Concept explainers

A 30-year bond with a face value of $1000 has a coupon rate of 5.5%, with semiannual payments.

- a. What is the coupon payment for this bond?

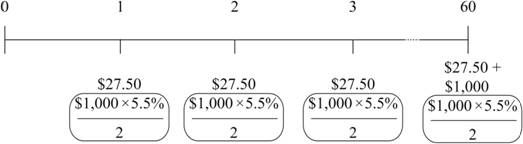

- b. Draw the cash flows for the bond on a timeline.

a.

To determine: The coupon payment on a bond.

Introduction:

Yield to maturity (YTM) is the rate of return projected for a security or a bond, which is apprehended until its maturity period. It is also considered as the internal rate of return (IRR) for a security or bond and it likens the current estimation of bond’s future cash flow to its present market cost. Coupon rate is expressed as an interest rate on a fixed income security like a bond. It is also called as the interest rate that the bondholders receive from their investment. It depends on the yield as of the day when the bond is issued.

Answer to Problem 1P

Explanation of Solution

Determine the coupon payment on a bond

The bond is paid on semi-annual basis.

Therefore, the coupon payment on a bond is $27.50.

b.

To determine: The cash flows of the bond on a timeline.

Explanation of Solution

Cash Flow Timeline:

Want to see more full solutions like this?

Chapter 6 Solutions

Corporate Finance

Additional Business Textbook Solutions

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Operations Management

Marketing: An Introduction (13th Edition)

Foundations Of Finance

Financial Accounting (12th Edition) (What's New in Accounting)

Principles of Economics (MindTap Course List)

- The value of an investment grows from $10,000 to $15,000 in 3 years. What is the CAGR?Soovearrow_forwardSuppose that the treasurer of IBM has an extra cash reserve of $100,000,000 to invest for six months. The six-month interest rate is 9 percent per annum in the United States and 8 percent per annum in Germany. Currently, the spot exchange rate is €1.07 per dollar and the six-month forward exchange rate is €1.05 per dollar. The treasurer of IBM does not wish to bear any exchange risk. Where should they invest to maximize the return? Required: The maturity value in six months if the extra cash reserve is invested in Germany:arrow_forwardThe value of an investment grows from $10,000 to $15,000 in 3 years. What is the CAGR?arrow_forward

- You invest $5,000 in a project, and it generates $1,250 annually. How long will it take to recover your investment?arrow_forwardA company pays an annual dividend of $3 per share, and the current stock price is $50. What is the dividend yield?arrow_forwardYou invest $1,000 in a stock, and after 2 years, it grows to $1,200. What is the annual return?arrow_forward

- You invest $1,000 in a stock, and after 2 years, it grows to $1,200. What is the annual return? Exparrow_forwardWells and Associates has EBIT of $ 72800. Interest costs are $ 18400, and the firm has 15600 shares of common stock outstanding. Assume a 40 % tax rate. a. Use the degree of financial leverage (DFL) formula to calculate the DFL for the firm. b. Using a set of EBIT -EPS axes, plot Wells and Associates' financing plan. c. If the firm also has 1200 shares of preferred stock paying a $ 5.75 annual dividend per share, what is the DFL? d. Plot the financing plan, including the 1200 shares of $ 5.75 preferred stock, on the axes used in part (b). e. Briefly discuss the graph of the two financing plans.arrow_forwardYou invest $5,000 for 3 years at an annual interest rate of 6%. The interest is compounded annually. Need helparrow_forward

- What is the future value of $500 invested for 3 years at an annual compound interest rate of 4%? Explarrow_forwardYou invest $5,000 for 3 years at an annual interest rate of 6%. The interest is compounded annually.arrow_forwardWhat is the future value of $500 invested for 3 years at an annual compound interest rate of 4%?arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning