Concept explainers

Absorption Costing Approach to Cost-Plus Pricing LO6—8

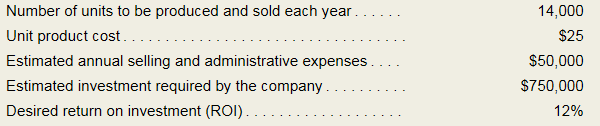

Martin Company uses the absorption costing approach to cost-plus pricing. It is considering the introduction of a new product. To determine a selling price, the company has gathered the following information:

Required:

- Compute the markup percentage on absorption cost required to achieve the desired ROL.

- Compute the selling price per unit.

Concept Introduction:

Costing is a process of calculation of the cost of the product or service manufactured or provided by an organization. There are two methods of costing; absorption costing and variable costing.

As per nature, costs can be divided into three categories, i.e., variable costs, fixed costs, and mixed costs.

Requirement-1:

The markup percentage.

Answer to Problem 6A.1E

The markup percentage is 25.71%.

Explanation of Solution

The markup percentage is calculated as follows:

| Number of units (A) | $ 14,000 |

| Unit product cost (B) | $ 25 |

| Total absorption product cost (C) = (A*B) | $ 350,000 |

| Selling and admn expenses (D) | $ 50,000 |

| Total Cost (E) = (C+D) | $ 400,000 |

| Amount of investment (F) | $ 750,000 |

| Desired return on investment (G) | 12% |

| Desired markup (H) = (F*G) | $ 90,000 |

| Markup % (I) = (H/C) | 25.71% |

Concept Introduction:

Costing is a process of calculation of the cost of the product or service manufactured or provided by an organization. There are two methods of costing; absorption costing and variable costing.

As per nature, costs can be divided into three categories, i.e., variable costs, fixed costs, and mixed costs.

Requirement-2:

The selling price per unit.

Answer to Problem 6A.1E

The selling price per unit is $35.

Explanation of Solution

The selling price per unit is calculated as follows:

| Number of units (A) | $ 14,000 |

| Unit product cost (B) | $ 25 |

| Total absorption product cost (C) = (A*B) | $ 350,000 |

| Selling and admn expenses (D) | $ 50,000 |

| Total Cost (E) = (C+D) | $ 400,000 |

| Amount of investment (F) | $ 750,000 |

| Desired return on investment (G) | 12% |

| Desired markup (H) = (F*G) | $ 90,000 |

| Markup % (I) = (H/C) | 25.71% |

| Tota cost per unit (J) = (E/A) | $ 28.57 |

| Markup per unit (K) = (H/A) | $ 6.43 |

| Selling price (J+K) | $ 35.00 |

Want to see more full solutions like this?

Chapter 6A Solutions

MANAGERIAL ACCOUNTING FOR MANAGERS EBOOK

- Cullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardCullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardGeneral Accounting questionarrow_forward

- What Is the correct answer A B ?? General Accounting questionarrow_forwardCullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardAccounting questionarrow_forward

- Determine the cost of the patent.arrow_forwardAccounting questionarrow_forwardMs. Sharon Washton was born 26 years ago in Bahn, Germany. She is the daughter of a Canadian High Commissioner serving in that country. However, Ms. Washton is now working in Prague, Czech Republic. The only income that she earns in the year is from her Prague marketing job, $55,000 annually, and is subject to income tax in Czech Republic. She has never visited Canada. Determine the residency status of Sharon Washtonarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub