INTERMEDIATE ACCOUNTING(LL)-W/CONNECT

9th Edition

ISBN: 9781260216141

Author: SPICELAND

Publisher: MCG CUSTOM

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 18, Problem 18.24E

Profitability ratio

• LO18–1

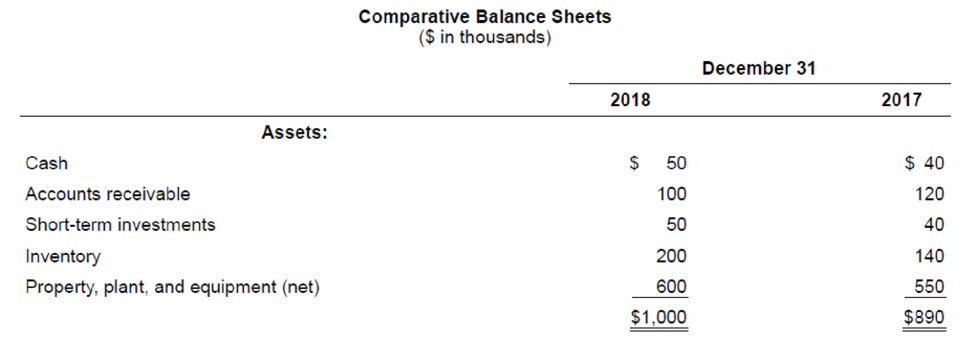

Comparative

Liabilities and Shareholders’ Equity:

| Current liabilities | $ 240 | $210 |

| Bonds payable | 160 | 160 |

| Paid-in capital | 400 | 400 |

| 200 | 120 | |

| $1,000 | $890 |

Required:

1. Determine the return on shareholders’ equity for 2018.

2. What does the ratio measure?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Financial Accounting Question need answer please

Problem solve this problem

Need help with this Question please provide

Chapter 18 Solutions

INTERMEDIATE ACCOUNTING(LL)-W/CONNECT

Ch. 18 - Identify and briefly describe the two primary...Ch. 18 - Prob. 18.2QCh. 18 - Prob. 18.3QCh. 18 - Prob. 18.4QCh. 18 - Prob. 18.5QCh. 18 - Prob. 18.6QCh. 18 - Prob. 18.7QCh. 18 - What is meant by a shareholders preemptive right?Ch. 18 - Terminology varies in the way companies...Ch. 18 - Most preferred shares are cumulative. Explain what...

Ch. 18 - The par value of shares historically indicated the...Ch. 18 - Prob. 18.12QCh. 18 - How do we report components of comprehensive...Ch. 18 - The balance sheet reports the balances of...Ch. 18 - At times, companies issue their shares for...Ch. 18 - Prob. 18.16QCh. 18 - The costs of legal, promotional, and accounting...Ch. 18 - When a corporation acquires its own shares, those...Ch. 18 - Discuss the conceptual basis for accounting for a...Ch. 18 - The prescribed accounting treatment for stock...Ch. 18 - Brandon Components declares a 2-for-1 stock split....Ch. 18 - What is a reverse stock split? What would be the...Ch. 18 - Suppose you own 80 shares of Facebook common stock...Ch. 18 - Prob. 18.24QCh. 18 - Comprehensive income LO181 Schaeffer Corporation...Ch. 18 - Stock issued LO184 Penne Pharmaceuticals sold 8...Ch. 18 - Prob. 18.3BECh. 18 - Prob. 18.4BECh. 18 - Prob. 18.5BECh. 18 - Retirement of shares LO185 Agee Storage issued 35...Ch. 18 - Treasury stock LO185 The Jennings Group...Ch. 18 - Prob. 18.8BECh. 18 - Prob. 18.9BECh. 18 - Cash dividend LO188 Real World Financials...Ch. 18 - Effect of preferred stock on dividends LO187 The...Ch. 18 - Property dividend LO187 Adams Moving and Storage,...Ch. 18 - Stock dividend LO188 On June 13, the board of...Ch. 18 - Prob. 18.14BECh. 18 - Stock split LO188 Refer to the situation...Ch. 18 - Prob. 18.16BECh. 18 - Comprehensive income LO182 The following is from...Ch. 18 - Prob. 18.2ECh. 18 - Earnings or OCI? LO182 Indicate by letter whether...Ch. 18 - Stock issued for cash; Wright Medical Group LO184...Ch. 18 - Issuance of shares; noncash consideration LO184...Ch. 18 - Prob. 18.6ECh. 18 - Share issue costs; issuance LO184 ICOT Industries...Ch. 18 - Reporting preferred shares LO184, LO187 Ozark...Ch. 18 - Prob. 18.9ECh. 18 - Prob. 18.10ECh. 18 - Retirement of shares LO185 In 2018, Borland...Ch. 18 - Treasury stock LO185 In 2018, Western Transport...Ch. 18 - Treasury stock; weighted-average and FIFO cost ...Ch. 18 - Prob. 18.14ECh. 18 - Prob. 18.15ECh. 18 - Prob. 18.16ECh. 18 - Transact ions affecting retained earnings LO186,...Ch. 18 - Effect of cumulative, nonparticipating preferred...Ch. 18 - Stock dividend LO188 The shareholders equity of...Ch. 18 - Prob. 18.20ECh. 18 - Cash in lieu of fractional share rights LO188...Ch. 18 - Prob. 18.22ECh. 18 - Transact ions affecting retained earnings LO186...Ch. 18 - Profitability ratio LO181 Comparative balance...Ch. 18 - Prob. 18.25ECh. 18 - Various stock transactions; correction of journal...Ch. 18 - Share buybackcomparison of retirement and treasury...Ch. 18 - Reacquired sharescomparison of retired shares and...Ch. 18 - Prob. 18.4PCh. 18 - Shareholders equity transactions; statement of...Ch. 18 - Prob. 18.6PCh. 18 - Prob. 18.7PCh. 18 - Prob. 18.8PCh. 18 - Effect o f preferred stock characteristics on...Ch. 18 - Prob. 18.10PCh. 18 - Stock dividends received on investments;...Ch. 18 - Various shareholders equity topics; comprehensive ...Ch. 18 - Prob. 18.13PCh. 18 - Prob. 18.1BYPCh. 18 - Prob. 18.2BYPCh. 18 - Research Case 184 FASB codification; comprehensive...Ch. 18 - Judgment Case 185 Treasury stock; stock split;...Ch. 18 - Prob. 18.6BYPCh. 18 - Prob. 18.7BYPCh. 18 - Prob. 18.8BYPCh. 18 - Prob. 1CCTC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Base on the financial ratios of company A, what is your recommendations and conclusion for company A.arrow_forwardPlease answer all parts with explanations thx also need times interest earned for 2014- 2018 and ratio of liabilities to stockholders equity for 2014-2018arrow_forwardIncome Statement for Year Ended December 31, 2018 (Millions of Dollars) Net sales 795.0 Cost of goods sold 660.0 Gross profit 135.0 Selling expenses 73.5 EBITDA 61.5 Depreciation expenses 12.0 Earnings before interest and taxes (EBIT) 49.5 Interest expenses 4.5 Earnings before taxes (EBT) 45.0 Taxes (40%) 18.0 Net income 27.0 a. Calculate the ratios you think would be useful in this analysis. b. Construct a DuPont equation, and compare the companys ratios to the industry average ratios. c. Do the balance-sheet accounts or the income statement figures seem to be primarily responsible for the low profits? d. Which specific accounts seem to be most out of line relative to other firms in the industry? e. If the firm had a pronounced seasonal sales pattern or if it grew rapidly during the year, how might that affect the validity of your ratio analysis? How might you correct for such potential problems?arrow_forward

- Qb 08.arrow_forwardWhich company is more reliant on equity to fund their assets based on the ratios you have? What are some of the consequences should it anticipate if it relies heavily on equity? Explain using supporting ratios and scenarios.arrow_forwardAnalyze credit risk in the past and current years Analyze profitability in the past and current yearsarrow_forward

- Describe how volatile the payout ratios are based on earnings and cash flows.arrow_forwardWhat caused a decrease in the current ratio?arrow_forward4. Table 1 below presents some of the financial ratios of Company XYZ for 2019. Table 1. Financial Ratios of Company XYZ, 2019 Value 2.6 12 2.7 16% 2% 20% 60% Ratio Total Asset Turnover Ratio Fixed Asset Turnover Ratio Current Ratio Gross Profit Margin Net Profit Margin Long-term Debt Ratio Total Debt Ratio What is the company's Return on Equity (ROE) for 2019? A. 6.5% B. 13.0% C. 9.6% D. 3.12% Net Protit marigin XTT Xarrow_forward

- Liquidity Ratios: 2022 2021 Current ratio Working capital I need help finding liquidity ratios. Could you explain why you got that? Thanks.arrow_forwardg.Total liabilities: RM_____________.h. Total stockholders’ equity is RM_____________.i.Current ratio is ____________ times.arrow_forwardsaarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License