Concept explainers

Discuss the basic principles of income taxes and determine your filing status.

To discuss: The basic principles of income taxes and person X’s filling status

Explanation of Solution

The basic principles of income taxes and person X’s filling status:

Every individual has a tax bases and tax rate. That is base multiplied with rate. The tax’s name will denote the tax base and the tax base for income tax is denoted as income for the sales tax. Here the base is the sales. Income is common to the tax purpose and accounting purpose. There are some concept worked in the tax calculation and filling. The standard deduction and itemized deduction are the two important parts.

The main concepts are exclusion, deductions, credits and rates.

The concept of tax rates is progressive means the tax rate will increase if income increases. The taxes are classified into various individual characteristics.

- Single

- Joint

- Married filing separately

- Head of households

For example,

Person X has an income of $38,700 so the taxable payable will be $4,345.5 as he comes under the filling status single.

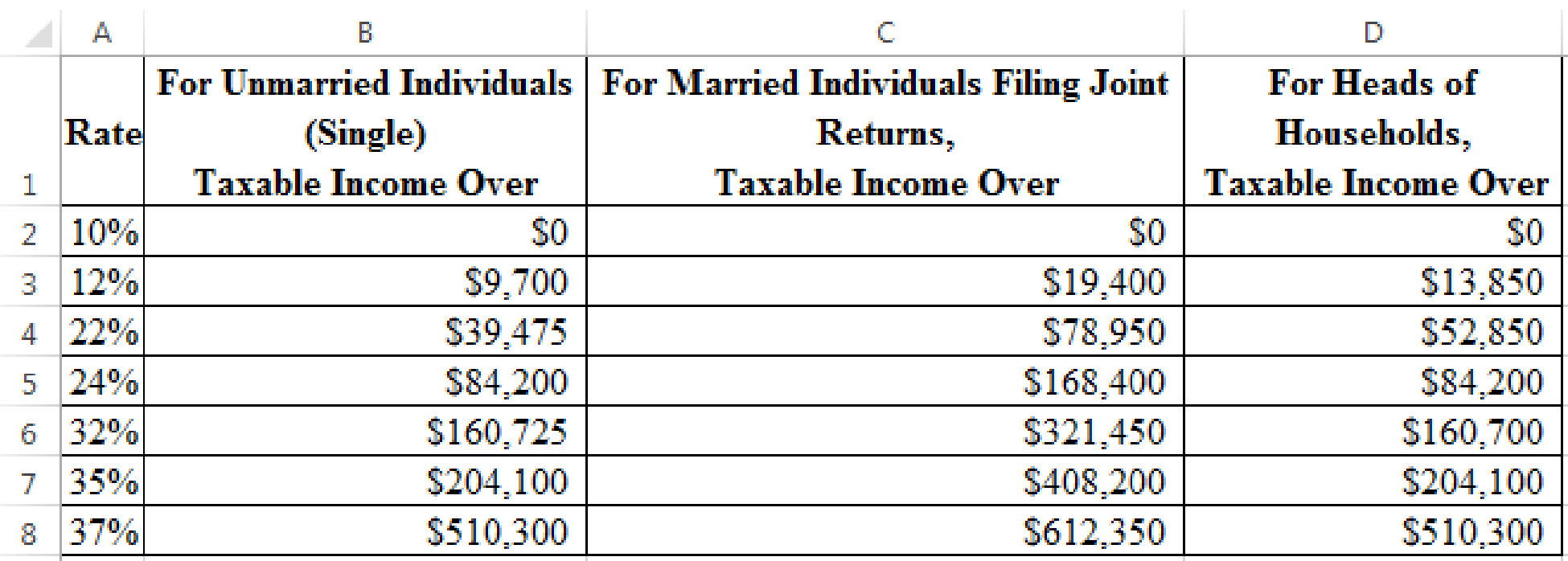

Slab rate for different categories for the year 2019:

Want to see more full solutions like this?

Chapter 3 Solutions

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

- Hello tutor this is himlton biotech problem.arrow_forwardYan Yan Corp. has a $2,000 par value bond outstanding with a coupon rate of 4.7 percent paid semiannually and 13 years to maturity. The yield to maturity of the bond is 5.05 percent. What is the dollar price of the bond?arrow_forwardA trip goa quesarrow_forward

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub