Financial and Managerial Accounting - Workingpapers

15th Edition

ISBN: 9781337912112

Author: WARREN

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 4, Problem 2MAD

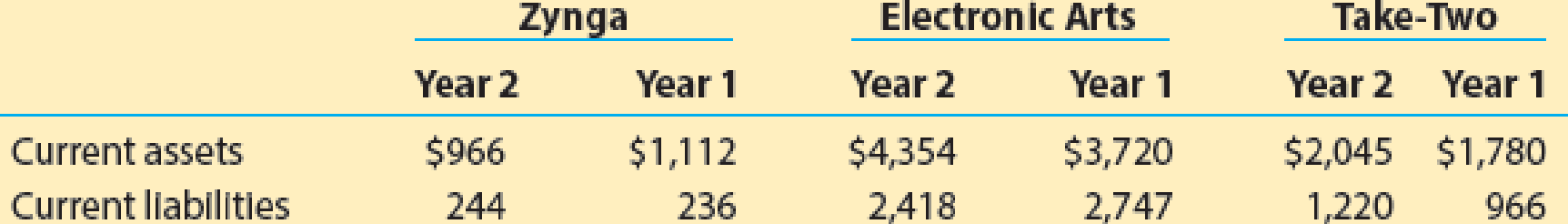

Analyze and compare Zynga, Electronic Arts, and Take-Two

Data (in millions) from recent financial statements of Zynga Inc. (ZNGA), Electronic Arts Inc. (EA), and Take-Two Interactive Software, Inc. (TTWO) are as follows:

- a. Compute the

working capital for Year 2 and Year 1 for each company. - b. Which company has the largest working capital?

- c. Compute the

current ratio for Year 2 and Year 1 for each company. Round to one decimal place. - d. For Year 2, rank the companies from most liquid to least liquid based upon the current ratio.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Everton Manufacturing reported the following

liabilities on its trial balance at December 31, 2021:

Accounts payable: $45,000

Unearned revenue: $12,000

Bonds payable, due 2031: $75,000

Salaries payable: $22,000

Note payable, due 2022: $30,000

Note payable, due 2027: $55,000

What amount should be reported as current liabilities

on Everton's December 31, 2021 balance sheet?

a) $109,000

b) $67,000

c) $77,000

d) $87,000

Can you help me with accounting questions

An asset owned by Carlisle Industries has a book

value of $22,500 on December 31, Year 7. The asset

has been depreciated at an annual rate of $5,000

using the straight-line method. Assuming the asset

is sold on December 31, Year 7 for $19,000, how

should the company record the transaction?

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- If Ram Nation can give up one unit of future consumption and as a result increase its current consumption by 0.96 units, what must be its real rate of interest. Accounting 21arrow_forwardaccount questionarrow_forwardIf Ram Nation can give up one unit of future consumption and as a result increase its current consumption by 0.96 units, what must be its real rate of interest.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License