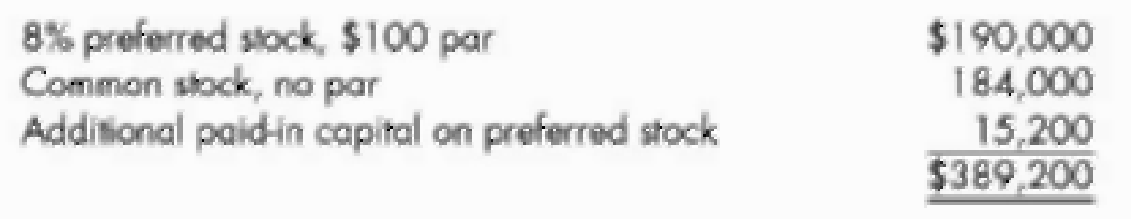

Comprehensive Young Corporation has been operating successfully for several years. It is authorized to issue 24,000 shares of no-par common stock and 6,000 shares of 8%, $100 par

Part a. A shareholder has raised the following questions:

- 1. What is the legal capital of the corporation?

- 2. At what average price per share has the preferred stock been issued?

- 3. How many shares of common stock have been issued (the common stock has been issued at an average price of $23 per share)?

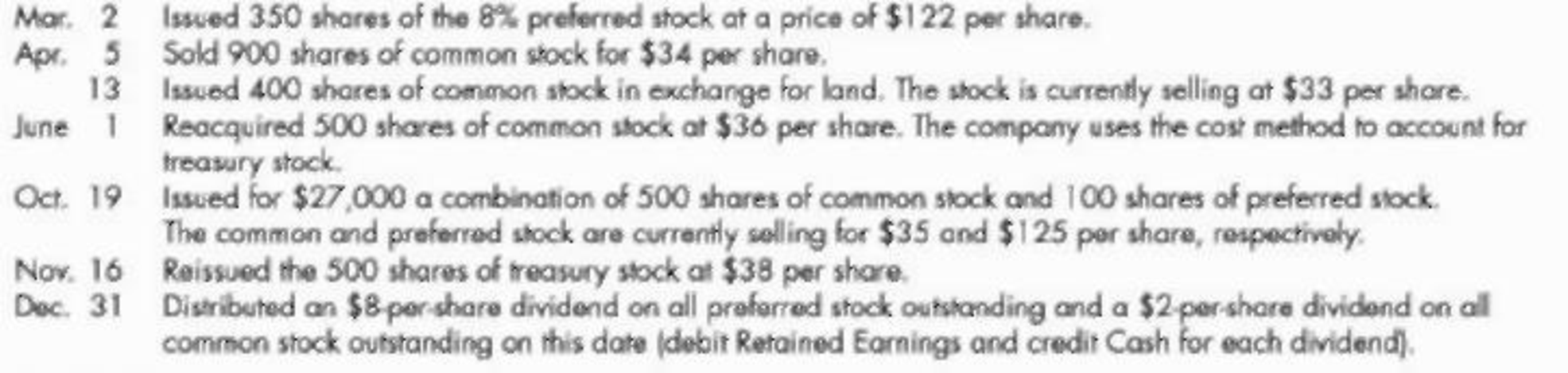

Part b. The company engaged in the following transactions in 2019:

Required:

- 1. Answer the questions in Part a.

- 2. Prepare

journal entries to record the transactions in Part b. - 3. Prepare the Contributed Capital section of Young’s December 31, 2016, balance sheet.

1 (1)

Identify the legal capital of the corporation.

Explanation of Solution

Legal capital: It is an amount of capital which is restricted for the purpose of dividends and other distributions.

The legal capital of corporation is $374,000

1 (2)

Identify the average issue price per share of the preferred stock

Explanation of Solution

Preferred stock: The stock that provides a fixed amount of return (dividend) to its stockholder before paying dividends to common stockholders is referred as preferred stock.

The average issue price per share of the preferred stock is $108

1 (3)

Identify the number of common stock have been issued.

Explanation of Solution

Common stock: The amount invested in the corporation by an investor to receive a return or share of profit from the profits earned by the corporation is known as common stock.

Compute number of common shares issued.

Therefore, the numbers of shares issued are 8,000 shares.

2.

Prepare the journal entries to record the given transactions in part b.

Explanation of Solution

Journal: Journal is the method of recording monetary business transactions in chronological order. It records the debit and credit aspects of each transaction to abide by the double-entry system.

Rules of Debit and Credit: Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Prepare the journal entries to record the given transactions in part b:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) |

| 2019 | ||||

| March 2 | Cash | 42,700 | ||

| Preferred Stock | 35,000 | |||

| Additional Paid-in Capital on Preferred Stock | 7,700 | |||

| (To record issuance of preferred stock) | ||||

| April 5 | Cash | 30,600 | ||

| Common Stock, no par | 30,600 | |||

| (To record issuance of no par common stock) | ||||

| April 13 | Land | 13,200 | ||

| Common Stock, no par | 13,200 | |||

| (To record exchange of no par common stock for land) | ||||

| June 1 | Treasury Stock: Common | 18,000 | ||

| Cash | 18,000 | |||

| (To record reacquisition of common stock) | ||||

| October 19 | Cash | 27,000 | ||

| Common Stock (1) | 15,750 | |||

| Preferred Stock | 10,000 | |||

| Additional Paid-in Capital on Preferred Stock | 1,250 | |||

| (To record issuance of common and preferred stock) | ||||

| November 16 | Cash | 19,000 | ||

| Treasury Stock: Common | 18,000 | |||

| Additional Paid-in Capital from Treasury Stock | 1,000 | |||

| (To record sale of treasury stock) | ||||

| December 31 | Retained Earnings | 18,800 | ||

| Cash | 18,800 | |||

| (To record payment of preferred dividends) | ||||

| December 31 | Retained Earnings | 19,600 | ||

| Cash | 19,600 | |||

| (To record payment of common dividends) |

Table (1)

Working note 1: Calculate the allocation of proceedings:

| Particulars | Calculations | Amount ($) |

| Common stock | $15,750 | |

| Preferred stock | $11,250 | |

| $27,000 |

Table (2)

3.

Prepare the contributed capital section of Corporation Y as on December 31, 2016.

Explanation of Solution

Note: There is no information available to prepare Contributed capital part of Corporation Y as on December 31, 2016. Based on the given information and requirements it is possible to prepare Contribution capital section for the year 2019. Hence, it is prepared for the year 2019.

Prepare the contributed capital section of Corporation Y as on December 31, 2019:

| Corporation Y | |

| Shareholders' Equity | |

| December 31, 2016 | |

| Contributed capital: | |

| Preferred stock, 8%, $100 par (6,000 shares authorized; 2,350 shares issued, and outstanding) | $235,000 |

| Common stock, no par (24,000 shares authorized, 9,800 shares issued and outstanding) | 243,550 |

| Additional paid-in capital on preferred stock | 24,150 |

| Additional paid-in capital from treasury stock | 1,000 |

| Total contributed capital | $503,700 |

Table (3)

Therefore, the total contributed capital is $503,700.

Want to see more full solutions like this?

Chapter 15 Solutions

INTERM.ACCT.:REPORTING...-CENGAGENOWV2

- EllaJane Corporation was organized several years ago and was authorized to issue 4,000,000 shares of $50 par value 6% preferred stock. It is also authorized to issue 1,750,000 shares of $1 par value common stock. In its fifth year, the corporation has the following transactions: Journalize the transactions.arrow_forwardZakaryan Corporation was organized on January 1, 2020. The corporation's governing documents authorized the issue of 100,000 shares of $1 par common stock. During 2020, Zakaryan had the following transactions relating to stockholders' equity: Issued 10,000 shares of common stock at $14 per share. Issued 20,000 shares of common stock at $16 per share. Reported a net income of $200,000. Paid dividends of $100,000. Purchased 3,000 shares of treasury stock at $20 (part of the 20,000 shares issued at $16). What is total shareholders' equity at the end of 2020? O $600,000. O $540,000. O $500,000. O $400,000. 4arrow_forwardYoung Corporation has been operating successfully for several years. It is authorized to issue 24,000 shares of no-par common stock and 6,000 shares of 8%, $100 par preferred stock. The Contributed Capital section of its January 1, 2019, balance sheet is as follows: 1. Answer the questions in Part a. 2. Prepare journal entries to record the transactions in Part b. 3. Prepare the Cobtributed Capital section of Young’s December 31, 2016, balance sheet.arrow_forward

- This topic is about Corporation. Please answer the ff questions How much is the authorized share capital? How much is the issued share capital? How many shares of stock have been issued?arrow_forwardThe company is desirous of comparing serval financial transactions and possible outcomes to assist in guiding its decision-making process. It is assumed that the company will be formed on January 1, 2021 and registered as Osbourne Corporation. The company’s charter will authorize 1,000,000 shares of common stock and 400,000, $100 par value, 5% cumulative preferred stock. Issued 45,500 shares of common stock. Stock has par value of $0.30 per share and was issued at $30 per share. Issued 8,000 shares of preferred stock at par value as payment in exchange for legal services. Exchanged 160,000 shares of common stock for land with an appraised value of $ 400,000.00 and a building with an appraised value of $ 650,000.00. Earned Net income $650,000.00. Paid dividends to preferred shareholders as well as $2 per share to common stockholders. Using the info above and as a guide: Prepare the journal entries with narrations to record the following: The issuances of stock. Close out net…arrow_forwardThe owners are desirous of comparing serval financial transactions and possible outcomes to assist in guiding their decision-making process. They assume that the company will be formed on January 1, 2020 and that Mulatto Company’s charter will authorize 1,000,000 shares of common stock and 400,000, $100 par value, 5% cumulative preferred stock. Issued 45, 500 shares of common stock. Stock has par value of 30 per share and was issued at $30per share. Issued 8000 shares of preferred stock at par value as payment in exchange for legal services. Exchanged 160,000 shares of common stock for land with an appraised value of $400,000 and a building with an appraised value of $650,000. Earned Net income $650,000. Paid dividends to preferred shareholders as well as $2 per share to common stockholders. Using the info above and as a guide: 1. Prepare the journal entries with narrations to record the following: The issuances of stock. Close out net income to retained earnings. Dividend paid.…arrow_forward

- Hammond Manufacturing Inc. was legally incorporated on January 2, 2020. Its articles of incorporation granted it the right to issue an unlimited number of common shares and 100,000 shares of $14.0 non-cumulative preferred shares. The following transactions are among those that occurred during the first three years of operations: 2020 Jan. 12 Issued 40,300 common shares at $4.4 each. 20 Issued 6,000 common shares to promoters who provided legal services that helped to establish the company. These services had a fair value of $32,000. 31 Issued 76,000 common shares in exchange for land, building, and equipment, which have fair market values of $356,000, $476,000, and $44,000, respectively. Mar. 4 Purchased equipment at a cost of $8,120 cash. This was thought to be a special bargain price. It was felt that at least $10,400 would normally have had to be paid to acquire this equipment. Dec. 31 During 2020, the company incurred a loss of $92,000. The Income Summary account was closed. 2021…arrow_forwardHammond Manufacturing Inc. was legally incorporated on January 2, 2020. Its articles of incorporation granted it the right to issue an unlimited number of common shares and 100,000 shares of $14.0 non-cumulative preferred shares. The following transactions are among those that occurred during the first three years of operations: 2020 Jan. 12 Issued 40,300 common shares at $4.4 each. 20 Issued 6,000 common shares to promoters who provided legal services that helped to establish the company. These services had a fair value of $32,000. 31 Issued 76,000 common shares in exchange for land, building, and equipment, which have fair market values of $356,000, $476,000, and $44,000, respectively. Mar. 4 Purchased equipment at a cost of $8,120 cash. This was thought to be a special bargain price. It was felt that at least $10,400 would normally have had to be paid to acquire this equipment. Dec. 31 During 2020, the company incurred a loss of $92,000. The Income Summary account was closed. 2021…arrow_forwardHammond Manufacturing Inc. was legally incorporated on January 2, 2020. Its articles of incorporation granted it the right to issue an unlimited number of common shares and 100,000 shares of $13.8 non-cumulative preferred shares. The following transactions are among those that occurred during the first three years of operations: 2020 Jan. 12 Issued 40,200 common shares at $4.2 each. 20 Issued 8,000 common shares to promoters who provided legal services that helped to establish the company. These services had a fair value of $30,000. 31 Issued 74,000 common shares in exchange for land, building, and equipment, which have fair market values of $354,000, $474,000, and $42,000, respectively. Mar. 4 Purchased equipment at a cost of $8,100 cash. This was thought to be a special bargain price. It was felt that at least $10,200 would normally have had to be paid to acquire this equipment. Dec. 31 During 2020, the company incurred a loss of $90,000. The Income…arrow_forward

- Hammond Manufacturing Inc. was legally incorporated on January 2, 2020. Its articles of incorporation granted it the right to issue an unlimited number of common shares and 100,000 shares of $14.0 non-cumulative preferred shares. The following transactions are among those that occurred during the first three years of operations: 2020 Jan. 12 Issued 40,400 common shares at $5.6 each. 20 Issued 3,000 common shares to promoters who provided legal services that helped to establish the company. These services had a fair value of $44,000. 31 Issued 88,000 common shares in exchange for land, building, and equipment, which have fair market values of $368,000, $488,000, and $56,800, respectively. Mar. 4 Purchased equipment at a cost of $8,240 cash. This was thought to be a special bargain price. It was felt that at least $11,600 would normally have had to be paid to acquire this equipment. Dec. 31 During 2020, the company incurred a loss of $104,000. The Income Summary account was closed. 2021…arrow_forwardHammond Manufacturing Inc. was legally incorporated on January 2, 2020. Its articles of incorporation granted it the right to issue an unlimited number of common shares and 100,000 shares of $14.1 non-cumulative preferred shares. The following transactions are among those that occurred during the first three years of operations: 2020 Jan. 12 Issued 40,350 common shares at $4.5 each. 20 Issued 5,000 common shares to promoters who provided legal services that helped to establish the company. These services had a fair value of $33,000. 31 Issued 77,000 common shares in exchange for land, building, and equipment, which have fair market values of $357,000, $477,000, and $45,000, respectively. 4 Purchased equipment at a cost of $8,130 cash. This was thought to be a special bargain price. It was felt that at least $10,500 would normally have had to be paid to acquire this equipment. Mar. Dec. 31 During 2020, the company incurred a loss of $93,000. The Income Summary account was ciosed. 2021…arrow_forwardHammond Manufacturing Inc. was legally incorporated on January 2, 2020. Its articles of incorporation granted it the right to issue an unlimited number of common shares and 100,000 shares of $13.9 non-cumulative preferred shares. The following transactions are among those that occurred during the first three years of operations: 2020 Jan. 12 Issued 40,250 common shares at $4.3 each. 20 Issued 7,000 common shares to promoters who provided legal services that helped to establish the company. These services had a fair value of $31,000. 31 Issued 75,000 common shares in exchange for land, building, and equipment, which have fair market values of $355,000, $475,000, and $43,000, respectively. Mar. 4 Purchased equipment at a cost of $8,110 cash. This was thought to be a special bargain price. It was felt that at least $10,300 would normally have had to be paid to acquire this equipment. Dec. 31 During 2020, the company incurred a loss of $91,000. The Income…arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College