FINANCIAL MANAGEMENT(LL)-TEXT

16th Edition

ISBN: 9781337902618

Author: Brigham

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 20SP

Begin with the partial model in the file Ch02 P20 Build a Model.xlsx on the textbook’s Web site.

- a. Britton String Corp. manufactures specialty strings for musical instruments and tennis racquets. Its most recent sales were $880 million; operating costs (excluding

depreciation ) were equal to 85% of sales; net fixed assets were $300 million; depreciation amounted to 10% of net fixed assets; interest expenses were $22 million; the state-plus-federal corporate tax rate was 25%; and it paid 40% of its net income out in dividends. Given this information, construct Britton String’s income statement. Also calculate total dividends and the addition toretained earnings . Report all dollar figures in millions. - b. Britton String’s partial

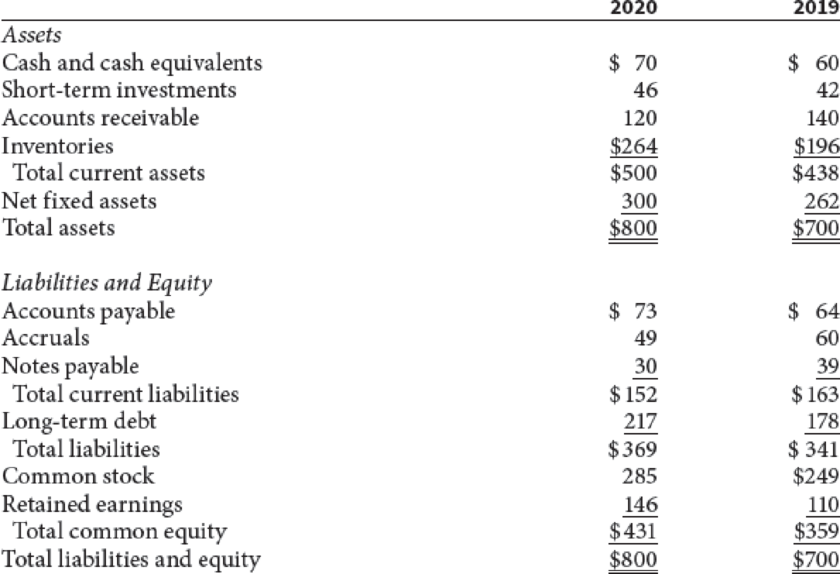

balance sheets follow. Britton issued $36 million of new common stock in the most recent year. Using this information and the results from part a, fill in the missing values for common stock, retained earnings, total common equity, and total liabilities and equity. - c. Construct the statement of cash flows for 2020.

Britton Strings Corp: Balance Sheets as of December 31 (Millions of Dollars)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

What is the difference between a contra asset account and a liability?i need help.

What is the significance of a company’s price-to-earnings (P/E) ratio? i need answer.

What is the significance of a company’s price-to-earnings (P/E) ratio?

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License