Concept explainers

Absorption Costing Approach to Cost-Plus Pricing LO6—8

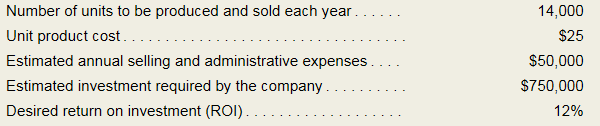

Martin Company uses the absorption costing approach to cost-plus pricing. It is considering the introduction of a new product. To determine a selling price, the company has gathered the following information:

Required:

- Compute the markup percentage on absorption cost required to achieve the desired ROL.

- Compute the selling price per unit.

Concept Introduction:

Costing is a process of calculation of the cost of the product or service manufactured or provided by an organization. There are two methods of costing; absorption costing and variable costing.

As per nature, costs can be divided into three categories, i.e., variable costs, fixed costs, and mixed costs.

Requirement-1:

The markup percentage.

Answer to Problem 6A.1E

The markup percentage is 25.71%.

Explanation of Solution

The markup percentage is calculated as follows:

| Number of units (A) | $ 14,000 |

| Unit product cost (B) | $ 25 |

| Total absorption product cost (C) = (A*B) | $ 350,000 |

| Selling and admn expenses (D) | $ 50,000 |

| Total Cost (E) = (C+D) | $ 400,000 |

| Amount of investment (F) | $ 750,000 |

| Desired return on investment (G) | 12% |

| Desired markup (H) = (F*G) | $ 90,000 |

| Markup % (I) = (H/C) | 25.71% |

Concept Introduction:

Costing is a process of calculation of the cost of the product or service manufactured or provided by an organization. There are two methods of costing; absorption costing and variable costing.

As per nature, costs can be divided into three categories, i.e., variable costs, fixed costs, and mixed costs.

Requirement-2:

The selling price per unit.

Answer to Problem 6A.1E

The selling price per unit is $35.

Explanation of Solution

The selling price per unit is calculated as follows:

| Number of units (A) | $ 14,000 |

| Unit product cost (B) | $ 25 |

| Total absorption product cost (C) = (A*B) | $ 350,000 |

| Selling and admn expenses (D) | $ 50,000 |

| Total Cost (E) = (C+D) | $ 400,000 |

| Amount of investment (F) | $ 750,000 |

| Desired return on investment (G) | 12% |

| Desired markup (H) = (F*G) | $ 90,000 |

| Markup % (I) = (H/C) | 25.71% |

| Tota cost per unit (J) = (E/A) | $ 28.57 |

| Markup per unit (K) = (H/A) | $ 6.43 |

| Selling price (J+K) | $ 35.00 |

Want to see more full solutions like this?

- I need help with this general accounting question using the proper accounting approach.arrow_forwardJob C-230arrow_forwardIngram Production creates 4,500 units. Each unit was expected to require 2.2 labor hours at a cost of $14 per hour. Total labor cost was $143,850 for 10,200 hours worked. Direct labor is measured in labor hours. What is the flexible budget variance for direct labor?arrow_forward

- I am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forwardCan you help me solve this financial accounting question using valid financial accounting techniques?arrow_forwardWestake Advisors is a consulting firm. The firm expects to have $75,000 in indirect costs during the year and bill customers for 10,000 hours. The cost of direct labor is $95 per hour. Calculate the predetermined overhead allocation rate for Westake Advisorsarrow_forward

- Andy Manufacturing produces plastic and metal kitchen utensils. In preparing the current budget, Andy's management estimated a total of $380,000 in manufacturing overhead costs and 19,000 direct labor hours for the coming year. In December, Andy's accountants reported actual manufacturing overhead incurred of $93,000 and 18,200 direct labor hours used during the year. Andy applies overhead based on direct labor hours. Required: What was Andy's predetermined overhead rate for the year? How much manufacturing overhead did Andy apply during the year?arrow_forwardPlease provide the solution to this general accounting question with accurate financial calculations.arrow_forwardI need help with this financial accounting question using standard accounting techniques.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub