You are reviewing the property, plant, and equipment working papers of Mandville Corporation, a company that publishes travel guides. The lead schedule for the account is included in the chapter as Figure 13.1. The following are among the findings relating to changes in the account:

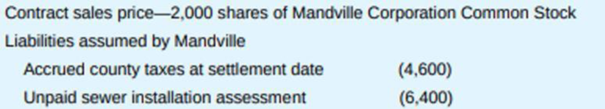

1. Land: The addition represents the purchase of land adjacent to the company’s existing plant and is financed as follows:

On June 17, the date on which the buyer and seller discussed the transaction, shares of Mandville Corporation stock were selling for $77.50. On June 30, the settlement date (day of the sale), Mandville stock was selling for $70.00 per share. The

Examination of publicly available records has indicated that prices of comparable land in the area have been relatively constant, selling in a range from $140,000 to $160,000 during the past 18 months.

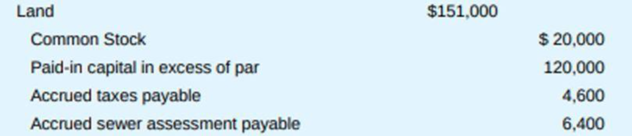

2. Land improvements: This account was increased by three journal entries (each recorded with a debit to land improvements and a credit to cash) during the year. Each of these improvements relates to the new land that was purchased in point (1) above.

3. Building: The building was constructed by an independent contractor; the contract was for $473,000. Progress payments were made during construction through use of proceeds of a bank loan, for which the building serves as collateral. The interest during construction was capitalized ($22,000), while the interest subsequent to construction but prior to year-end ($20,000) was expensed.

4. Equipment: The change in the equipment was a trade of old book “update printing equipment” for two new computer servers and associated software that will maintain electronic updates. Until recently, updates of outdated portions of guidebooks were printed and “shrinkwrapped” with the guidebook. Now the updates will be available on Mandville’s website. The old equipment had a cost of $60,000 and

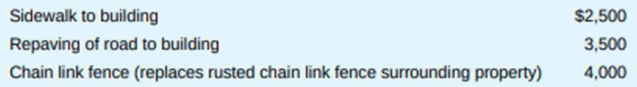

5. Depreciation provisions: Mandville uses software to calculate depreciation to the exact day.

Required:

- a. For additions (1) through (4) above, prepare any necessary

adjusting entries . If in any case your adjusting entry relies upon an assumption, provide that assumption. - b. For item (5), prepare a calculation of the depreciation provisions and determine whether they appear reasonable. For this calculation, assume that acquisitions, on average, occur at mid-year. If the provision does not appear reasonable, discuss follow-up procedures related to the provisions. Use the following table for your calculation:

Want to see the full answer?

Check out a sample textbook solution

Chapter 13 Solutions

PRINCIPLES OF AUDITING & OTHER ASSURANC

- Cullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardCullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardGeneral Accounting questionarrow_forward

- What Is the correct answer A B ?? General Accounting questionarrow_forwardCullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardAccounting questionarrow_forward

- Determine the cost of the patent.arrow_forwardAccounting questionarrow_forwardMs. Sharon Washton was born 26 years ago in Bahn, Germany. She is the daughter of a Canadian High Commissioner serving in that country. However, Ms. Washton is now working in Prague, Czech Republic. The only income that she earns in the year is from her Prague marketing job, $55,000 annually, and is subject to income tax in Czech Republic. She has never visited Canada. Determine the residency status of Sharon Washtonarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning