PFIN 7:STUDENT EDITION-MINDTAP (1 TERM)

7th Edition

ISBN: 9780357033647

Author: Billingsley

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

thumb_up100%

Chapter 3, Problem 1FPE

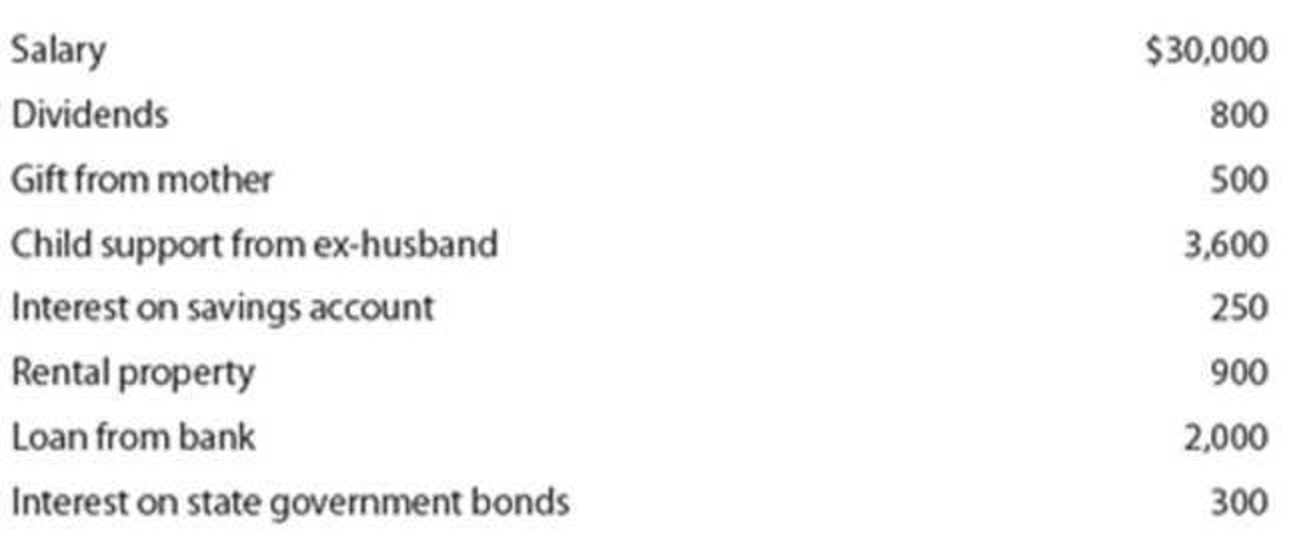

Calculating marginal tax rates. Lacey Hansen is single and received the items and amounts of income shown below during 2018, as shown below. Determine the marginal tax rate applicable to each item. Note that if the item is not taxable, the marginal rate is 0.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

What would be the marginal and average tax rates for a married couple with taxable income of $89,600? For an unmarried taxpayer

with the same income? Use Table 3.7. (Do not round intermediate calculations. Enter the marginal tax rate as a percent rounded to 1

decimal place. Enter the average tax rate as a percent rounded to 1 decimal place.)

a. What would be the marginal tax rate for a married couple with income of $89,600?

Marginal tax rate for a married couple

b. What would be the average tax rate for a married couple with income of $89,600?

Average tax rate for a married couple

%

Marginal tax rate for an unmarried taxpayer

c. What would be the marginal tax rate for an unmarried taxpayer with income of $89,600?

%

Average tax rate for an unmarried taxpayer

%

d. What would be the average tax rate for an unmarried taxpayer with income of $89,600?

%

Use the 2016 marginal tax rates to compute the tax owed by the following person.

A married man filing separately with a taxable income of $143,000.

Click the icon to view the 2016 marginal tax rates.

The tax owed is $

(Type an integer or a decimal. Round to the nearest cent as needed.)

bhaves

Chapter 3 Solutions

PFIN 7:STUDENT EDITION-MINDTAP (1 TERM)

Ch. 3 - Discuss the basic principles of income taxes and...Ch. 3 - Prob. 2LOCh. 3 - Prob. 3LOCh. 3 - Explain who needs to pay estimated taxes, when to...Ch. 3 - Know where to get help with your taxes and how...Ch. 3 - Implement an effective tax planning strategy.Ch. 3 - Calculating marginal tax rates. Lacey Hansen is...Ch. 3 - Estimating taxable income, tax liability, and...Ch. 3 - Calculating taxes on security transactions. If...Ch. 3 - Prob. 4FPE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Compute the 2019 tax liability and the marginal and average tax rates for the following taxpayers (use the 2019 Tax Rate Schedules in Appendix A for this purpose): a. Chandler, who files as a single taxpayer, has taxable income of 94,800. b. Lazare, who files as a head of household, has taxable income of 57,050.arrow_forwardMelodie's taxable income is $39,000 and she pays income tax of $4,489. If Melodie's taxable income increases to $41,000, she would pay income taxes of $4,884. What is Melodie's marginal tax rate? 19.75 22.00 18.50 12.00 Some other amountarrow_forwardDetermine the tax liability, marginal tax rate, and average tax rate in each of the following cases. Use the tax tables to determine tax liability. Required: Married taxpayers, taxable income of $97,763. Married taxpayers, taxable income of $67, 129. Note: For all requirements, round "Average tax rate" to 2 decimal places.arrow_forward

- Required: Determine the tax liability, marginal tax rate, and average tax rate in each of the following cases. Use the appropriate Tax Tables and Tax Rate Schedules. a. Married taxpayers, who file a joint return, have taxable income of $39,821. b. Married taxpayers, who file a joint return, have taxable income of $63,790. (For all requirements, use the tax tables to compute tax liability. Round "Average tax rate" to 2 decimal places.) Tax liability Marginal tax rate Average tax rate a % b.arrow_forwardDetermine the tax liability, marginal tax rate, and average tax rate in each of the following cases. Use the Tax Tables to compute tax liability. Required: Married taxpayers, who file a joint return, have taxable income of $97, 463. Married taxpayers, who file a joint return, have taxable income of $ 66,829. Note: For all requirements, round "Average tax rate" to 2 decimal places.arrow_forwardDuela Dent is single and had $181,600 in taxable income. Using the rates from Table 2.3, calculate her income taxes. What is the average tax rate? What is the marginal tax rate? Note: Do not round intermediate calculations and round your income tax answer to 2 decimal places, e.g., 32.16. Enter the average and marginal tax rate answers as a percent, rounded 2 decimal places, e.g., 32.16. Income taxes Average tax rate Marginal tax rate 39,801.50 X 22.00 × % % 32.00arrow_forward

- Determine the average tax rate and the marginal tax rate for each of the following instances: Use the appropriate Tax Tables and Tax Rate Schedules. a. A married couple filing jointly with taxable income of $32,991. b. A married couple filing jointly with taxable income of $192,257. c. A married couple filing separately, one spouse with taxable income of $43,885 and the other with $56,218. d. A single person with taxable income of $79,436. e. A single person with taxable income of $297,784. f. A head of household with taxable income of $96,592. g. A qualifying widow with taxable income of $14,019. h. A married couple filing jointly with taxable income of $11,216. (For all requirements, when computing average tax rate, use the Tax Tables for taxpayers with taxable income under $100,000 and the Tax Rate Schedules for those with taxable income above $100,000. Round "Average tax rate" to 1 decimal place.) Complete this question by entering your answers in the tabs below. Req a and b Req c…arrow_forwardDetermine the tax llability for tax year 2021 In each of the following Instances. In each case, assume the taxpayer can take only the standard deduction. Use the approprlate Tax Tables and Tax Rate Schedules. a. A single taxpayer, not head of household. with AGI of $24,793 and one dependent. b. A single taxpayer, not head of household, with AGI of $189,309 and no dependents. Note: Round your Intermedlate computations to 2 decCimal places and final answer to the nearest dollar amount CA marrled couple filing Jointly with AGI of $41,245 and two dependents. d. A marrled couple filing Jolntly with AGI of $163,588 and three dependents. Note: Round your Intermedlate computations to 2 decimal places and final answer to the nearest dollar amount e. A marrled couple fillng Jolntly with AGI of $313.894 and one dependent. Note: Round your Intermediate computations to 2 decimal places and final answer to the nearest do EA taxpayer filing marrled filing separately with AGI of $70,296 and one…arrow_forwardDetermine the tax liability, marginal tax rate, and average tax rate in each of the following cases. Use the Tax Tables to compute tax liability. Required: a. Married taxpayers, who file a joint return, have taxable income of $32,366. b. Single taxpayer, has taxable income of $67,342. Note: For all requirements, round "Average tax rate" to 2 decimal places. Tax liability a. $ b. $ 3,474 14,336 Marginal tax rate 15 % 25 % Average tax rate. 12.13 % 21.28 %arrow_forward

- Determine the tax liability, marginal tax rate, and average tax rate in each of the following cases. Use the Tax Tables to compute tax liability. Required: Married taxpayers, who file a joint return, have taxable income of $32,116. Single taxpayer, has taxable income of $67,057. Note: For all requirements, round "Average tax rate" to 2 decimal places.arrow_forwardHanasabenarrow_forwardUse the 2012 marginal tax rates to compute the tax owed by the following person. Round taxable income to the nearest dollar as needed. A manied couple filing jointly with a taxable income of $296,000 and a $7000 tax credit Click the icon to view the 2012 marginal tax rates. The tax owed is $ (Round to the nearest cent as needed.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Understanding U.S. Taxes; Author: Bechtel International Center/Stanford University;https://www.youtube.com/watch?v=QFrw0y08Oto;License: Standard Youtube License