McGraw-Hill's Taxation of Individuals and Business Entities 2020 Edition

11th Edition

ISBN: 9781260432466

Author: SPILKER, Brian

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 42P

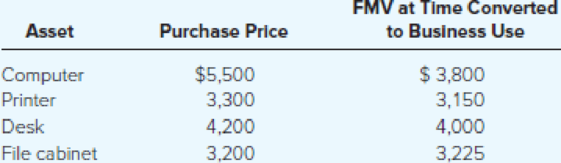

Brittany started a law practice as a sole proprietor. She owned a computer, printer, desk, and file cabinet she purchased during law school (several years ago) that she is planning to use in her business. What is the

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Maharaj Garage & Car Supplies sells a variety of automobile cleaning gadgets including a variety of hand

vacuums. The business began the first quarter (January to March) of 2024 with 20 (Mash up Dirt) deep clean,

cordless vacuums at a total cost of $126,800.

During the quarter, the business completed the following transactions relating to the "Mash up Dirt" brand.

January 8

January 31

February 4

February 10

February 28

March 4

March 10

March 31

March 31

105 vacuums were purchased at a cost of $6,022 each. In addition, the business paid a freight

charge of $518 cash on each vacuum to have the inventory shipped from the point of purchase

to their warehouse.

The sales for January were 85 vacuums which yielded total sales revenue of $768,400. (25 of

these units were sold on account to Mandys Cleaning Supplies, a longstanding customer)

A new batch of 65 vacuums was purchased at a total cost of $449,800

8 of the vacuums purchased on February 4 were returned to the supplier, as they were…

Tutor give me ans

I'm waiting for solution

Chapter 10 Solutions

McGraw-Hill's Taxation of Individuals and Business Entities 2020 Edition

Ch. 10 - Explain why certain long-lived assets are...Ch. 10 - Prob. 2DQCh. 10 - Explain the similarities and dissimilarities...Ch. 10 - Is an assets initial or cost basis simply its...Ch. 10 - Prob. 5DQCh. 10 - Explain why the expenses incurred to get an asset...Ch. 10 - Graber Corporation runs a long-haul trucking...Ch. 10 - What depreciation methods are available for...Ch. 10 - If a business places several different assets in...Ch. 10 - Prob. 38P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Operating Loss Carryback and Carryforward; Author: SuperfastCPA;https://www.youtube.com/watch?v=XiYhgzSGDAk;License: Standard Youtube License