Connect Access Card for McGraw-Hill's Taxation of Individuals and Business Entities 2019 Edition

10th Edition

ISBN: 9781260189698

Author: Brian C. Spilker Professor, Benjamin C. Ayers, John Robinson Professor, Edmund Outslay Professor, Ronald G. Worsham Associate Professor, John A. Barrick Assistant Professor, Connie Weaver

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 46P

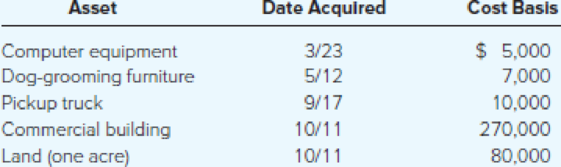

At the beginning of the year, Poplock began a calendar-year dog boarding business called Griff’s Palace. Poplock bought and placed in service the following assets during the year:

Assuming Poplock does not elect §179 expensing and elects not to use bonus

- a) What is Poplock’s year 1 depreciation deduction for each asset?

- b) What is Poplock’s year 2 depreciation deduction for each asset?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I need some help with letter c. I have done the calculations correctly, but if there is anything wrong, please correct them.

Given answer with calculation

Provide correct option

Chapter 10 Solutions

Connect Access Card for McGraw-Hill's Taxation of Individuals and Business Entities 2019 Edition

Ch. 10 - Explain why certain long-lived assets are...Ch. 10 - Prob. 2DQCh. 10 - Explain the similarities and dissimilarities...Ch. 10 - Is an assets initial or cost basis simply its...Ch. 10 - Prob. 5DQCh. 10 - Explain why the expenses incurred to get an asset...Ch. 10 - Graber Corporation runs a long-haul trucking...Ch. 10 - What depreciation methods are available for...Ch. 10 - If a business places several different assets in...Ch. 10 - Prob. 38P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Question 3Footfall Manufacturing Ltd. reports the following financial information at the end of the current year: net sale $100 000 debtor's turnover ration (based on net sales) 2 inventory turnover ration 1.25 fixed assets turnover ratio 0.8 debt to assets ratio 0.6 net profit margin 5% gross profit margin 25% return on investment 2% Use the given information to fill out the templates for income statement and balance sheet given below: Income Statement of Footfall Manufacturing Ltd. for the year ending December 31, 20XX(in $) sales 100,000 cost of goods sold gross profit other expenses earnings before tax tax @50% earnings after tax Balance Sheet of Footfall Manufacturing Ltd. as at December 31, 20XX (in $) liabilities amount assets amount equity net fixed assets long term debt 50, 000 inventory short term debt debtors…arrow_forwardfinal answer.arrow_forwardHow many weeks of supply does summit logistics Inc. Hold ? Accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Depreciation -MACRS; Author: Ronald Moy, Ph.D., CFA, CFP;https://www.youtube.com/watch?v=jsf7NCnkAmk;License: Standard Youtube License