Concept explainers

Consolidated

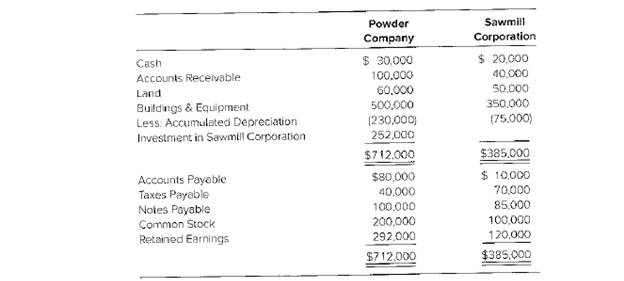

Powder Company spent $240,000 to acquire all of Sawmill Corporation’s stock on January 1,20X2. The balance sheets of the two companies on December 31, 20X3, showed the following amounts:

Sawmill reported

Required

a. Give the appropriate consolidation entry or entries needed to prepare a consolidated balancesheet as of December 31, 20X3.

b. Prepare a consolidated balance sheet worksheet as of December 31, 20X3.

Want to see the full answer?

Check out a sample textbook solution

Chapter 4 Solutions

EBK ADVANCED FINANCIAL ACCOUNTING

- Parent Company acquired 90% of Son Incorporate on January 31, 20X2 in exchange for cash. The book value of Son's individual assets and liabilities approximated their acquisition- date fair values. On the date of acquisition, Son reported the following: Cash Inventory Plant Assets (net) Property Total Assets $ 350,000 100,000 Current Liabilities $ 120,000 320,000 Common Stock 500,000 $ 1,270,000 Retained Earnings Total Liabilities and Equity 100,000 1,050,000 $ 1,270,000 During the year Son Incorporate reported $310,000 in net income and declared $15,000 in dividends. Parent Company reported $520,000 in net income and declared $25,000 in dividends. Parent accounts for their investment using the equity method. Required: 1) What journal entry will Parent make on the date of acquisition to record the Investment in Son Incorporate? 2) If Parent were to prepare a consolidated balance sheet on the acquisition date (January 31, 20X2), what is the basic consolidation entry Parent would use in…arrow_forwardVishnuarrow_forwardOn December 31, 20X8, Parkway Corporation acquired 80 percent of Street Company's common stock for $104,000 cash. The fair value of the noncontrolling interest at that date was determined to be $26,000. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition: Parkway Corporation Street Company Cash $ 90,000 $ 20,000 Accounts Receivable 80,000 35,000 Inventory 100,000 40,000 Land 40,000 60,000 Buildings and Equipment 300,000 100,000 Less: Accumulated Depreciation (100,000) (40,000) Investment in Street Company 104,000 Total Assets $ 614,000 $ 215,000 Accounts Payable 120,000 30,000 Mortgage Payable 200,000 100,000 Common Stock 50,000 25,000 Retained Earnings 244,000 60,000 Total Liabilities and Equity $ 614,000 $ 215,000 On that date, the book values of Street's assets and liabilities approximated fair value except for inventory, which had a fair value of $45,000, and buildings and equipment,…arrow_forward

- Planter Corporation used debentures with a par value of $644,000 to acquire 100 percent of Sorden Company's net assets on January 1, 20X2. On that date, the fair value of the bonds issued by Planter was $627,000. The following balance sheet data were reported by Sorden: Balance Sheet Item Assets Cash and Receivables Inventory Land Plant and Equipment Less: Accumulated Depreciation Goodwill Total Assets Liabilities and Equities Accounts Payable Common Stock Additional Paid-In Capital Retained Earnings Total Liabilities and Equities Historical Cost $ 56,000 114,000 64,000 414,000 (154,000) 12,000 $ 506,000 $ 49,000 84,000 57,000 316,000 $ 506,000 Fair Value $ 48,000 182,000 92,000 290,000 $ 612,000 $ 49,000 Required: Prepare the journal entry that Planter recorded at the time of exchange. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.arrow_forwardOn January 1, 20X6, Pumpkin Corporation acquired 70 percent of Spice Company's common stock for $210,000 cash. The fair value of the noncontrolling interest at that date was determined to be $90,000. Data from the balance sheets of the two companies included the following amounts as of the date of acquisition: Cash Accounts Receivable Pumpkin $ 50,000 70,000 Spice $ 15,000 25,000 Inventory 30,000 20,000 Land 150,000 80,000 Buildings and Equipment 250,000 200,000 Less: Accumulated Depreciation (70,000) (20,000) Investment in Spice Co. 210,000 Total Assets $690,000 $320,000 Accounts Payable $ 40,000 $ 10,000 Bonds Payable 150,000 40,000 Common Stock 300,000 90,000 200,000 $690,000 180,000 $320,000 Retained Earnings Total Liabilities and Equity At the date of the business combination, the book values of Spice's assets and liabilities approximated fair value except for inventory, which had a fair value of $30,000, and land, which had a fair value of $95,000. Based on the preceding…arrow_forward18. Power Company purchased Sark Corporation’s net assets on January 3, 20X2, for $635,000 cash. In addition, Power incurred $8,000 of direct costs in consummating the combination. At the time of acquisition, Sark reported the following historical cost and current market data: Balance Sheet Item Book Value Fair Value Assets Cash and Receivables $ 67,000 $ 67,000 Inventory 108,000 154,000 Buildings and Equipment (net) 210,000 305,000 Patent 0 202,000 Total Assets $ 385,000 $ 728,000 Liabilities and Equities Accounts Payable $ 22,000 $ 22,000 Common Stock 92,000 Additional Paid-In Capital 70,000 Retained Earnings 201,000 Total Liabilities and Equities $ 385,000 Required: Prepare the journal entry or entries with which Power recorded its acquisition of Sark’s net assets. A. Record the payment of acquisition costs. B. Record the acquisition of Sark Corporation's net assets.arrow_forward

- HELP MEarrow_forwardfirst picture is information for the second picture. thank you!!arrow_forwardLibra Company is purchasing 100% of the outstanding stock of Genall Company for $700,000. Genall has the following balance sheet on the date of acquisition: (see attachment)Appraisals indicate that the following fair values for the assets and liabilities should be acknowledged: Accounts receivable . . . . . . . . . . . . . . . $300,000 Inventory . . . . . . . . . . . . . . . . . . . . . . . . 215,000 Property, plant, and equipment . . . . . . . 700,000 Computer software . . . . . . . . . . . . . . . . 130,000 Current liabilities . . . . . . . . . . . . . . . . . . 250,000 Bonds payable . . . . . . . . . . . . . . . . . . . 210,000 1. Prepare the value analysis schedule and the determination and distribution of excess schedule. 2. Prepare the elimination entries that would be made on a consolidated worksheet prepared on the date of purchase.arrow_forward

- On January 1, 20X1, XYZ, Inc. purchased 70% of Set Corporation for $469,000. On that date the book value of the net assets of Set totaled $500,000. Based on the appraisal done at the time of the purchase, all assets and liabilities had book values equal to their fair values except as follows: Book Value Fair Value Inventory $100,000 $120,000 Land 75,000 85,000 Equipment (useful life 4 years) 125,000 165,000 The remaining excess of cost over book value was allocated to a patent with a 10-year useful life. During 20X1 XYZ reported net income of $200,000 and Set had net income of $100,000. What income from subsidiary did Promo include in its net income if Promo uses the simple equity method? a. $70,000 b. $42,000 c. $38,000 d. $110,000arrow_forwardS acquired 100 percent of F for P275,000. At the date of acquisition, F had the following book and market values: (see image below) What is the amount of the “Investment in F” account on S’s financial records at the acquisition date?arrow_forwardPutt Corporation acquired 80 percent of Slice Company's voting common stock on January 1, 20X4, for $138,000. At that date, the fair value of the noncontrolling interest was $34,500. Slice's balance sheet at the date of acquisition contained the following balances: Cash Accounts Receivable Land Building and Equipment Less: Accumulated Depreciation Total Assets SLICE COMPANY Balance Sheet January 1, 20X4 $ 20,000 35,000 90,000 300,000 (85,000) $360,000 Accounts Payable Notes Payable Common Stock Additional Paid-in Capital Retained Earnings Total Liabilities and Stockholders' Equity $ 35,000 180,000 100,000 75,000 (30,000) $360,000 At the date of acquisition, the reported book values of Slice's assets and liabilities approximated fair value. Required: Prepare the consolidation entry or entries needed to prepare a consolidated balance sheet immediately following the business combination. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education