Concept explainers

The University Club recently issued $1,500,000 of 10-year, 9% bonds at an effective interest rate of 10%. Bond interest is payable annually.

You have been asked to calculate the issuance price of the bonds and prepare amortization schedules for any discount or premium. The worksheet BONDS has been provided to assist you. Note that the worksheet contains a scratch pad at the bottom that has been preprogrammed to automatically compute and display the relevant

Calculate the issue price of bonds and prepare amortization schedules for any discount or premium.

Explanation of Solution

Calculate the issue price of bonds and prepare amortization schedules for any discount and premium.

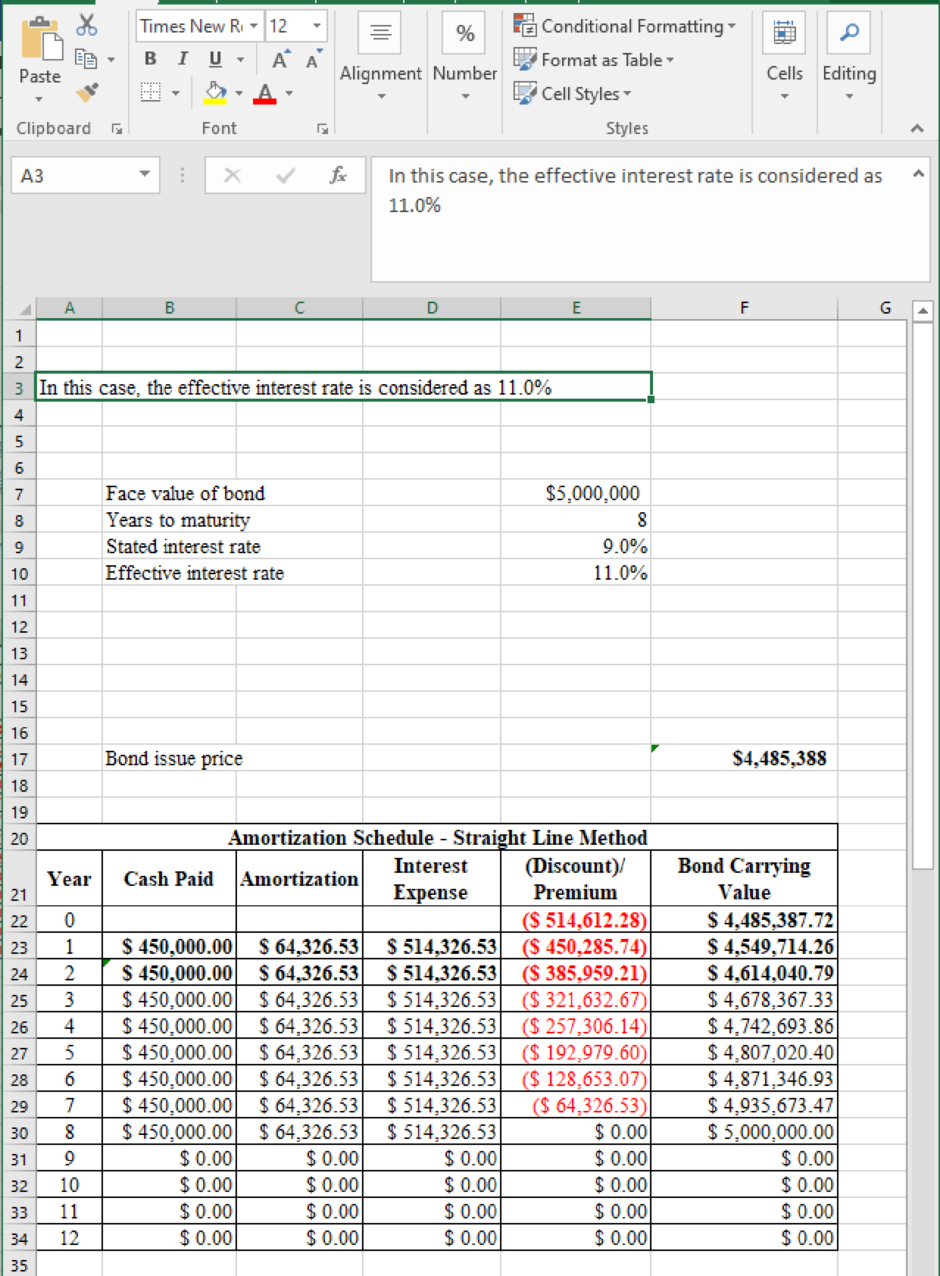

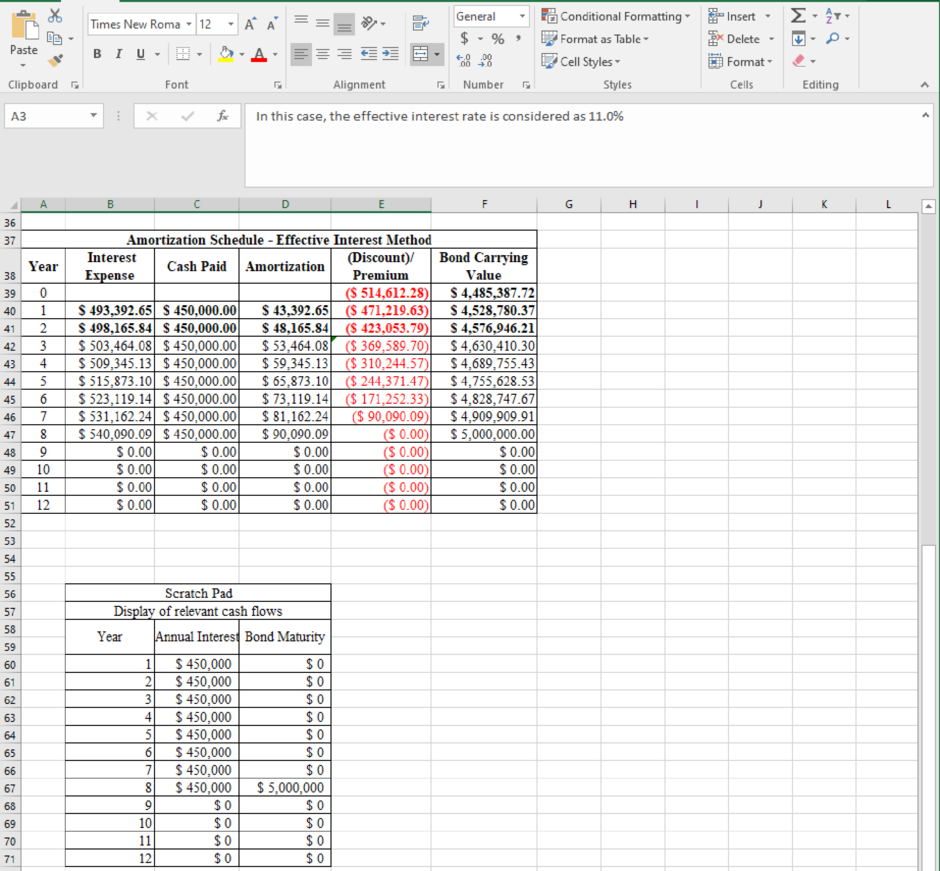

Table (1)

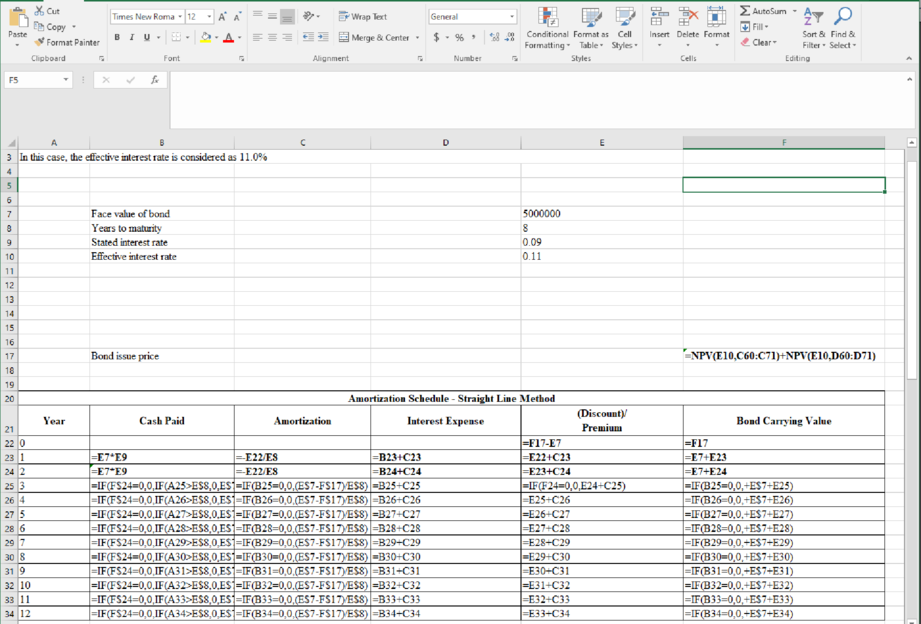

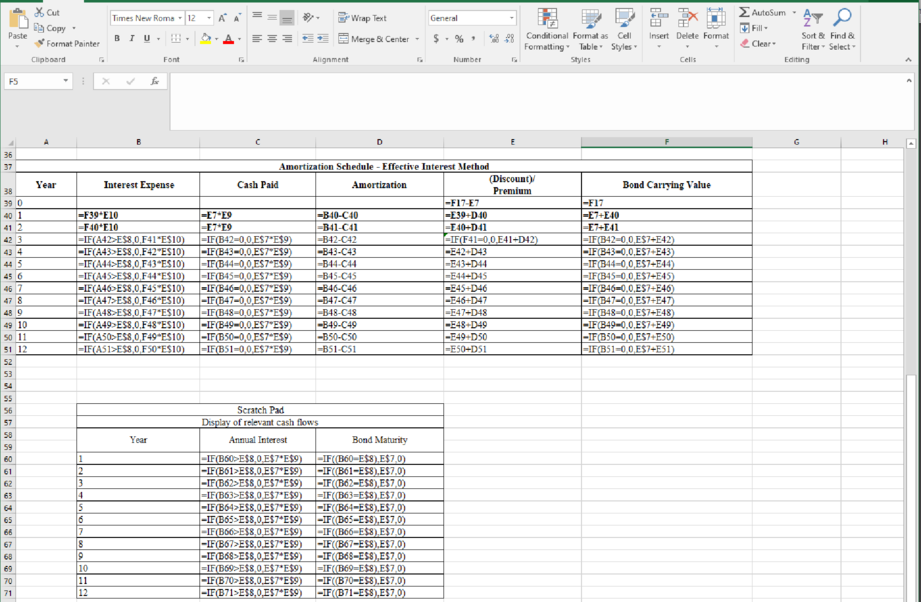

The formulae for the above calculation are as follows:

Figure (2)

Want to see more full solutions like this?

Chapter 11 Solutions

Excel Applications for Accounting Principles

- Provide answer pleasearrow_forwardHello tutor provide correct answer this general accounting questionarrow_forwardGiven the following information: Average Cost per Unit: Direct materials: $12.00 Direct labor: $7.00 Variable manufacturing overhead: $4.00 Fixed manufacturing overhead: $10.00 Fixed selling expense: $6.00 Fixed administrative expense: $5.00 Sales commissions: $4.00 Variable administrative expense: $3.00 Assuming the cost object is units of production, what is the total indirect manufacturing cost incurred to make 40,000 units?arrow_forward

- Quick answer of this accounting questionarrow_forwardDiana Weaves produces custom table runners. It takes 1.5 hours of direct labor to produce a single runner. Diana's standard labor cost is $15 per hour. During September, Diana produced 8,000 units and used 12,400 hours of direct labor at a total cost of $187,320. What is Diana's labor efficiency variance for September? Helparrow_forwardwhat was the amount of sales for the month?arrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning