Assets are listed on the

| Learning Objective 1 |

- purchase date.

- adjustments.

- liquidity.

- balance.

Assets in Balance Sheet

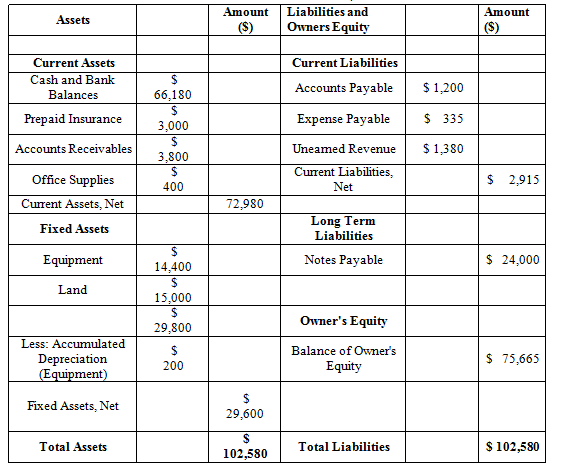

A balance sheet is a list of assets and liabilities as on a given date of an entity. It consists of several assets and liabilities, grouped and presented together to ensure consistency and aid stakeholders.

Assets and Liabilities are listed in order of their liquidity. The most liquid assets are displayed first followed by current assets and finally fixed assets.

To explain:

The basis on which assets are displayed in the balance sheet.

Answer to Problem 1QC

Solution:

The correct answer is Option C.

Explanation of Solution

- In a balance sheet, assets are listed in the order of their liquidity. Liquidity means the ability of an asset to convert into cash.

- The most liquid assets are displayed first followed by current assets and finally fixed assets.

- Current assets are assets convertible to cash within a period of one year. Examples include accounts receivable, inventory, etc.

- Fixed assets are assets that have a longer life and duration of greater than one year. Examples include Property, Plant and Equipment.

- An example of the balance sheet with the assets displayed in order of their liquidity is given below for understanding purposes.

Hence, it can be seen that the assets are listed in the balance sheet in the order of their liquidity.

Want to see more full solutions like this?

Chapter 4 Solutions

Horngren's Accounting (11th Edition)

Additional Business Textbook Solutions

Business Essentials (12th Edition) (What's New in Intro to Business)

Financial Accounting, Student Value Edition (5th Edition)

Macroeconomics

Engineering Economy (17th Edition)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

- Solve & show allarrow_forwardKrypton Corp. estimated manufacturing overhead for the year to be $842,000. At the end of the year, actual direct labor hours were 48,300 hours, the actual manufacturing overhead was $919,500, and manufacturing overhead was overapplied by $76,200. If the predetermined overhead rate is based on direct labor hours, what were the estimated direct labor hours at the beginning of the year used in the predetermined overhead rate?arrow_forwardHi expert please give me answer general accounting questionarrow_forward

- I need solution step by step clearly.arrow_forwardPlease provide problem with accounting questionarrow_forwardA machine has a cost of $18,500, an estimated residual value of $4,500, and an estimated useful life of five years. The machine is being depreciated on a straight-line basis. At the end of the second year, what amount will be reported for accumulated depreciation?arrow_forward

- What is the amount of the net income ?arrow_forwardThurman Industries expects to incur overhead costs of $18,000 per month and direct production costs of $155 per unit. The estimated production activity for the upcoming year is 1,800 units. If the company desires to earn a gross profit of $72 per unit, the sales price per unit would be which of the following amounts?arrow_forwardSolve step by step clearly.arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,