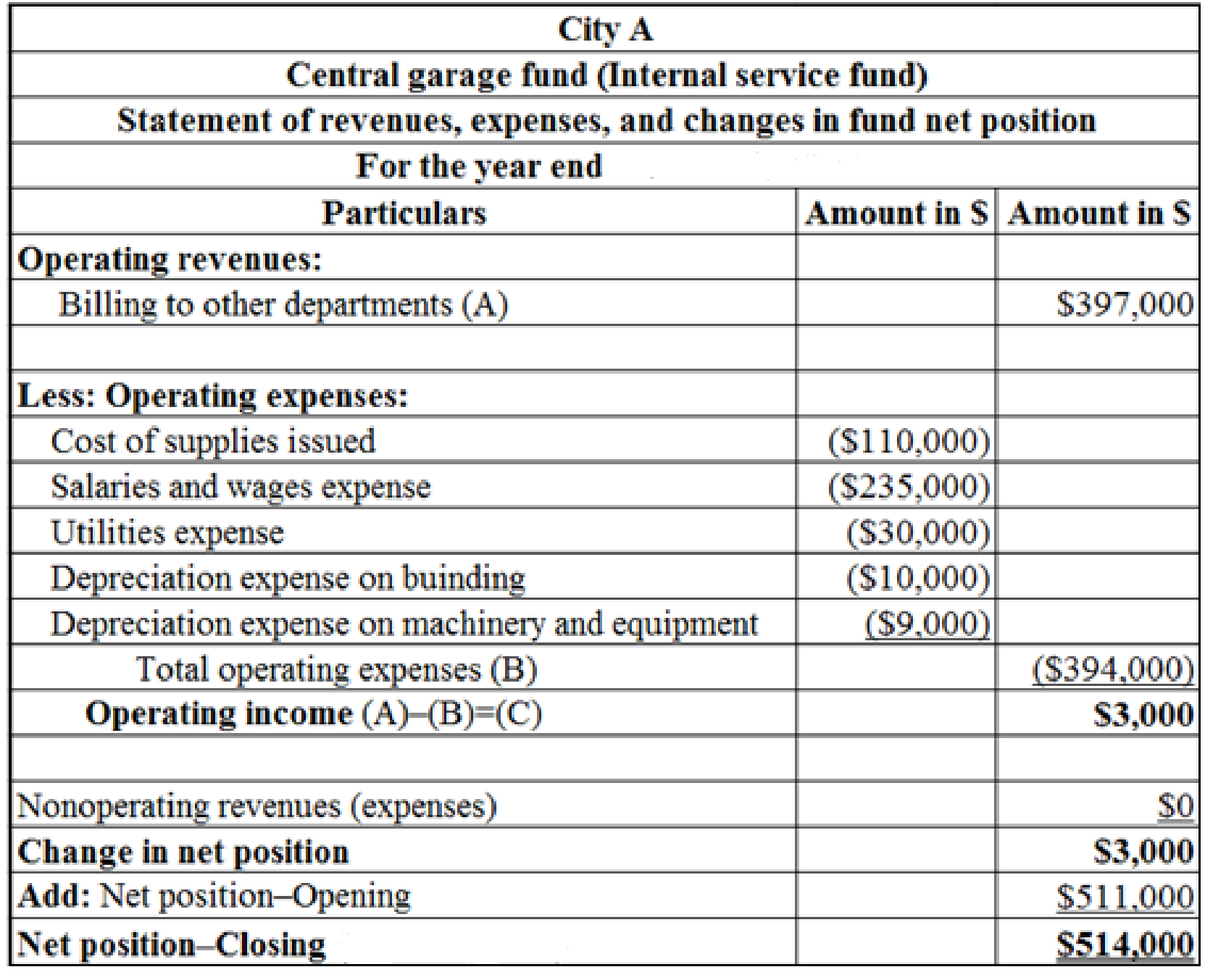

b.

Prepare a “statement of revenues, expenses, and changes in fund net position” for Central Garage Fund.

Explanation of Solution

Statement of revenues, expenses and changes in net position: Statement of activities is the operating statement that reports revenues, expenses, and changes in net position during the year.

Prepare a “statement of revenues, expenses, and changes in fund net position” for Central Garage Fund.

Table (16)

Working note: Determine the opening net position.

Before the fiscal year adjustments, the net position of “net investment is capital assets” is $333,000 and the unrestricted net position is $178,000. Hence, the total opening net position is $511,000

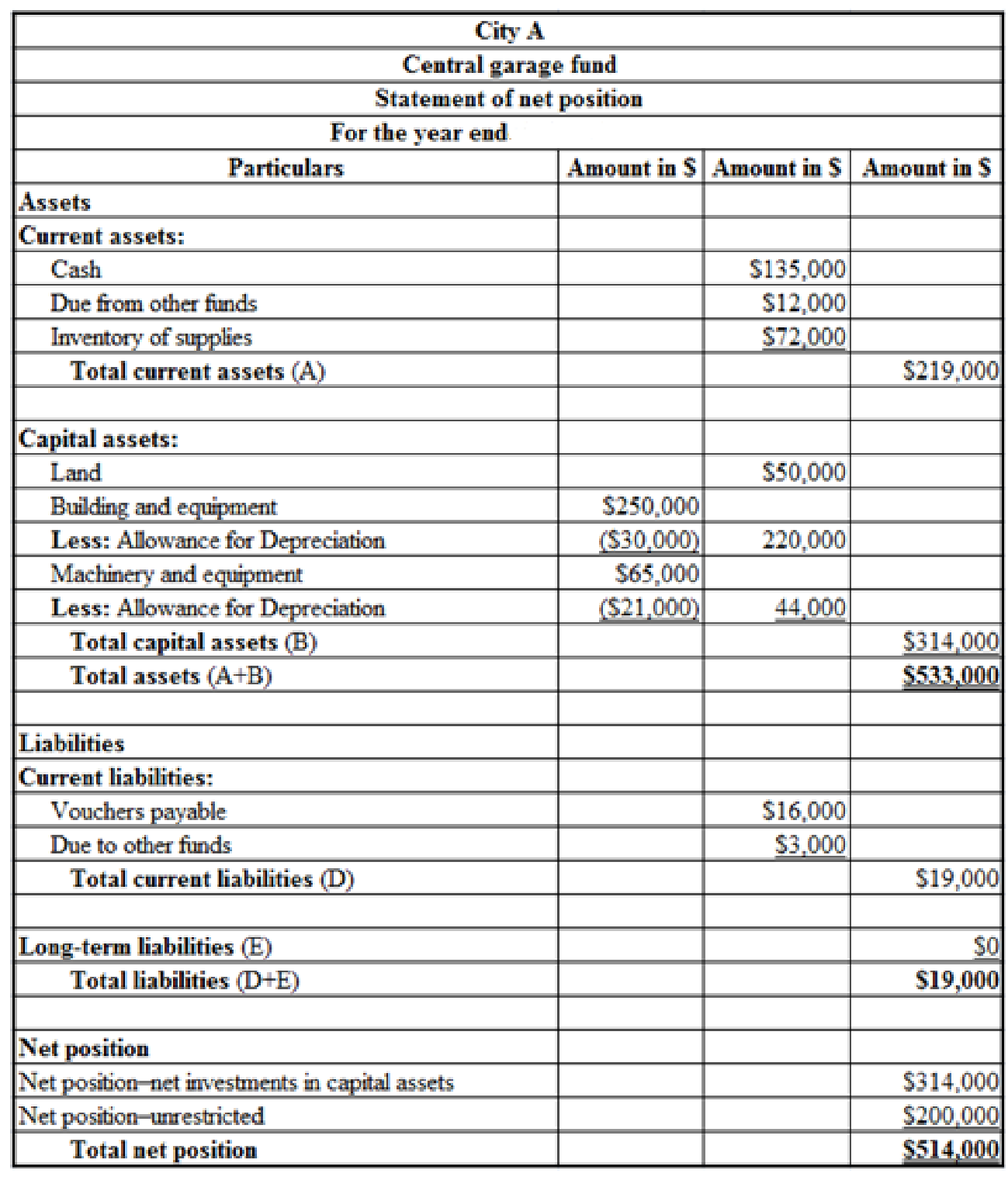

(c)

Prepare a “statement of net position” for Central Garage Fund.

Explanation of Solution

Statement of net position: Statement of financial position is a balance sheet that reports the assets, deferred outflow of resources, liabilities, deferred inflow of resources and the residual amount or net position of the government at the end of the fiscal year.

Prepare a “statement of net position” for Central Garage Fund.

Table (17)

Working notes:

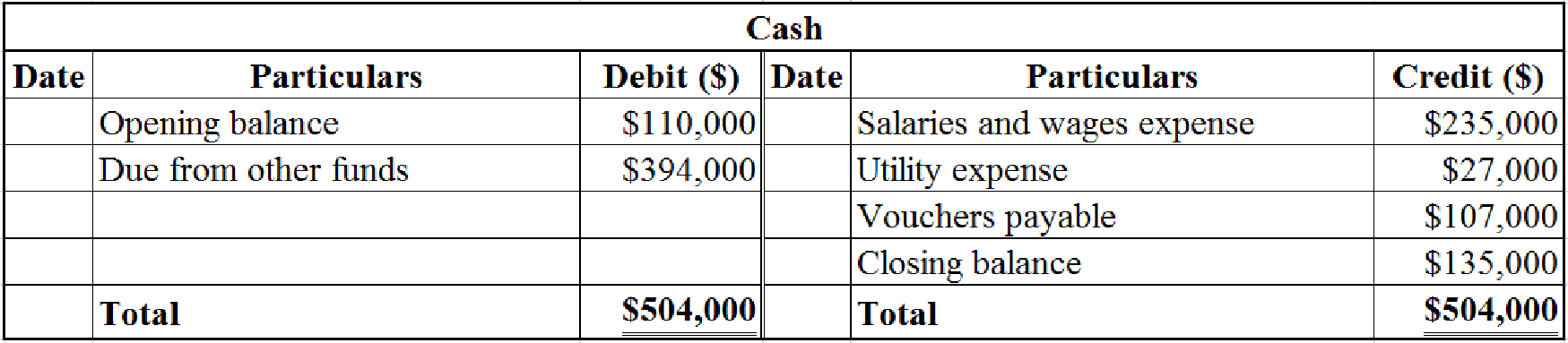

- Determine the closing balance of cash.

Table (18)

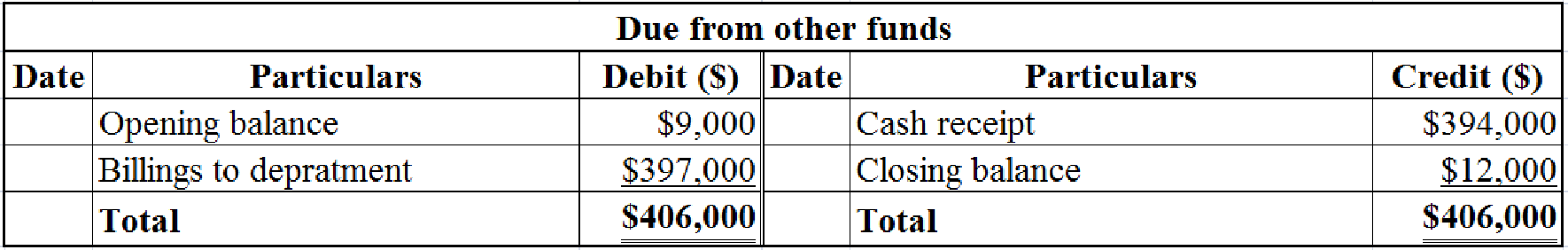

- Determine the closing balance of due from other funds.

Table (19)

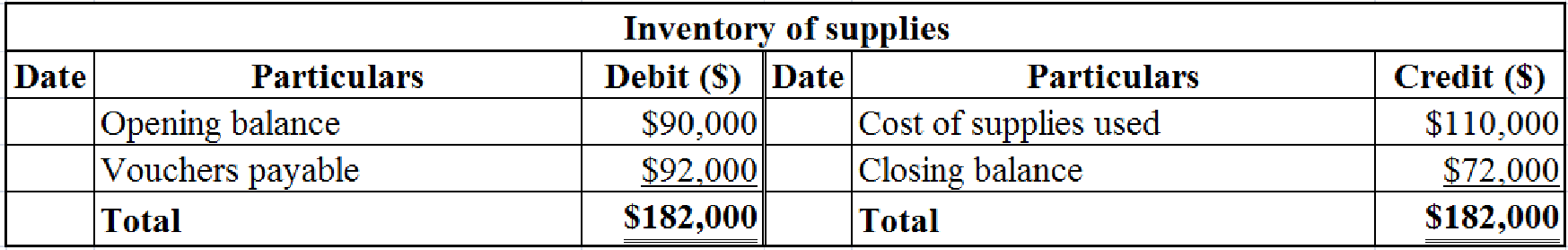

- Determine the closing balance of inventory of supplies.

Table (20)

- Determine the accumulated depreciation for building.

The accumulated depreciation on building is the sum of current year depreciation ($10,000) and the previous year accumulated depreciation (20,000). Hence, the accumulated depreciation for current year is $30,000

- Determine the accumulated depreciation for machinery and equipment.

The accumulated depreciation on machinery is the sum of current year depreciation ($9,000) and the previous year accumulated depreciation (12,000). Hence, the accumulated depreciation for current year is $21,000

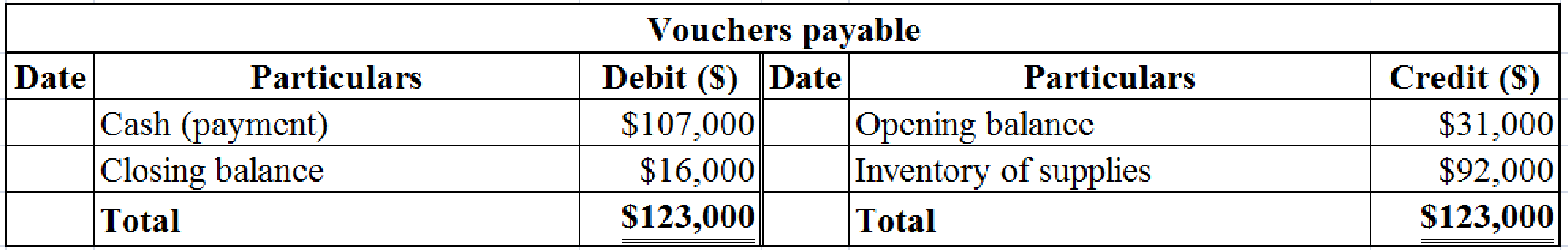

- Determine the closing balance of vouchers payable.

Table (21)

- Determine the net position of “net investment in capital assets”.

The opening balance of “net investment in capital assets” is $333,000. The current year’s depreciation is $19,000. Hence, the closing balance of “net investment in capital assets” is $314,000

- Determine the unrestricted net position as on June 30.

(d)

Discuss about the information that the “central garage fund” has to report in the governmental activities.

Explanation of Solution

Since, the “Central Garage Fund” is an internal service fund; it has to report its activities and net assets in the “governmental activities” statements. It has to merge the “garage fund” with the “governmental funds” and report it in the “governmental activities column”.

Want to see more full solutions like this?

Chapter 7 Solutions

Loose-leaf For Accounting For Governmental & Nonprofit Entities

- Answer? ? Financial accounting questionarrow_forwardData for the two departments of Gurley Industries for September of the current fiscal year are as follows: Drawing Department Winding Department Work in process, September 1 4,900 units, 20% completed 3,000 units, 65% completed Completed and transferred to next processing department during September 67,100 units 66,000 units Work in process, September 30 3,700 units, 55% completed 4,100 units, 20% completed Production begins in the Drawing Department and finishes in the Winding Department. Question Content Area a. If all direct materials are placed in process at the beginning of production, determine the direct materials and conversion equivalent units of production for September for the Drawing Department. If an amount is zero, enter in "0". Drawing DepartmentDirect Materials and Conversion Equivalent Units of ProductionFor September Line Item Description Whole Units Direct MaterialsEquivalent Units ConversionEquivalent Units Inventory in process,…arrow_forwardThe charges to Work in Process—Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production. Work in Process-Assembly Department Transaction Debit amount Transaction Credit amount Bal., 3,000 units, 45% completed 6,900 To Finished Goods, 69,000 units ? Direct materials, 71,000 units @ $1.4 99,400 Direct labor 106,400 Factory overhead 41,440 Bal., ? units, 55% completed ? Cost per equivalent units of $1.40 for Direct Materials and $2.10 for Conversion Costs. a. Based on the above data, determine the different costs listed below. Line Item Description Amount 1. Cost of beginning work in process inventory completed this period fill in the blank 1 of 4$ 2. Cost of units transferred to finished goods during the period fill in the blank 2 of 4$ 3. Cost of ending work in process inventory fill in the blank 3 of 4$ 4. Cost per unit of…arrow_forward

- Hii expert please given correct answer financial accountingarrow_forwardThe following information concerns production in the Baking Department for August. All direct materials are placed in process at the beginning of production. Date Item Debit Credit BalanceDebit BalanceCredit August 1 Bal., 6,300 units, 4/5 completed 16,884 31 Direct materials, 113,400 units 226,800 243,684 31 Direct labor 64,390 308,074 31 Factory overhead 36,212 344,286 31 Goods finished, 114,900 units 332,958 11,328 31 Bal., ? units, 2/5 completed 11,328 a. Based on the above data, determine each cost listed below. Round "cost per equivalent unit" answers to the nearest cent. Line Item Description Amount 1. Direct materials cost per equivalent unit $fill in the blank 1 2. Conversion cost per equivalent unit $fill in the blank 2 3. Cost of the beginning work in process completed during August $fill in the blank 3 4. Cost of units started and completed during August $fill in the blank 4 5. Cost of the ending work in…arrow_forwardWaiting for your solution general accounting questionarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education