Judgment Case 3–5

• LO3–2 through LO3–4

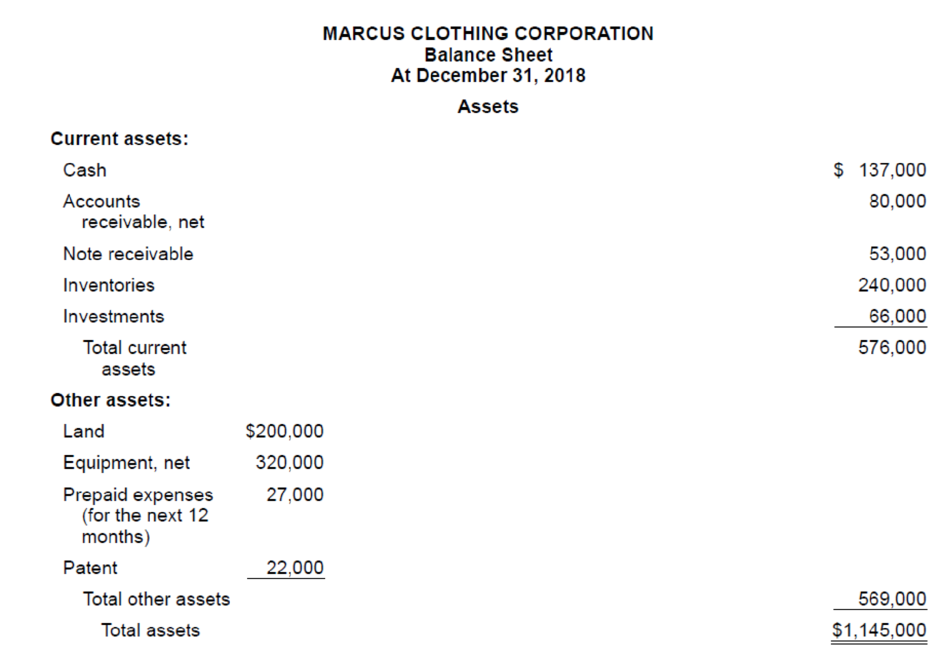

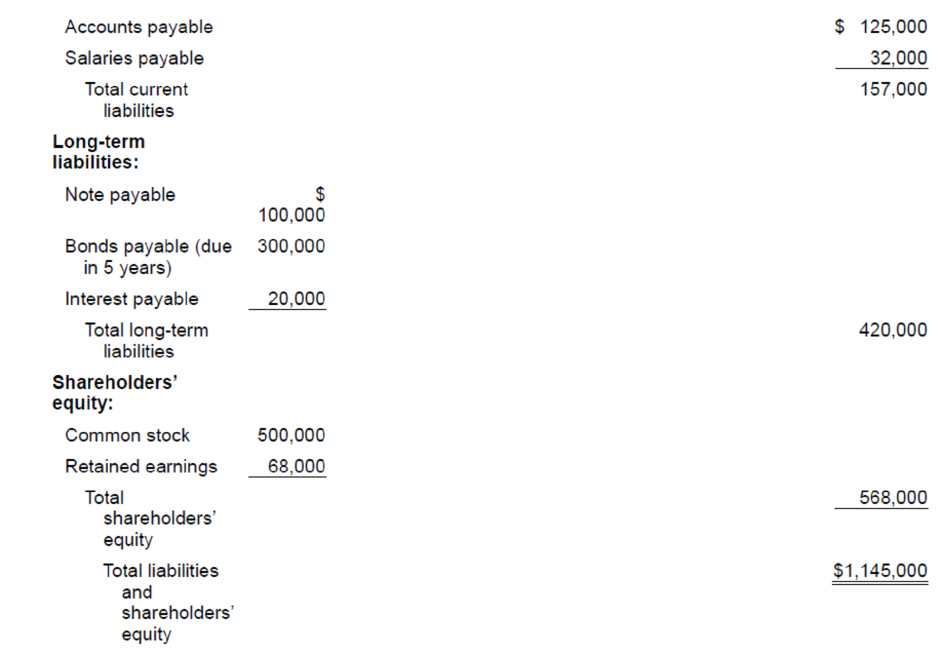

You recently joined the internal auditing department of Marcus Clothing Corporation. As one of your first assignments, you are examining a balance sheet prepared by a staff accountant.

In the course of your examination you uncover the following information pertaining to the balance sheet:

1. The company rents its facilities. The land that appears in the statement is being held for future sale.

2. The note receivable is due in 2020. The balance of $53,000 includes $3,000 of accrued interest. The next interest payment is due in July 2019.

3. The note payable is due in installments of $20,000 per year. Interest on both the notes and bonds is payable annually.

4. The company’s investments consist of marketable equity securities of other corporations. Management does not intend to liquidate any investments in the coming year.

Required:

Identify and explain the deficiencies in the statement prepared by the company’s accountant. Include in your answer items that require additional disclosure, either on the face of the statement or in a note.

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

SPICELAND GEN CMB LL INTRM ACCTG; CNCT

- Quick answer of this accounting questionsarrow_forwardMead Incorporated began operations in Year 1. Following is a series of transactions and events involving its long-term debt investments in available-for-sale securities. Year 1 January 20 Purchased Johnson & Johnson bonds for $20,500. February 9 Purchased Sony notes for $55,440. June 12 Purchased Mattel bonds for $40,500. December 31 Fair values for debt in the portfolio are Johnson & Johnson, $21,500; Sony, $52,500; and Mattel, $46,350. Year 2 April 15 Sold all of the Johnson & Johnson bonds for $23,500. July 5 Sold all of the Mattel bonds for $35,850. July 22 Purchased Sara Lee notes for $13,500. August 19 Purchased Kodak bonds for $15,300. December 31 Fair values for debt in the portfolio are Kodak, $17,325; Sara Lee, $12,000; and Sony, $60,000. Year 3 February 27 Purchased Microsoft bonds for $160,800. June 21 Sold all of the Sony notes for $57,600. June 30 Purchased Black & Decker bonds for $50,400. August 3 Sold all of the Sara…arrow_forwardWhat is the ending inventory?arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning