Reporting for a Variable Interest Entity

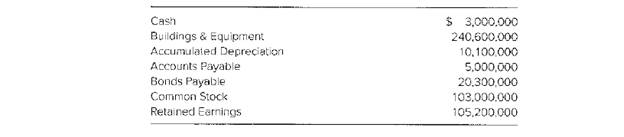

Gamble Company convinced Conservative Corporation that the two Companies should establish Simpletown Corporation to build a new gambling casino in Simpletown Coiner. Although chances for the casino’s success were relatively low, a local bank loaned $140 million to the new corporation, which built, the casino at a cost of $130 million. Conservative purchased 100 percent of the initial capital stock offering for $5.6 million, md Gamble agreed to supply 100 percent of the management which would include directing Simpletown’s day-to-day activities. Gamble also agreed to guarantee the bank loan. Additionally, Gamble guaranteed a 20 percent return to Conservative on its investment for the first 10 years. Gamble will receive all profits in excess of the 20 percent return to Conservative. Immediately after the casino’s construction, Gamble reported the following amounts:

The only disclosure that Gamble currently provides in its financial reports about its relationships to Conservative and Simpletown is a brief footnote indicating that a

Required

Prepare a consolidated

Want to see the full answer?

Check out a sample textbook solution

Chapter 3 Solutions

ADVANCED FINANCIAL ACCT.(LL) >CUSTOM<

- Manny Carson, certified management accountant and controller of Wakeman Enterprises, has been given permission to acquire a new computer and software for the companys accounting system. The capital investment analysis showed an NPV of 100,000. However, the initial estimates of acquisition and installation costs were made on the basis of tentative costs without any formal bids. Manny now has two formal bids, one that would allow the firm to meet or beat the original projected NPV and one that would reduce the projected NPV by 50,000. The second bid involves a system that would increase both the initial cost and the operating cost. Normally, Manny would take the first bid without hesitation. However, Todd Downing, the owner of the firm presenting the second bid, is a close friend. Manny called Todd and explained the situation, offering Todd an opportunity to alter his bid and win the job. Todd thanked Manny and then made a counteroffer. Todd: Listen, Manny, this job at the original price is the key to a successful year for me. The revenues will help me gain approval for the loan I need for renovation and expansion. If I dont get that loan, I see hard times ahead. The financial stats for loan approval are so marginal that reducing the bid price may blow my chances. Manny: Losing the bid altogether would be even worse, dont you think? Todd: True. However, if you award me the job, Ill be able to add personnel. I know that your son is looking for a job, and I can offer him a good salary and a promising future. Additionally, Ill be able to take you and your wife on that vacation to Hawaii that weve been talking about. Manny: Well, you have a point. My son is having an awful time finding a job, and he has a wife and three kids to support. My wife is tired of having them live with us. She and I could use a vacation. I doubt that the other bidder would make any fuss if we turned it down. Its offices are out of state, after all. Todd: Out of state? All the more reason to turn it down. Given the states economy, it seems almost criminal to take business outside. Those are the kind of business decisions that cause problems for people like your son. Required: Evaluate the ethical behavior of Manny. Should Manny have called Todd in the first place? Would there have been any problems if Todd had agreed to meet the lower bid price? Identify the parts of the Statement of Ethical Professional Practice (Chapter 1) that Manny may be violating, if any.arrow_forwardAbaco is planning to acquire Cozumel Airlines, a freestanding C corporation, in the expectation that new management can be brought in to achieve substantial operating efficiencies. You have been retained to advise Abaco on how to structure the acquisition. Two graduate school friends, Monique and Denise, own Cozumel Airlines. Together, they have a $1 million basis in their Cozumel Airlines stock. Both Monique and Denise have held their Cozumel Airlines stock for several years but must sell their stock for nontax reasons. Cozumel Airlines' tax-basis balance sheet contains $14 million of assets, no liabilities, and no net operating loss carry-overs. All parties agree that Cozumel Airlines would be worth $20 million to Abaco with no step-up in Cozumel's inside (asset) basis, but $21.25 million if its inside (asset) basis was stepped up to fair market value. Monique and Denise each face a 40% tax rate on ordinary income and a 20% tax rate on capital gains.The corporate tax rate is 35%.…arrow_forwardGGG Company ventured into construction of a condominium in Baguio which is rated as the largest state-of-the-art structure. The board of directors decided that instead of selling the condominium, the entity would hold this property for purposes of earning rentals by letting out space to business executives in the area. The construction of the condominium was completed and the property was placed in service on January 1, 2019. The cost of the construction was P50,000,000. The useful life of the condominium is 25 years and the residual value is P5,000,000. An independent valuation expert provided the following hair value at each subsequent year-end: December 31, 2019 = 55,000,000; December 31, 2020 = 53,000,000; December 31, 2021 = 60,000,000. Under fair value model, what amount should be recognized as gain from change in fair value in 2019?arrow_forward

- GGG Company ventured into construction of a condominium in Baguio which is rated as the largest state-of-the-art structure. The board of directors decided that instead of selling the condominium, the entity would hold this property for purposes of earning rentals by letting out space to business executives in the area. The construction of the condominium was completed and the property was placed in service on January 1, 2019. The cost of the construction was P50,000,000. The useful life of the condominium is 25 years and the residual value is P5,000,000. An independent valuation expert provided the following hair value at each subsequent year-end: December 31, 2019 = 55,000,000; December 31, 2020 = 53,000,000; December 31, 2021 = 60,000,000. Under the cost model, what amount should be reported as depreciation on investment property for 2019?arrow_forwardBetterCare Hospitals, Inc. operates a chain of hospitals throughout the United States. Th ecompany has been expanding by acquiring local hospitals. Its largest acquisition, that of Statewide Medical, was made in 2001 under the pooling of interests method. BetterCare complieswith US GAAP.BetterCare is currently forming a 50/50 joint venture with Supreme Healthcare underwhich the companies will share control of several hospitals. BetterCare plans to use the equitymethod to account for the joint venture. Supreme Healthcare complies with IFRS and will usethe proportionate consolidation method to account for the joint venture.Erik Ohalin is an equity analyst who covers both companies. He has estimated the jointventure’s fi nancial information for 2010 in order to prepare his estimates of each company’searnings and fi nancial performance. Th is information is presented in Exhibit 1. EXHIBIT 1 Selected Financial StatementForecasts for Joint Venture ($ Millions)Year ending 31 December…arrow_forwardBetterCare Hospitals, Inc. operates a chain of hospitals throughout the United States. Th ecompany has been expanding by acquiring local hospitals. Its largest acquisition, that of Statewide Medical, was made in 2001 under the pooling of interests method. BetterCare complieswith US GAAP.BetterCare is currently forming a 50/50 joint venture with Supreme Healthcare underwhich the companies will share control of several hospitals. BetterCare plans to use the equitymethod to account for the joint venture. Supreme Healthcare complies with IFRS and will usethe proportionate consolidation method to account for the joint venture.Erik Ohalin is an equity analyst who covers both companies. He has estimated the jointventure’s fi nancial information for 2010 in order to prepare his estimates of each company’searnings and fi nancial performance. Th is information is presented in Exhibit 1. EXHIBIT 1 Selected Financial StatementForecasts for Joint Venture ($ Millions)Year ending 31 December…arrow_forward

- BetterCare Hospitals, Inc. operates a chain of hospitals throughout the United States. Th ecompany has been expanding by acquiring local hospitals. Its largest acquisition, that of Statewide Medical, was made in 2001 under the pooling of interests method. BetterCare complieswith US GAAP.BetterCare is currently forming a 50/50 joint venture with Supreme Healthcare underwhich the companies will share control of several hospitals. BetterCare plans to use the equitymethod to account for the joint venture. Supreme Healthcare complies with IFRS and will usethe proportionate consolidation method to account for the joint venture.Erik Ohalin is an equity analyst who covers both companies. He has estimated the jointventure’s fi nancial information for 2010 in order to prepare his estimates of each company’searnings and fi nancial performance. Th is information is presented in Exhibit 1. EXHIBIT 1 Selected Financial StatementForecasts for Joint Venture ($ Millions)Year ending 31 December…arrow_forwardBetterCare Hospitals, Inc. operates a chain of hospitals throughout the United States. Th ecompany has been expanding by acquiring local hospitals. Its largest acquisition, that of Statewide Medical, was made in 2001 under the pooling of interests method. BetterCare complieswith US GAAP.BetterCare is currently forming a 50/50 joint venture with Supreme Healthcare underwhich the companies will share control of several hospitals. BetterCare plans to use the equitymethod to account for the joint venture. Supreme Healthcare complies with IFRS and will usethe proportionate consolidation method to account for the joint venture.Erik Ohalin is an equity analyst who covers both companies. He has estimated the jointventure’s fi nancial information for 2010 in order to prepare his estimates of each company’searnings and fi nancial performance. Th is information is presented in Exhibit 1. EXHIBIT 1 Selected Financial StatementForecasts for Joint Venture ($ Millions)Year ending 31 December…arrow_forwardBetterCare Hospitals, Inc. operates a chain of hospitals throughout the United States. Th ecompany has been expanding by acquiring local hospitals. Its largest acquisition, that of Statewide Medical, was made in 2001 under the pooling of interests method. BetterCare complieswith US GAAP.BetterCare is currently forming a 50/50 joint venture with Supreme Healthcare underwhich the companies will share control of several hospitals. BetterCare plans to use the equitymethod to account for the joint venture. Supreme Healthcare complies with IFRS and will usethe proportionate consolidation method to account for the joint venture.Erik Ohalin is an equity analyst who covers both companies. He has estimated the jointventure’s fi nancial information for 2010 in order to prepare his estimates of each company’searnings and fi nancial performance. Th is information is presented in Exhibit 1. EXHIBIT 1 Selected Financial StatementForecasts for Joint Venture ($ Millions)Year ending 31 December…arrow_forward

- Honesty Company started negotiating for the acquisition of Integnity Company. The offer was for shareholders of Integrity to receive one Honesty share with a market value of P125 for every four shares held in exchange for all assets of Integrity (except shares in listed companies). In addition to the shares, Honesty will transfer its shares in listed companies which has a fair market value of P750,000. Honesty will also pay integrity sufficient cash to enable Integrity to pay all its creditors then Integrity will liquidate. The shareholders of Integrity accepted the offer. The Balance Sheet on December 31, 2020 is given below (see image below). The net assets of Integrity are reflected at their fair values except for the following: Inventory, P1,300,000 fair market value Land and building, P4,000,000 fair market value Shares in listed companies, P900,000 fair market value How much is the total assets of Honesty after the merger? Honesty 7,250,000 1,700,000 2,800,000 800,000 3,500,000…arrow_forwardHelparrow_forwardHello there, I need your help in this. 1) John Inc and Victor Inc. formed a joint venture on January 1, 2020. John Inc. invested plant and equipment with a book value of $600,000 and a fair value of $950,000 for a 25% interest in the venture which was to be called Jinxtor Ltd. John Inc.’s plant and equipment was estimated to provide an additional 7 years of utility to Jinxtor.Victor Inc. contributed assets with a fair value of $1,500,000 (including $150,000 in cash) for its 75% stake in Jinxtor. John receives $100,000 in return for investing its plant and equipment.Jinxtor reported a net income of $4,500,000 for 2020. The transactions set out above were considered to have commercial substance. Required: Answer the following questions related to the above. A) What amount would John record its initial investment in Jinxtor. B) What would be the unrealized gain on January 1, 2020 arising from John's investment in Jinxtor. What would be the realized portion of the unrealized gain…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning