Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 1R

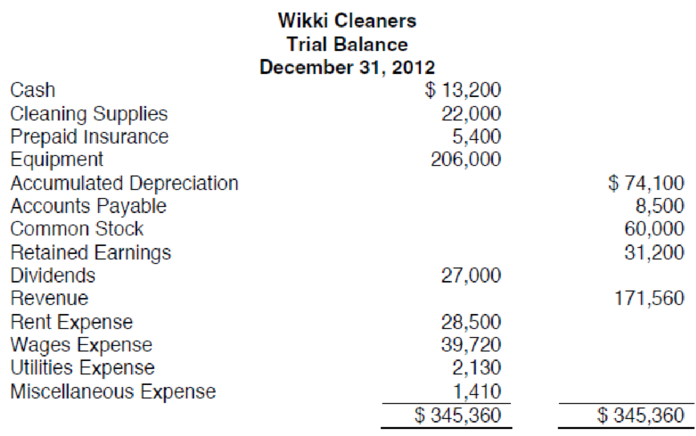

The

Information for the

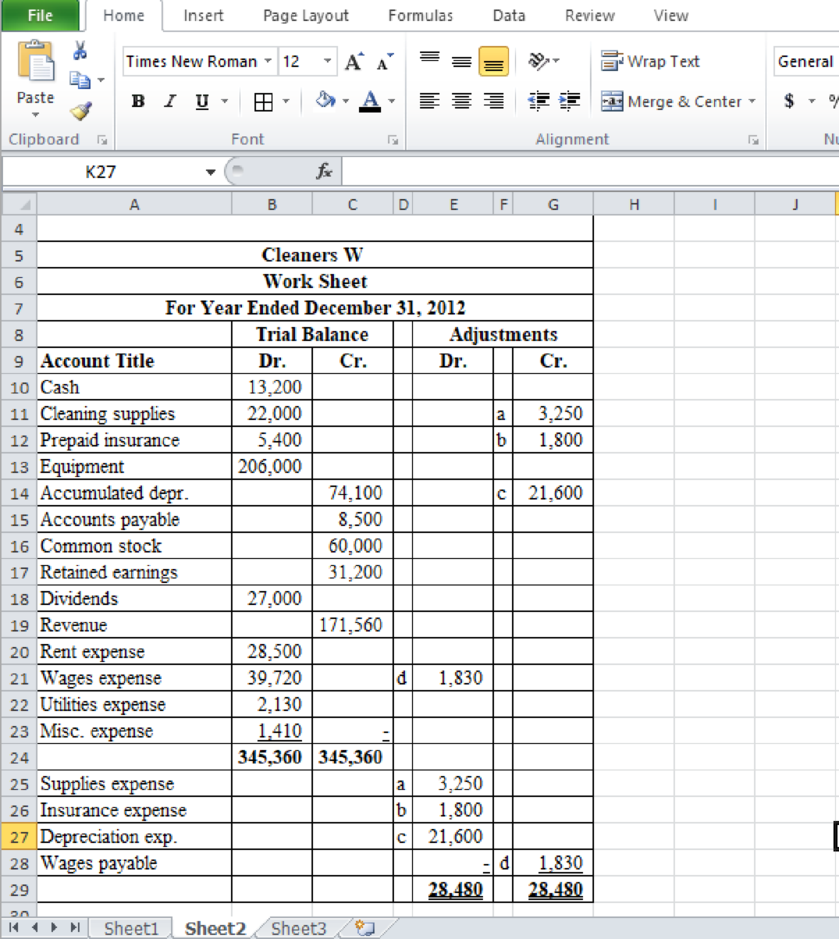

- a. Cleaning supplies on hand on December 31, 2012, $18,750.

- b. Insurance premiums expired during the year, $1,800.

- c.

Depreciation on equipment during the year, $21,600. - d. Wages accrued but not paid at December 31, 2012, $1,830.

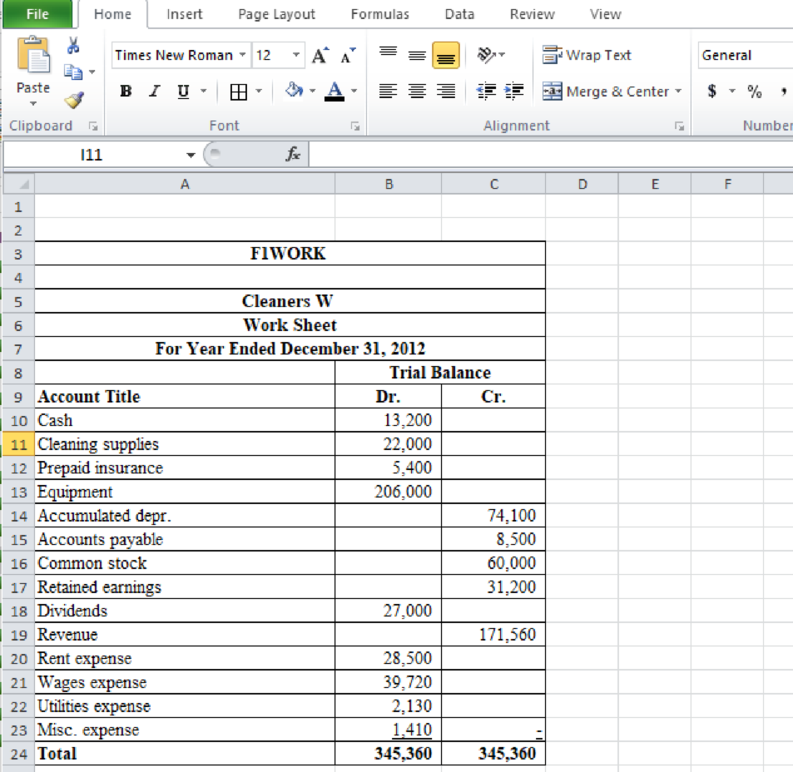

As the accountant for Wikki Cleaners, you have been asked to prepare financial statements for the year. A file called F1WORK has been provided to assist you in this assignment. As you review this file, it should be noted that columns H and I will automatically change when you enter values in columns E or G.

Expert Solution & Answer

To determine

Prepare financial statement by entering the amount in its respective column in the worksheet.

Explanation of Solution

(Figure 1)

(Figure 2)

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

no AI

part 3 and part. 4

What is its return on equity for these financial accounting question?

Question Accounting-Cash conversion cycle: Pem Corp. has an inventory period of 22.6 days, an accounts payable period of 37.7 days, and an accounts receivable period of 31.9 days. What is the company's cash cycle?

Chapter 2 Solutions

Excel Applications for Accounting Principles

Ch. 2 - The trial balance of Wikki Cleaners at December...Ch. 2 - The trial balance of Wikki Cleaners at December...Ch. 2 - The trial balance of Wikki Cleaners at December...Ch. 2 - The trial balance of Wikki Cleaners at December...Ch. 2 - The trial balance of Wikki Cleaners at December...Ch. 2 - The trial balance of Wikki Cleaners at December...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Solve this question and please don't use ai toolsarrow_forwardHow much overhead cost would be assigned to product?arrow_forwardGhana Company reported inventory of $60,000 at the beginning of 2023. During the year, it purchased inventory of $625,000 and sold inventory for $950,000. A count of inventory at the end of the year determined that the cost of inventory on hand was $50,000. What was Ghana's cost of goods sold for 2023?arrow_forward

- Last year, the House of Pink had sales of $736,750, net operating income of $61,000, and operating assets of $95,000 at the beginning of the year and $80,000 at the end of the year. What was the company's turnover? (Provide answer to this financial accounting Problem)arrow_forwardWhat is the company's gross profit?arrow_forwardHello tutor please given General accounting question answer do fast and properly explain all answerarrow_forward

- During the year, Kier Company made an entry to write off a $9,000 uncollectible account. Before this entry was made, the balance in accounts receivable was $315,000 and the balance in the allowance account was $27,000. The net realizable value of accounts receivable after the write-off entry was: A. $200,000. B. $184,000. C. $176,000. D. $288,000.arrow_forwardDear tutor need assistance and don't use ai toolarrow_forwardSolve both problems but do not use aiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY