Principles of Accounting

12th Edition

ISBN: 9781133626985

Author: Belverd E. Needles, Marian Powers, Susan V. Crosson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 13, Problem 4P

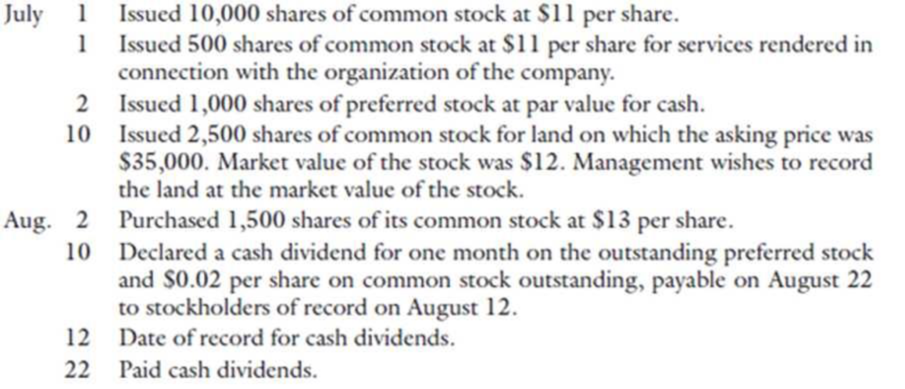

Kraft Unlimited, Inc., was organized and authorized to issue 5,000 shares of $100 par value, 9 percent

REQUIRED

- 1. Prepare

journal entries to record these transactions. - 2. Prepare the stockholders’ equity section of Kraft’s

balance sheet as it would appear on August 31, 2014. Net income for July was zero and August was $11,500. - 3. Calculate dividend yield, price/earnings ratio, and return on equity. Assume earnings per common share are $1.00 and market price per common share is $20. For beginning stockholders’ equity, use the balance after the July transactions. (Round to the nearest tenth of a percent.)

- 4. Discuss the results in requirement 3, including the effect on investors’ returns and the company’s profitability as it relates to stockholders’ equity.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

MCQ: Financial Accounting : Which of the following is NOT a component of stockholders' equity? (a) Notes Payable (b) Retained Earnings (c) Dividends (d) Common Stock

Please explain how to solve this financial accounting question with valid financial principles.

What is the correct answer with accounting

Chapter 13 Solutions

Principles of Accounting

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forwardI need guidance in solving this financial accounting problem using standard procedures.arrow_forwardDion Traders has a selling price of $75, variable costs of $60, and fixed costs are $90,000. How many units must be sold to break even? A) 4,500 B) 6,000 C) 3,000 D) 7,500arrow_forward

- General accounting questionarrow_forwardIn December 2019, Solar Systems Inc. management establishes the 2020 predetermined overhead rate based on direct labor cost. The information used in setting this rate includes estimates that the company will incur $920,000 of overhead costs and $600,000 of direct labor cost in year 2020. During March 2020, Solar Systems began and completed Job No. 20-78. What is the predetermined overhead rate for year 2020?arrow_forwardWhat is the earings per share?arrow_forward

- Riverdale Manufacturing purchased a production machine on January 15, 2025, for $82,500. The estimated useful life of the machine is 8 years, and the residual (salvage) value is $7,500. Compute the annual depreciation expense for Year 1 and Year 2 using the straight-line method.arrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardMy problem accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Earnings per share (EPS), basic and diluted; Author: Bionic Turtle;https://www.youtube.com/watch?v=i2IJTpvZmH4;License: Standard Youtube License