Lorena likes to play golf. The number of times per year that she plays depends on both the

a. Using the data under D1 and D2, calculate the cross elasticity of Lorena’s demand for golf at all three prices. (To do tins, apply the midpoints approach to the cross

b. Using the data under D2 and D3, calculate the income elasticity of Lorena's demand for golf at all three prices. (To do this, apply the midpoint approach to the income elasticity of demand.) Is the income elasticity the same at all three prices? Is golf an inferior good?

Subpart (a):

Explanation of Solution

In scenario D1, Lorena’s income is $50,000 per year and movies cost $9 each. In scenario D2, Lorena’s income is also $50,000 per year, but the price to watch a movie rises to $11. And in scenario D3, Lorena’s income rises up to $70,000 per year while the movies cost $11.

Cross price elasticity of demand can be calculated by using the midpoint formula:

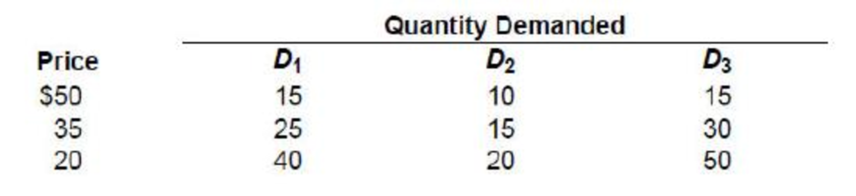

Table -1 shows the demand schedule for the three different goods.

Table -1

| Price | Demand 1 | Demand 2 | Demand 3 |

| 50 | 15 | 10 | 15 |

| 35 | 25 | 15 | 30 |

| 20 | 40 | 20 | 50 |

Substitute the respective values in Equation (1), to calculate the cross elasticity when the demand changes from 15 units to 10 units and the price changes from $9 to $11:

Substitute the respective values in Equation (1), to calculate the cross elasticity When the demand changes from 25 units to 15 units and the price changes from $9 to $11.

Price elasticity is 2.5 (Ignore the sign).

Substitute the respective values in Equation (1), to calculate the cross elasticity when the demand changes from 40 units to 20 units and the price changes from $9 to $11:

Price elasticity is 3.33.

It can be concluded that the cross price elasticities are not same in all three cases (for three different prices). As the price decreases, the percentage change in quantity increases.

In all three cases, the cross price elasticities are negative which indicates that golf and movie are complements. If the price of the movie increases, the quantity of movie falls and the consumption of golf games also decline. This implies that, the consumption of a movie and golf games decline as the price of movies rises and vice versa.

Concept introduction:

Cross price elasticity of demand: The cross price elasticity of demand is the change in the quantity demanded for a good due to the price change in another good. The sign of the coefficients of cross price elasticity of demand tells that whether the good is a complement or substitute. If the cross price elasticity of demand is positive, both goods are substitutes. Two goods are complement to each other if the cross price elasticity of demand is negative.

Income elasticity of demand: The income elasticity of demand is the change in the quantity demand for a good due to the change in income. The sign of the coefficients of income elasticity of demand tells whether the good is normal or inferior. If the income elasticity of demand is positive, the good is considered to be a normal good. The good is an inferior good if the income elasticity of demand is negative.

Subpart (b):

Explanation of Solution

Income elasticity of demand can be calculated by using the midpoint formula:

Substitute the respective values in Equation (2), to calculate the cross elasticity when the quantity changes from 10 units to 15 units and the income changes from $50,000 to $70,000.

Substitute the respective values in Equation (2), to calculate the cross elasticity when the quantity changes from 15 units to 30 units and the income changes from $50,000 to $70,000.

Substitute the respective values in Equation (2), to calculate the cross elasticity when the quantity changes from 20 units to 50 units and the income changes from $50,000 to $70,000, required income elasticity of demand is given by;

In all three cases, the income elasticity of demand is not the same. As the price declines, the change in the quantity demanded becomes more sensitive to the change in income. The demand for the golf games is more sensitive to the income at lower prices.

Here, signs of the coefficients of income elasticity of demand are positive which indicates that, as the income increases, the demand for golf games increases and as income decreases, the demand for the golf game falls. That is the income and the demand for golf is positively related. Thus, the golf game is a considered to be a normal good.

If the demand for a good increases with the decrease in income, the sign of the coefficients of income elasticity of demand is negative and thus the good is an inferior good.

In short, if the sign of the coefficient of income elasticity of demand is positive, the good is a normal good and if it is negative, the good is an inferior good.

The golf game is a normal good and not an inferior good.

Concept introduction:

Cross price elasticity of demand: The cross price elasticity of demand is the change in the quantity demanded for a good due to the price change in another good. The sign of the coefficients of cross price elasticity of demand tells that whether the good is a complement or substitute. If the cross price elasticity of demand is positive, both goods are substitutes. Two goods are complement to each other if the cross price elasticity of demand is negative.

Income elasticity of demand: The income elasticity of demand is the change in the quantity demand for a good due to the change in income. The sign of the coefficients of income elasticity of demand tells whether the good is normal or inferior. If the income elasticity of demand is positive, the good is considered to be a normal good. The good is an inferior good if the income elasticity of demand is negative.

Want to see more full solutions like this?

Chapter 6 Solutions

ECONOMICS W/CONNECT+20 >C<

- Who are the Airbnb's independent auditors and what is the role of these auditors? What opinion do the Airbnb independent auditors express regarding the financial statements and what does this opinion mean to an investor?arrow_forwardDoes Airbnb's fiscal year-end coincide with a calendar year-end? What products and/or services does Airbnb sell? Please be detailed. What major industry does Airbnb operate in? name at least two competitors. What are two risks identified by Airbnb management? Describe these risks.arrow_forwardSolve please and thanks!arrow_forward

- #5. What is cardinality (aleph- naught, also called as aleph null or aleph 0) ?arrow_forwardnot use ai pleasearrow_forward(d) Calculate the total change in qı. Total change: 007 (sp) S to vlijnsi (e) B₁ is our original budget constraint and B2 is our new budget constraint after the price of good 1 (p1) increased. Decompose the change in qı (that occurred from the increase in p₁) into the income and substitution effects. It is okay to estimate as needed via visual inspection. Add any necessary information to the graph to support your 03 answer. Substitution Effect: Income Effect:arrow_forward

- everything is in image (8 and 10) there are two images each separate questionsarrow_forwardeverything is in the picture (13) the first blank has the options (an equilibrium or a surplus) the second blank has the options (a surplus or a shortage)arrow_forwardeverything is in the photo (27) the first blank has options (The US, Mexico, Canada) the second blank has the options (The US, Mexico, Canada)arrow_forward

Microeconomics: Principles & PolicyEconomicsISBN:9781337794992Author:William J. Baumol, Alan S. Blinder, John L. SolowPublisher:Cengage Learning

Microeconomics: Principles & PolicyEconomicsISBN:9781337794992Author:William J. Baumol, Alan S. Blinder, John L. SolowPublisher:Cengage Learning Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning