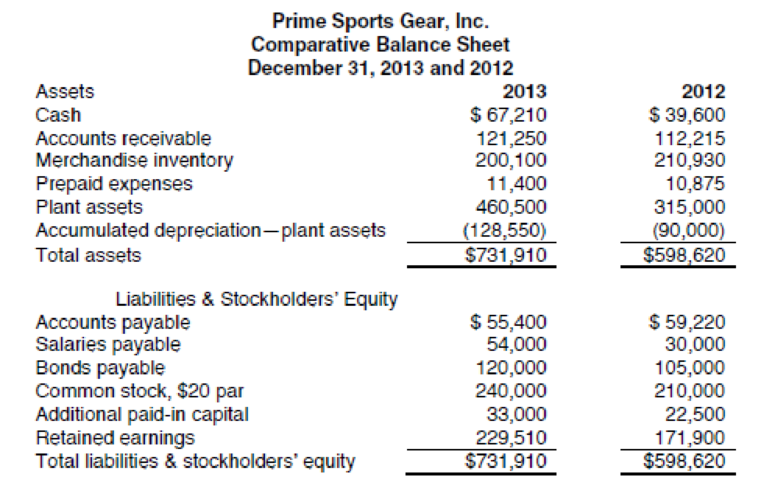

The comparative

Additional data obtained from the records of Prime Sports Gear are as follows:

- a. Net income for 2013 was $121,610.

- b.

Depreciation reported on income statement for 2013 was $46,500. - c. Purchased $165,000 of new equipment, putting $90,000 cash down and issuing $75,000 of bonds for the balance.

- d. Old equipment originally costing $19,500, with

accumulated depreciation of $7,950, was sold for $8,000. - e. Retired $60,000 of bonds.

- f. Declared cash dividends of $64,000.

- g. Issued 1,500 shares of common stock at $27 cash per share.

You have been asked to prepare a statement of

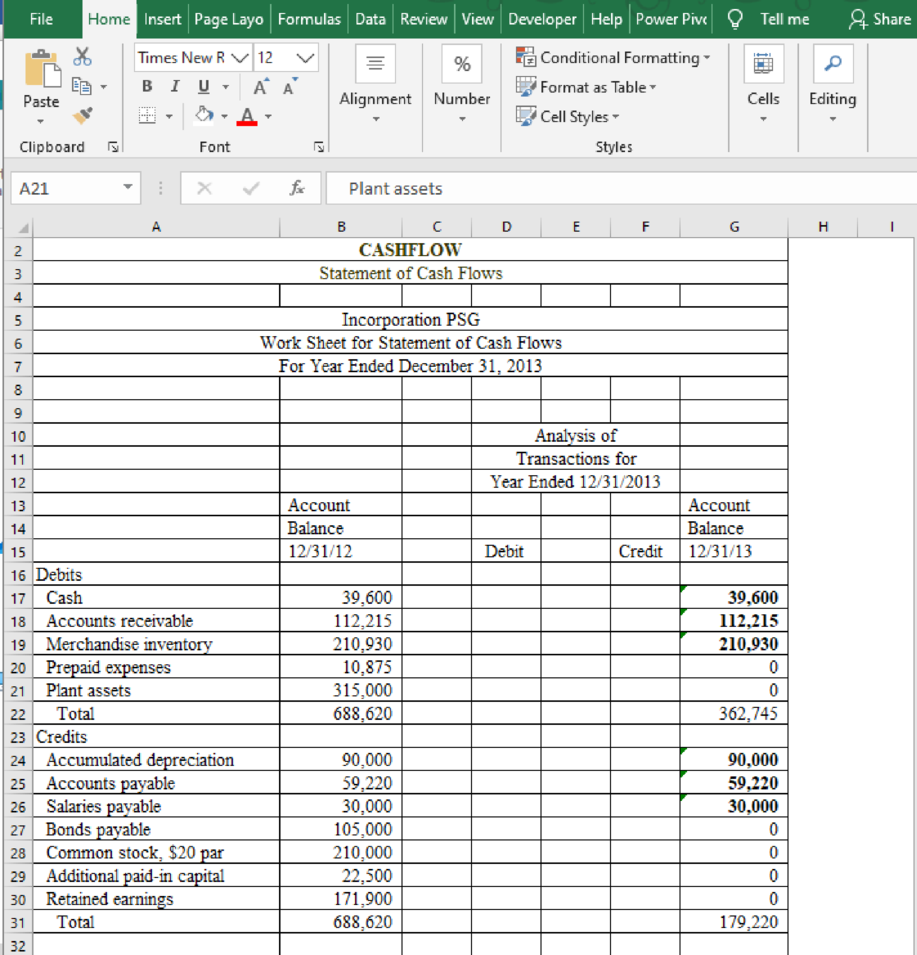

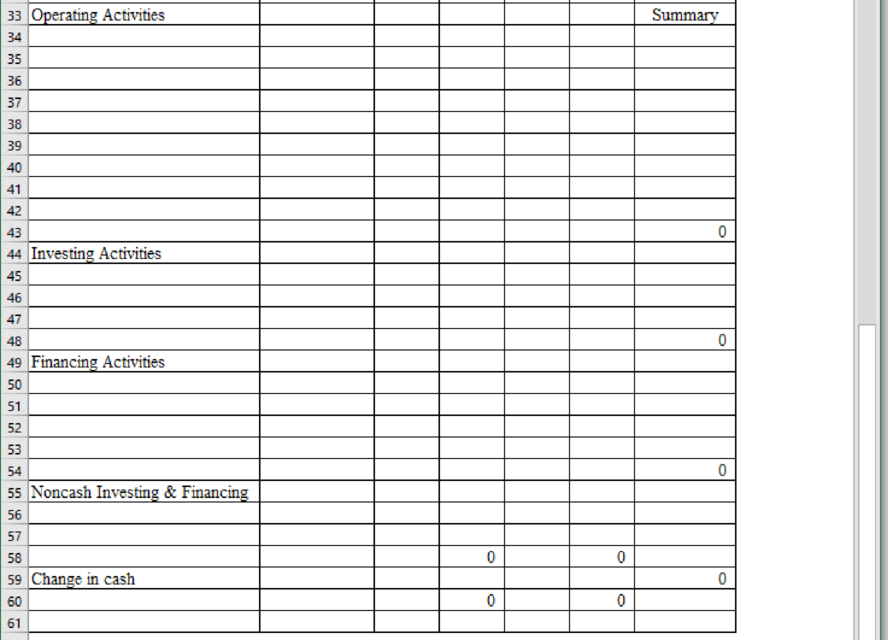

Prepare the statement of cash flow for Incorporation PSG and review the worksheet.

Explanation of Solution

Prepare the statement of cash flow for Incorporation PSG and review the worksheet.

Table (1)

Want to see more full solutions like this?

Chapter 14 Solutions

Excel Applications for Accounting Principles

- Solve this qn plzarrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardRichard Gear Co. manufactures mountain bike tires. The tires sell for $75. The variable cost per tire is $40, and monthly fixed costs are $360,000. If the company is currently selling 18,000 tires monthly, what is the degree of operating leverage?arrow_forward

- Dylan Manufacturing had an estimated 90,000 direct labor hours, $360,000 manufacturing overhead, and 30,000 machine hours. The actual results were 91,200 direct labor hours, 32,500 machine hours, and $415,000 manufacturing overhead. Overhead is applied based on machine hours. Calculate the predetermined overhead rate. Need helparrow_forwardRivertown Media has reported a total asset turnover of 2.8 times and an ROA of 15% and ROE of 22%. What is the firm's net profit margin?arrow_forwardWhat is the return on equity ?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning