Wixis Cabinets makes custom wooden cabinets for high-end stereo systems from specialty woods. The company uses a

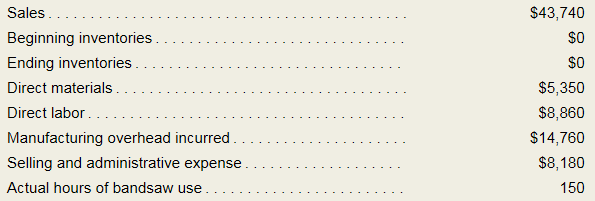

The results of a recent month’s operations appear below:

Required:

- Prepare an income statement following the example in Exhibit 3B—1 that records the cost of unused capacity on the income statement as a period expense.

- Why do unused capacity costs arise when the predetermined overhead rate is based on capacity?

1.

Introduction: Job costing is a technique of determine the cost of a manufacturing job rather than the process of the job. Manufacturing overhead is applied to product or job order is determined as predetermined overhead. Absorption costing is used to calculate the cost of product while taking indirect and direct expense into account. Activity based costing assign the cost of all the activity of the organization according to their actual consumption

To prepare: The income statement that record the cost of unused capacity.

Answer to Problem 3B.1E

Income statement given shown below:

Explanation of Solution

Cost of goods manufactured and under applied overhead

| Particular | Amount $ |

| Direct material | 5,350 |

| Direct labor | 8,860 |

| Manufacturing overhead applied | 12,300 |

| Total manufacturing cost charged to jobs | 26,510 |

| Add: Beginning work in process inventory | 0 |

| 26,510 | |

| Deduct: Ending work in process inventory | 0 |

| Cost of goods manufactured | 26,510 |

The manufacturing overhead incurred was $14200 and the applied manufacturing overhead was $12,300. Thus, under applied overhead is:

Income statement:

| Particular | Amount $ | Amount $ |

| Sales | 43,740 | |

| Cost of goods | 26,510 | |

| Gross margin | 17,230 | |

| Under applied manufacturing overhead | 1920 | |

| Selling and manufacturing expense | 8180 | 10,100 |

| Net operating income | 7,130 |

2.

Introduction: Job costing is a technique of determine the cost of a manufacturing job rather than the process of the job. Manufacturing overhead is applied to product or job order is determined as predetermined overhead. Absorption costing is used to calculate the cost of product while taking indirect and direct expense into account. Activity based costing assign the cost of all the activity of the organization according to their actual consumption

The reason for unused capacity cost arises when the predetermined overhead rate is based on capacity.

Answer to Problem 3B.1E

Manufacturing overhead typically includes a significant amount of fixed cost that results in overhead being under applied when the predetermined overhead rate is based on capacity.

Explanation of Solution

Manufacturing overhead typically includes a significant amount of fixed cost that results in overhead being under applied when the predetermined overhead rate is based on capacity. If the plant never operates at full capacity, an amount less than the total fixed cost will actually be applied to each job. However, since fixed costs remain fixed the amount overhead applied to each job will typically be underapplied.

Want to see more full solutions like this?

Chapter 3B Solutions

MANAG ACCT F/..(LL)+CONNECT W/PROCTORIO+

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning