Concept explainers

Problem 23-3B

Flexible budget preparation; computation of materials, labor, and

P1P2P3

Suncoast Company set the following standard costs for one unit of its product.

Direct materials (6 lbs. @ $5 per lb.) …………………. $ 27

Direct labor (2 hrs. @ $17 per hr.) ……………………... 18

Overhead (2 hrs. @ $ 18.50 per hr.) ……………………. 24

Total

The predetermined overhead rate ($ 16.00 per direct labor hour) is based on an expected volume of 75% of the factory’s capacity of 20,000 units per month. Following are the company’s budgeted overhead costs per month at the 75% capacity level.

Overhead Budget (75% Capacity)

Variable overhead costs

Indirect materials ……………………………………… $ 22,000

Indirect labor …………………………………………… 90,000

Power …………………………………………………… 22,500

Repairs and maintenance ……………………………….. 45,000

Total variable overhead costs …………………………… $180,000

Fixed overhead costs

Depreciation- Machinery ………………………………… 72,000

Taxes and insurance ……………………………………… 18,000

Supervision ………………………………………………... 66,000

Total fixed overhead costs …………………………………180,000

Total overhead costs ………………………………………………$ 360,000

The company incurred the following actual costs when it operated at 75% of capacity in October.

Direct materials (91,000 lbs. @ $5.10 per lb) …………………… $ 420,900

Direct labor (30,500 hrs. @ $ 17.25 per hr.) ……………………… 280,440

Overhead costs

Indirect materials …………………………………………. $ 21,600

Indirect labor ………………………………………………. 82,260

Power ………………………………………………………. 23,100

Repairs and maintenance …………………………………… 46,800

Depreciation-Building ……………………………………… 24,000

Depreciation-Machinery …………………………………….. 75,000

Taxes and insurance …………………………………………. 16,500

Supervision …………………………………………………… 66,000

355,260

Total costs ……………………………………………………………_____

$1,056,600 _______

Required

- Examine the monthly overhead budget to (a) determine the costs per unit for each variable overhead item and its total per unit costs and (b) identity the total fixed costs per month.

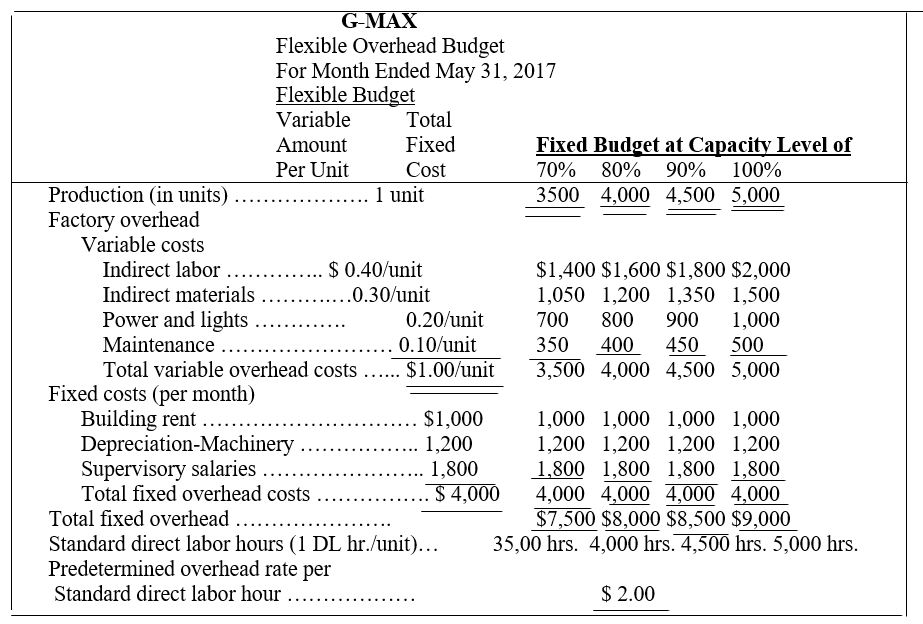

- Prepare flexible overhead budgets (as in Exhibit 23.12) for October showing the amounts of each variable and fixed cost at the 65%, 75%, and 85% capacity levels.

- Compute the direct materials cost variance, including its price and quantity variances.

- Compute the direct labor cost variance, including its rate and efficiency variances.

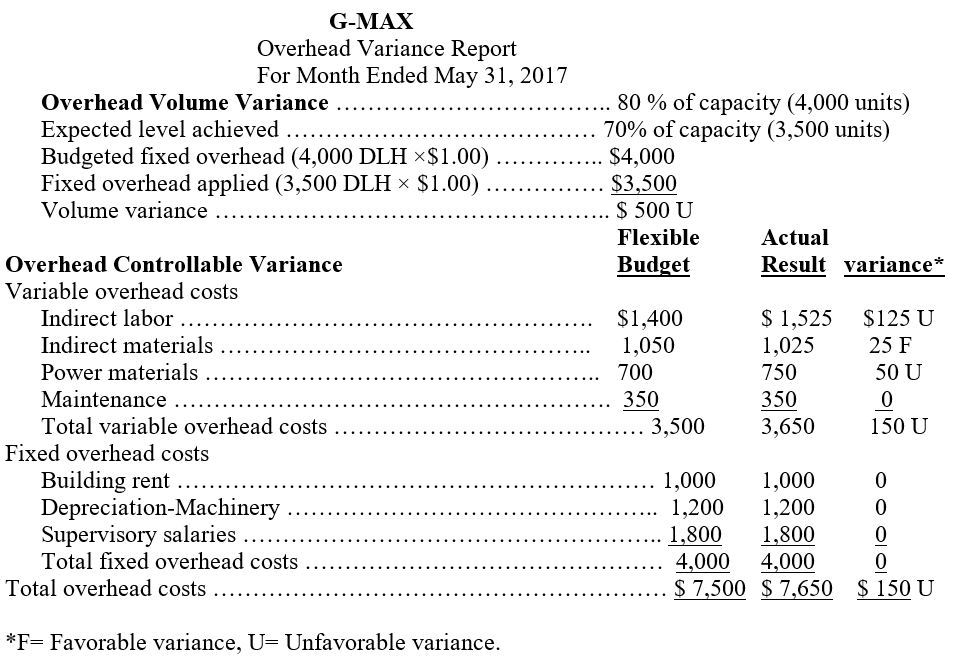

- Prepare a detailed overhead variance report (as in Exhibit 23.16) that shows the variances for individual items of overhead.

EXHIBIT 23.12 Flexible Overhead Budgets

EXHIBIT 23.16 Overhead Variance Report

Want to see the full answer?

Check out a sample textbook solution

Chapter 23 Solutions

Fundamental Accounting Principles -Hardcover

- Exercise 21-7 (Algo) Standard cost per unit, total budgeted cost, and total cost variance LO P2 A manufactured product has the following information for August. Direct materials Direct labor Overhead Units manufactured Total manufacturing costs Standard Quantity and Cost 2 pounds per unit @ $4.00 per pound 0.5 hour per unit @ $28 per DLH $30 per DLH Actual Results 12,600 units $ 460,400 (1) Prepare the standard cost card showing standard cost per unit. (2) Compute total budgeted cost for production in August. (3) Compute the total cost variance for August. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare the standard cost card showing standard cost per unit. (Round your final answers to 2 decimal places.) Inputs Direct materials Standard quantity or hours pounds x Standard price or rate Standard cost per unit Direct labor Overhead DLH × DLH ×arrow_forwardVariance Problem Standard Quantity Standard Cost Standard price $1.75 per hr $11.50 per hr $5.00 per hr per unit $7.00 $13.80 $6.00 per unit Direct Materials Direct Labor Variable Overhead 4 1.2 1.2 Manufacturing overhead is applied using direct labor hours as the base. During the month of July, XYZ company had the following information available about production: a. 9,000 units were produced b. 37,000 lbs of raw materials were purchased at a cost of $62,900 c. There was no beginning inventory and no ending iInventory of raw materials d. 10,500 hours of direct labor were used during the month at a cost of $119,175 e. Variable overhead cost in July totaled $57,750 Compute the following and verify the total variance for each component of product cost: 1. Material price variance, Material quantity variance, and Total material variance 2. Labor rate variance, Labor efficiency variance, and Total labor variance 3. Variable Overhead spending variance, Variable Overhead efficiency variance,…arrow_forwardHrd.13arrow_forward

- Question 2arrow_forwardQuestion Two Apex Ltd manufactures three products X, Y and Z in two product ion departments; P1 and Pz. The company also has two service departments: Sı and Sz. The company's budgeted product ion data and manufacturing costs for the year 2021 were as f ollows: Product Product ion (units) Direct materials (Shs. per unit) Direct labour: P: (Shs. per unit) 4,200 6,900 1,700 11 14 17 6 4 2 P2 (shs. Per unit) 12 3 21 Machine hours per unit 6 3 4 Additional information 1. Absorpt ion rates in depart ments Pı and Pz are based on machine hours and labour wages respectively. 2. Budgeted overheads for rent, heating and lighting amounted to shs.17,000 while depreciation and ins urance amount ed to shs.25,000, 3. The costs of service department Szare apportioned to production departments Pi and P2 at the ratio of 7:3 while the costs of Si are apportioned to depart ments Pi Pz and Sz based on the number of employees. 4. Other information includes: P1 Pz S. Sz 27,660 19,47o 16,600 26,650 Budgeted…arrow_forwardQuestion 40arrow_forward

- Question Content Area The following data relate to direct labor costs for the current period: Line Item Description Value Standard costs 7,000 hours at $11.80 Actual costs 6,300 hours at $10.80 The direct labor rate variance is a. $14,560 unfavorable b. $6,300 favorable c. $14,560 favorable d. $8,260 favorablearrow_forwardBudget Standard per unit Actual production 50 units 30 units Direc material usage 4 Ibs. @ $ 0.5 per Ib 140 Ibs @ $ 1 per Ib. Direct labour usage 2hrs. @ $ 1 per hour 72 hrs @ $ 0.75 per hr. Compute a) Material price variance b)Material quantity variance c)Total material variance d)Labor rate variance e) Labor efficiency variance f) Total pabor variancearrow_forwardQuestion Content Area Myers Corporation has the following data related to direct materials costs for November: actual cost for 4, 690 pounds of material at $5.30 and standard cost for 4, 410 pounds of material at $6.30 per pound. The direct materials price variance is a. $1,764 favorable b. $4,690 favorable c. $1,764 unfavorable d. $4,690 unfavorablearrow_forward

- 9q-15arrow_forwardQuestion 15 The budgeted and actual costs at Goodyear Company is as follows: Budgeted costs Materials (per tire): 12 lbs @ Actual costs Total materials purchased: 849,600 1bs $1.80/1b Labor (per tire): 4 hrs. @ S14/hr Factory O/H (per tire): 3 hrs. @ $8/hr Total cost of purchase: $1,571,760 Total material used: 849,600 lbs Labor (per tire): 4.1 hrs @ S13/hr Factory O/H (per tire): 2.8 hrs @ $8.50/hr During October, Goodyear produced 72,000 tires. The direct materials quantity variance is: $25,920 (U) $44,400 (F) $25,920 (F) $44,400 (U)arrow_forwardQuestion # 1 Standard and the actual costs for direct materials and direct labor are given as under: Standard costs Direct materials 8,000 units at total direct material costs Rs. 40,000 Direct labor: 7,000 hours at Rs. 6 per hour Actual costs Direct materials 8,500 units at Rs. 4.5 per unit Direct labor: 6,500 hours at Rs. 6.25 per hour Required a. Material Price Variance and Material Quantity Variance b. Labor Rate Variance and Labor Efficiency Variancearrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning